FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

1 - Explain why the traditional and activity-based cost assignments differ.

2 - What advice would you give the management of Jackson Manufacturing regarding pricing of products in the future.

Transcribed Image Text:Jackson Manufacturing, Inc., makes two types of industrial component parts-the XT-

100 and the LT-200. An absorption costing income statement for the most recent period

is shown:

Jackson Manufacturing Inc.

Income Statement

Sales

$2,100,000

Cost of goods sold

1,600,000

Gross margin

500,000

Selling and administrative expenses

550,000

Net operating loss

$ (50,000)

Table Summary: Income statement with two-line heading. Descriptions of income

items are in first column and dollar values in second column.

Jackson produced and sold 70,000 units of XT-100 at a price of $20 per unit and 17,500

units of LT-200 at a price of $40 per unit. The company's traditional cost system

allocates manufacturing overhead to products using a plantwide overhead rate and

direct labor dollars as the allocation base. Additional information relating to the

company's two product lines is shown below:

XT-100

LT-200

Total

Direct materials

$436,300 $251,700

$ 688,000

Direct labor

$200,000 $104,000

304,000

Manufacturing overhead

608,000

Cost of goods sold

$1,600,000

The company has created an activity-based costing system to evaluate the profitability

of its products. Jackson's ABC implementation team concluded that $50,000 and

$100,000 of the company's advertising expenses could be directly traced to XT-100 and

LT-200, respectively. The remainder of the selling and administrative expenses was

organization-sustaining in nature. The ABC team also distributed the company's

manufacturing overhead to four activities as shown:

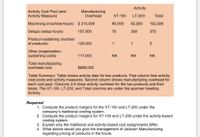

Transcribed Image Text:Activity

Activity Cost Pool (and

Activity Measure)

Manufacturing

Overhead

XT-100

LT-200

Total

Machining (machine-hours) $213,500

90,000

62,500

152,500

Setups (setup hours)

157,500

75

300

375

Product-sustaining (number

of products)

120,000

1

1

Other (organization-

sustaining costs)

117,000

NA

NA

NA

Total manufacturing

overhead cost

$608,000

Table Summary: Table shows activity data for two products. First column lists activity

cost pools and activity measures. Second column shows manufacturing overhead for

each cost pool. Columns 3-5 show activity numbers for the two products and their

totals. The XT-100, LT-200, and Total columns are under the spanner heading

Activity.

Required:

1. Compute the product margins for the XT-100 and LT-200 under the

company's traditional costing system.

2. Compute the product margins for XT-100 and LT-200 under the activity-based

costing system.

3. Explain why the traditional and activity-based cost assignments differ.

4. What advice would you give the management of Jackson Manufacturing

regarding pricing of products in the future.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4) Design ABC system for EON and Brothers (discuss steps) 5) What are the Costs per unit of Alfa and Beta under traditional and ABC costing systems?What would be the prices of Alpha and Beta traditional and ABC costing systems? Comparethe costs and prices calculated in the two systems (Calculations should be shown in theappendix) and for analysis 6) Discuss your recommendation on the viability of ABC for EON and Brothers Ltd., given thefinancial director's concerns.arrow_forwardMastery Problem: Contribution Margin, Cost-Volume-Profit Analysis and Break-Even Point (Overview) Fixed, Variable and Mixed Costs An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points. 1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as: a.fixed b.mixed c.variable. a. Pressure-molded plastic for chair frames b. Pension cost: $0.50 per employee hour on the job c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million d. Property taxes: $120,000 per year for…arrow_forwardCost-volume-profit analysis is used to make many decisions, including product pricing and controlling costs. What are the limitations of using operating leverage to predict profitability?arrow_forward

- Decisions where relevant cost analysis might be used effective is Make or Buy Decision. Explain IN YOUR OWN WORDS what "Make or Buy Decision" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forward1arrow_forwardContribution Margin, Cost-Volume-Profit Analysis and Break-Even Point (Overview) Fixed, Variable and Mixed Costs An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points. 1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as fixed, mixed, or variable. a. Pressure-molded plastic for chair frames b. Pension cost: $0.50 per employee hour on the job c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million d. Property taxes: $120,000 per year for the factory building and…arrow_forward

- What considerations should managers make when deciding whether to sell a product as-is or after additional processing?arrow_forwardDecisions where relevant cost analysis might be used effective is Sell or process decisions. Explain IN YOUR OWN WORDS what "sell or process decision" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education