College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Need Answer of this General Accounting Question

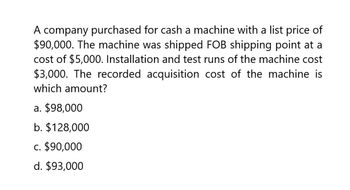

Transcribed Image Text:A company purchased for cash a machine with a list price of

$90,000. The machine was shipped FOB shipping point at a

cost of $5,000. Installation and test runs of the machine cost

$3,000. The recorded acquisition cost of the machine is

which amount?

a. $98,000

b. $128,000

c. $90,000

d. $93,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give true answer this general accounting questionarrow_forwardABC Corp acquired an equipment with an invoice price of P2,500,000 with terms of 3/30, n/65. Installation cost is P50,000. Decommissioning cost is P200,000. Expected useful life is 10 years and effective rate was 12% How much is the initial cost of the equipment? 2,550,000 2,539,395 2,614,395 2,750,000arrow_forwardTarget purchased equipment. The following data relates to the purchase: Purchase cost Purchase cost Freight cost Costs of building a foundation and installation Salvage value Useful life O $35,400. Depreciation expense each year using the straight-line method will be O $29,400. ✔--- PURE LU HUGAUCUNE Raw YHANIN E SUARNENE wemo w 04 O $24.600. O $24.000. O $24.600. $150,000 $150.000 7,000 4 20,000 30.000 5.years:arrow_forward

- VC purchased a machine for use in operations at a quoted price of $35,120. Full payment was cash of $8,000, plus a two-year non-interest-bearing note for $27,121. The market rate of interest for this note is 8 percent. VC should record the cost of the machine as (rounded to the nearest dollar): a. $32,950 b. $31,250 c. $23,250 d. $35,000 Please answer explaining in detail step by step without table and graph thankyouarrow_forwardIn comparing the machines on a present worth basis, the present worth of machine P is closest to:a. $ -82,130b. $-87,840c. $-91,568d. $-112,230arrow_forwardI want to correct answer general accountingarrow_forward

- The Weber Company purchased a mining site for $510,498 on July 1. The company expects to mine ore for the next 10 years and anticipates that a total of 82,226 tons will be recovered. During the first year the company extracted 6,000 tons of ore. The depletion expense is a.$46,488.30 b.$45,615.00 c.$37,260.00 d.$33,922.34arrow_forwardThe acquisition of a new machine with a purchase price of $80,545, transportation costs of $9,221, installation costs of $6,311, and special acquisition fees of $2,597, would be journalized with a debit to the asset account for Oa. $80,545 Ob. $89,453 Oc. $86,856 Od. $98,674arrow_forwardSanta Rosa recentiy purchased a new boat to help ship product overseas. The following information is related to that purchase: Purchase price $4,100,000 Cost to bring boat to production facility $29,000 Yearly insurance cost $29,000 Annual maintenance cost of $40,000 Received 6% discount on sales price A. Determine the acquisition cost of the boat. $ 4,375,000 X Feedback Check My Work Remember that any costs incurred in the process of acquiring an asset and making it ready for its intended use can be capitalized as part of the value of the asset. Any other costs that maintain the asset during its use are standard expenses (not capitalized). B. Record the journal entry needed. If an amount box does not require an entry, leave it blank. Вoat 4,375,000 X Cash 4,375,000 Xarrow_forward

- An assembly line conveyor system with a 5-year life is to be depreciated by the DDB method. The conveyor units had a first cost of $30,000 with a$9000 salvage value. The annual operating cost allocated to the conveyor is $7000 per year. The book value at the end of year 2 is closest to:a. $6,480b. $10,800c. $12,400d. $18,000arrow_forwardA machine with a cost of $141,000 and accumulated depreciation of $90,500 is sold for $61,000 cash. The amount that should be reported in the operating activities section reported under the direct method is: Multiple Choice $61,000. $10,500. $50,500.arrow_forwardAgranary purchases a conveyor used in the manufacture of grain for transporting, filling. or emptying. It is purchased and installed for $80,000 with a market value for salvage purposes that decreases at arate of 20% per year with a minimum of value $1.750, Operation and maintenance is expected to cost $15.000 in the first year, increasing $1.060 per year thereafter. The granary uses a MARR of 15%. What is the optimum replacement interval for the conveyor? years, Click here to access the TVM Factor Table Calculator For calculation purposes, use 5 decimal places as displayed in the factor table provided.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage