FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

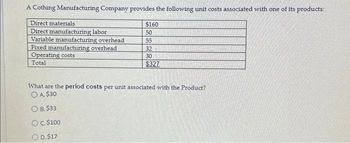

Transcribed Image Text:A Cothing Manufacturing Company provides the following unit costs associated with one of its products:

Direct materials.

Direct manufacturing labor

Variable manufacturing overhead

Fixed manufacturing overhead

Operating costs

Total

$160

50

55

32

30

$327

What are the period costs per unit associated with the Product?

O A $30

O B. $33

OC. $100

O D. $17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following data, determine the unit product cost under variable costing. Units produced 1,000 Direct materials $6 Direct labor $10 Fixed overhead $6,000 Variable overhead $6 Fixed selling and administrative $2,000 Variable selling and administrative $22 $24 $28 $30 $2arrow_forwardGiven the following data, calculate product cost per unit under absorption costing. Direct labor Direct materials Variable overhead Fixed overhead Units produced per year Multiple Choice $28.00 per unit $28.60 per unit $30.00 per unit $30.90 per unit $ 17.00 per unit $ 11.00 per unit $ 0.90 per unit $ 100,000 50,000 unitsarrow_forwardBruce Corporation makes four products in a single facility. These products have the following unit product costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead. Unit product cost Additional data concerning these products are listed below. Multiple Choice Product C Product B Product D Product A Products A B C D $17.20 $ 21.10 $ 14.10 $ 16.80 19.20 22.60 17.00 11.00 6.00 7.20 29.10 16.00 $71.50 A 2.25 $ 86.70 $ 2.95 4,600 9.70 16.10 $66.90 $ 56.90 Products Grinding minutes per unit Selling price per unit Variable selling cost per unit Monthly demand in units. The grinding machines are potentially the constraint in the production facility. A total of 10,500 minutes are available per month on these machines. Direct labor is a variable cost in this company. Which product makes the MOST profitable use of the grinding machines? Note: Round your intermediate calculations to 2 decimal places. B 1.30 $ 79.10 $ 3.65 3,600 C 0.85 $ 75.90 $4.40 3,600arrow_forward

- The following variable production costs apply to goods made by Fanning Manufacturing Corporation: Item Materials Labor Variable overhead Total Required Determine the total variable production cost, assuming that Fanning makes 10,000, 20,000, or 30,000 units. Units Produced Cost per Unit $10.00 2.50 0.75 $13.25 Total variable cost 10,000 20,000 30,000arrow_forwardGiven the following information, determine the product cost of one unit: Direct Materials = $60; Direct labor = $10; Apply Overhead based on $2 per Direct Labor hour; Direct labor hours is 4 hours per unit. a. $70 per unit b. $80 per unit c. $78 per unit d. $85 per unit Contribution margin is sales less: a. Fixed overhead and fixed selling and administrative expenses b. Variable Cost of goods sold and variable selling & administrative expenses c. Variable selling and administrative expemses and Fixed selling and administrative expenses d. variable cost of goods sold An investment generates an operating income of $100,000, and the average operating assets are $400,000. What is the return on the investment? a. 100% b. 75% c. 25% d. 20%arrow_forwardA standard cost card for one unit of a product may look like the following: Direct materials (4 pounds @ $1.25 per pound) $5.00 Direct labor (0.1 DLH @ $18 per hour) 1.80 Variable overhead (0.1 DLH @ $2.00 per hour) 0.20 Fixed overhead (0.1 DLH @ $4.60 per hour) 0.46 Total cost per unit $7.46 The standard cost to produce one unit is $7.46. The standard cost to produce 600 units are $ Of course, this is a simplification as the standard cost does not take fixed and variable costs into account. However, if the firm is producing at or near capacity, then the cost per unit of $7.46 could be multiplied by total units to get total standard cost. The standard cost card gives both unit and cost standards. The direct materials total of $5.00 is based on the use of four pounds of material at $1.25 per pound. Similarly, it should take six minutes (0.1 direct labor hour) to produce one unit. This makes it easy to determine total quantities and cost would be for multiple units. If 400 units were…arrow_forward

- Average Cost per Unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense $6.55 $3.45 $1.45 $3.80 $1.40 $0.95 $1.35 $0.85 Sales commissions Variable administrative expense If 7,300 units are sold, the variable cost per unit sold is closest to:arrow_forwardB. Find the cost of a product Different costs are presented below Direct materials $ 5.00 per unit Indirect materials $ 2.00 per unit Direct labor $ 10.00 per hour Indirect labor $ 3.00 per hour Other variable indirect costs $ 6.00 per hour Other fixed indirect costs $ 10.00 per unit Commissions to sellers $ 4.00 per unit Variable administrative costs $ 6.00 per unit Fixed Administrative Costs $ 10.00 per unit 1. Determine the cost of making each unit. When it says hourly, it refers to hours of direct labor. It takes 15 minutes for the company to make each product. .arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education