FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

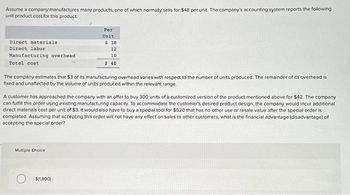

Transcribed Image Text:Assume a company manufactures many products, one of which normally sells for $48 per unit. The company's accounting system reports the following

unit product cost for this product:

Direct materials.

Direct labor

Manufacturing overhead

Total cost

Per

Unit

The company estimates that $3 of its manufacturing overhead varies with respect to the number of units produced. The remainder of its overhead is

fixed and unaffected by the volume of units produced within the relevant range.

Multiple Choice

$18

12

10

$ 40

A customer has approached the company with an offer to buy 300 units of a customized version of the product mentioned above for $42. The company

can fulfill this order using existing manufacturing capacity. To accommodate the customer's desired product design, the company would incur additional

direct materials cost per unit of $3. It would also have to buy a special tool for $520 that has no other use or resale value after the special order is

completed. Assuming that accepting this order will not have any effect on sales to other customers, what is the financial advantage (disadvantage) of

accepting the special order?

$(1,800)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Edney Company employs a standard cost system for product costing. The per-unit standard cost of its product is: Raw materials Direct labor (2 direct labor hours x $8.00 per hour) Manufacturing overhead (2 direct labor hours x $12.20 per hour) $ 14.00 16.00 24.40 $ 54.40 Total standard cost per unit The manufacturing overhead rate is based on a normal capacity level of 600,000 direct labor hours. The firm has the following annual manufacturing overhead budget: Variable Fixed $ 3,960,000 3,360,000 $ 7,320,000 Edney incurred $434,550 in direct labor cost for 54,100 direct labor hours to manufacture 26,000 units in November. Other costs incurred in November include $296,000 for fixed manufacturing overhead and $342,000 for variable manufacturing overhead. Required: 1. Determine each of the following for November. [Note: Indicate whether each variance is favorable (F) or unfavorable (U).] a. The variable overhead rate (spending) variance. b. The variable overhead efficiency variance. c. The…arrow_forwards === Mulligan Manufacturing Company uses a job order cost system with overhead applied to products at a rate of 150 percent of direct labor cost. Required: Treating each case independently, selected from the manufacturing data given below, find the missing amounts. You should do them in the order listed. (Hint: For the manufacturing costs in Case 3, first solve for conversion costs and then determine how much of that is direct labor and how much is manufacturing overhead.) Note: Do not round your intermediate calculations. Round your final answers to the nearest whole dollar. Enter all amounts as positive values. Direct materials used Direct labor Manufacturing overhead applied Total current manufacturing costs Beginning work in process inventory Ending work in process inventory Cost of goods manufactured Beginning finished goods inventory Ending finished goods inventory Cost of goods sold 89 SEP 17 84 < Prev Case 1 16,000 12,000 8,100 5,900 3,800 7,900 6 of 8 tv Case 2 ‒‒‒ ‒‒‒ ▬▬▬…arrow_forwardSnavely, Incorporated, manufactures and sells two products: Product E1 and Product A7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E1 Product A7 Total direct labor-hours Product E1 Product A7 The direct labor rate is $22.70 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $286.00 $ 223.00 Activity Cost Pools Labor-related Machine setups Order size Expected Production 600 500 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Direct Labor- Total Direct Hours Per Unit Labor-Hours 6,000 10.0 5.0 2,500 8,500 Activity Measures DLHs setups MHS Estimated Expected Activity Overhead Cost Product E1 Product A7 $ 121,100 57, 110 893,250 $ 1,071,460 6,000 700 3,000 2,500 500 2,800 Total 8,500 1,200 5,800 The total overhead applied to Product E1…arrow_forward

- Melinda Corporation estimates its factory overhead based on direct labor hours. Melinda estimates FOH to be $1,750,000 and direct labor hours to be 500,000. Actual information is as follows: Sales Direct Labor Advertising Expense...... Indirect Materials. Direct Materials ************** $1,234,000 432,000 145,000 1,210,000 252,000 Indirect Labor 400,000 Depreciation Expense - Factory 185,000 Direct labor hours........... 510,000 (a) Calculate the predetermined overhead rate and calculate the overhead applied during the year. Show Journal Entry (b) Determine the amount of over- or underapplied overhead and state whether it was under or overapplied. Prepare the journal entry to eliminate the over- or underapplied overhead.arrow_forwardThe controller at Wesson Company's manufacturing plant has provided you with the following information for the first quarter's operations: Direct materials Fixed manufacturing overhead costs Sales price Variable manufacturing overhead Direct labor Fixed marketing and administrative costs Units produced and sold during the quarter Variable marketing and administrative costs Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. Complete this question by entering your answers Required A Required B Prepare a contribution margin income statement. Contribution Margin Income Statementarrow_forwardDo not give image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education