Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

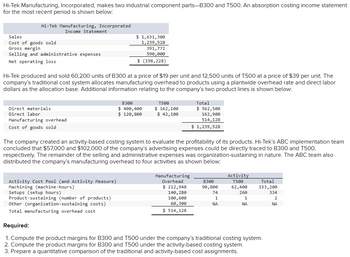

Transcribed Image Text:Hi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income statement

for the most recent period is shown below:

Hi-Tek Manufacturing, Incorporated

Income Statement

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

$ 1,631,300

1,239,528

391,772

Net operating loss

590,000

$ (198,228)

Hi-Tek produced and sold 60,200 units of B300 at a price of $19 per unit and 12,500 units of T500 at a price of $39 per unit. The

company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor

dollars as the allocation base. Additional information relating to the company's two product lines is shown below:

Direct materials

Direct labor

Manufacturing overhead

Cost of goods sold

B300

$ 400,400

$ 120,800

T500

$ 162,100

$ 42,100

Total

$ 562,500

162,900

514,128

$ 1,239,528

The company created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team

concluded that $57,000 and $102,000 of the company's advertising expenses could be directly traced to B300 and T500,

respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also

distributed the company's manufacturing overhead to four activities as shown below:

Activity Cost Pool (and Activity Measure)

Machining (machine-hours)

Manufacturing

Overhead

Setups (setup hours)

Product-sustaining (number of products)

$ 212,948

140,280

100,600

B300

90,800

Activity

T500

Total

62,400

74

1

260

1

153,200

334

2

Other (organization-sustaining costs)

60,300

NA

ΝΑ

ΝΑ

Total manufacturing overhead cost

$ 514,128

Required:

1. Compute the product margins for B300 and T500 under the company's traditional costing system.

2. Compute the product margins for B300 and T500 under the activity-based costing system.

3. Prepare a quantitative comparison of the traditional and activity-based cost assignments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Vinubhaiarrow_forwardPlease helparrow_forwardHi-Tek Manufacturing, Incorporated, makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing IncorporatedIncome Statement Sales $ 1,637,200 Cost of goods sold 1,230,044 Gross margin 407,156 Selling and administrative expenses 610,000 Net operating loss $ (202,844) Hi-Tek produced and sold 60,100 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $39 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below: B300 T500 Total Direct materials $ 400,800 $ 162,200 $ 563,000 Direct labor $ 120,100 $ 42,500 162,600 Manufacturing overhead 504,444 Cost of goods sold $ 1,230,044 The company has created an…arrow_forward

- Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss $1,766,100 1,243,888 522,212 640,000 $ (117,788) Hi-Tek produced and sold 60,100 units of B300 at a price of $21 per unit and 12,600 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,500 $ 120,000 T500 $ 162,000 $ 42,700 Total $ 562,500 162,700 518,688 $1,243,888 The company has created an activity-based costing system to evaluate the profitability of…arrow_forwardHi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Incorporated Income Statement Sales Cost of goods sold Selling and administrative expenses Gross margin Net operating loss $ 1,651,800 1,211,394 440,406 640,000 $ (199,594) Hi-Tek produced and sold 60,200 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,700 $ 162,000 $ 120,200 $ 42,000 T500 Total $ 562,700 162,200 486,494 $ 1,211,394 The company has created an activity-based costing system to evaluate the profitability…arrow_forwardHi-Tek Manufacturing, Inc., makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Inc. Income Statement Sales Cost of goods sold $ 1,653,900 1,228,630 Gross margin Selling and administrative expenses Net operating loss 425,270 640,000 $ (214,730) Hi-Tek produced and sold 60,100 units of B300 at a price of $19 per unit and 12,800 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,500 $162,700 $ $ 120,900 $ 42,800 T500 Total 563,200 163,700 501,730 $ 1,228,630 The company has created an activity-based costing system to evaluate the profitability of its products.…arrow_forward

- Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing IncorporatedIncome Statement Sales $ 1,716,000 Cost of goods sold 1,209,314 Gross margin 506,686 Selling and administrative expenses 580,000 Net operating loss $ (73,314) Hi-Tek produced and sold 60,400 units of B300 at a price of $20 per unit and 12,700 units of T500 at a price of $40 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below: B300 T500 Total Direct materials $ 400,100 $ 162,000 $ 562,100 Direct labor $ 121,000 $ 42,700 163,700 Manufacturing overhead 483,514 Cost of goods sold $ 1,209,314 The company has created an…arrow_forwardHi-Tek Manufacturing, Incorporated, makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing IncorporatedIncome Statement Sales $ 1,714,000 Cost of goods sold 1,224,031 Gross margin 489,969 Selling and administrative expenses 580,000 Net operating loss $ (90,031) Hi-Tek produced and sold 60,100 units of B300 at a price of $20 per unit and 12,800 units of T500 at a price of $40 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below: B300 T500 Total Direct materials $ 400,300 $ 162,500 $ 562,800 Direct labor $ 120,900 $ 42,300 163,200 Manufacturing overhead 498,031 Cost of goods sold $ 1,224,031 The company has created an…arrow_forwardHi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income state for the most recent period is shown below: Hi-Tek Manufacturing, Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss. Hi-Tek produced and sold 60,300 units of B300 at a price of $20 per unit and 12,500 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labo dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold $ 1,706,000 1,221,008 484,992 570,000 $ (85,008) Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead…arrow_forward

- Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing IncorporatedIncome Statement Sales $ 1,693,400 Cost of goods sold 1,219,200 Gross margin 474,200 Selling and administrative expenses 630,000 Net operating loss $ (155,800) Hi-Tek produced and sold 60,100 units of B300 at a price of $20 per unit and 12,600 units of T500 at a price of $39 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below: B300 T500 Total Direct materials $ 400,800 $ 162,600 $ 563,400 Direct labor $ 120,300 $ 42,100 162,400 Manufacturing overhead 493,400 Cost of goods sold $ 1,219,200 The company has created an…arrow_forwardHi-Tek Manufacturing, Inc., makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Inc.Income Statement Sales $ 1,755,300 Cost of goods sold 1,253,994 Gross margin 501,306 Selling and administrative expenses 610,000 Net operating loss $ (108,694 ) Hi-Tek produced and sold 60,000 units of B300 at a price of $21 per unit and 12,700 units of T500 at a price of $39 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below: B300 T500 Total Direct materials $ 400,800 $ 162,200 $ 563,000 Direct labor $ 120,200 $ 42,400 162,600 Manufacturing overhead 528,394 Cost of goods sold $ 1,253,994 The company has…arrow_forwardHi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income state for the most recent period is shown below: Hi-Tek Manufacturing, Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss. Hi-Tek produced and sold 60,300 units of B300 at a price of $20 per unit and 12,500 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labo dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold $ 1,706,000 1,221,008 484,992 570,000 $ (85,008) Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub