Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

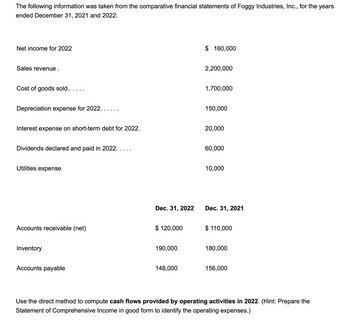

Transcribed Image Text:The following information was taken from the comparative financial statements of Foggy Industries, Inc., for the years

ended December 31, 2021 and 2022:

Net income for 2022

Sales revenue.

Cost of goods sold.. . . . .

Depreciation expense for 2022. . . . . .

$ 160,000

2,200,000

1,700,000

150,000

Interest expense on short-term debt for 2022.

20,000

Dividends declared and paid in 2022. . . . .

60,000

Utilities expense

10,000

Dec. 31, 2022

Dec. 31, 2021

Accounts receivable (net)

$ 120,000

Inventory

Accounts payable

$110,000

190,000

180,000

148,000

156,000

Use the direct method to compute cash flows provided by operating activities in 2022. (Hint: Prepare the

Statement of Comprehensive Income in good form to identify the operating expenses.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callablearrow_forwardThe following are the comparative financial statements for Outland Corporation for 2020 and 2019: OUTLAND CORPORATION Statement of Income For Periods Ending October 31 Sales Revenue Cost of Goods Sold Gross Profit.. 2020 167,500 100,000 67,500 2019 140,000 85,000 55,000 Expenses Depreciation Selling and Administrative Interest Expense. Total Expenses. 15,000 22,500 15,000 15,000 47,500 35,000 Net Income (before taxes). Income Taxes 25,000 10,000 15,000 22,500 7,500 15,000 Net Income OUTLAND CORPORATION Statement of Financial Position As at October 31 2020 2019 Assets Current Assets: 4,000 10,000 35,000 31,000 80,000 Cash. 2,500 7,500 30,000 25,000 65,000 Marketable Securities. Accounts Receivable. Inventory Total Current Assets Investments (at cost).. 30,000 32,500 Property, plant and equipment Property, Plant and Equipment.. Less: Accumulated Depreciation. 200,000 87,500 112,500 2,500 225,000 190,000 80,000 110,000 2,500 210,000 Goodwill Total Assets Liabilities and Shareholders'…arrow_forwardSelected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ 442,035 $ 338,635 266,105 214,695 123,940 46,732 29,800 76,532 47,408 9,719 Sales Cost of goods sold Gross profit! Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings KORBIN COMPANY Comparative Balance Sheets Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2021, 2020, and 2019 2021 2020 Long-term investments Plant assets, net Total assets 175,930 62,769 39,783 102,552 73,378 13,648 $ 59,730 $ 37,689 Liabilities and…arrow_forward

- Mirabel Corporation's financial statements for 2020 follow: Sales...... Cost of goods sold. Gross profit.... Operating expenses. Income before taxes. Income taxes.. Net income.. MIRABELCORPORATION Statement of Income For the Year Ended July 31, 2020 Cash. Receivables. Inventory...... MIRABEL CORPORATION Statement of Financial Position July 31, 2020 Property, plant and equipment (net). Total assets. Current liabilities. Non-current liabilities. Common shares. Retained earnings.. Total liabilities and shareholders' equity. Calculate the current ratio (use up to two decimal places) $1,575,000 (976,500) 598,500 (236,250) 362,250 (144,900) $217,350 49,000 143,900 167,800 682,800 $1,043,500 $ 131,000 450,000 250,000 212,500 $1,043,500arrow_forwardLiverton Co.’s income statement for the year ended 31 March 2019 and statements of financial position at 31 March 2019 and 2018 were as follows in the images. Calculate for the financial year ended 31 March 2019 and, where possible, for 31 March 2018, the following ratios: i) Gross profit marginii) Assets usageiii) Current ratioiv) Acid testv) Inventories holding periodvi) Debt to Equity ratioarrow_forwardRousseau Corporation has the following Statement of Income for the year ended May 31, 2020: Sales... $1,675,200 Cost of goods sold.. 887,600 Gross margin... 787,600 Selling & administrative expense.. 241,200 Interest expense. 65,000 Income before income taxes. 481,400 192,500 $288,900 Income taxes.. Net income.... Calculate the interest-coverage ratio for Rousseau Corporation for May31, 2020 (place answer at up to 2 decimal places in the space below). 신arrow_forward

- Comparitive balance sheet of Hillard Co. as of Dec 31, 2020 and 2021 is as under: Assets 2020 2021 Liabilities Cash Accounts Receivable Inventory Fixed Assets Investments Sales Cost of Goods Sold Gross profit 16,425 12,300 Salaries expenses Depreciation expense Income tax expense Admin. Expenses Net profit 16,100 163,000 13,500 221,325 28,025 10,600 Income statement for the year 2021 is as under: 18,400 206,300 9,200 272,525 829,400 614,450 214,950 12,900 11,600 1,150 164,400 24,900 Accounts Payable Salaries Payable Income tax payable Loans Payable Retained earnings Please prepare the cash flow statement using the indirect method. 2020 26,900 2,400 1,600 106,250 84,175 221,325 2021 33,450 3,100 2,050 113,250 120,675 272,525arrow_forwardSelected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 Sales. Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments. Plant assets, net Total assets KORBIN COMPANY Comparative Balance Sheets Liabilities and Equity Current liabilities. 2021 2020 2019 $ 483,981 $ 370,769 $ 257,300 291,357 234,326 164,672 192,624 136,443 92,628 68,725 51,166 43,558 32,628 112,283 83,794 80,341 52,649 14,943 10,793 $ 65,398 $ 41,856 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Common stock Other paid-in capital Retained earnings Total liabilities and equity December 31 2021 S % $ 57,843 0 KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2021, 2020, and 2019 2021…arrow_forwardThe following are the financial statement JNC Ltd. for the year ended 31 March 2020: JNC Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 JNC Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities: Loan 85 25…arrow_forward

- please answerarrow_forwardCondensed balance sheet and income statement data for Oriole Corporation are presented here. Cash Accounts receivable (net) Other current assets Investments Property, plant, and equipment (net) Current liabilities Long-term debt Common stock, $10 par Retained earnings Oriole Corporation Balance Sheets December 31 2022 $ 30,100 49,800 89,600 55,100 500,100 $724,700 24 $84,500 145.700 381,000 113.500 $724,700 Sales Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses (including income taxes) Net income Oriole Corporation Income Statement For the Years Ended December 31 2022 $16,100 45,500 95,000 70,000 370,800 $597,400 $79,400 84,300 319,000 114,700 $597,400 2021 $744.500 39 200 705 300 424.700 280,600 188.911 $91.689 2021 $605,400 30,700 574.700 366.000 208.700 151 200 $57.470 2020 $18,300 47,900 63,000 46,000 358,600 $533,800 306,000 107,400 $533,800 $69,700 50,700 Additional information: The market price of Oriole's common stock was…arrow_forwardSelected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31. 2020 $ 487,179 $ 373,219 2021 293,282 236,621 193,897 69,179 43,846 113,025 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets 84,347 80,872 52,251 15,042 10,711 $ 65,830 $ 41,540 KORBIN COMPANY Comparative Balance Sheets December 31 Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities. Common stock Other paid-in capital Retained earnings Total liabilities and equity 136,598 51,504 32,843 2021 2020 2019 $ 259,000 165,760 93,240 34,188 21,497 55,685 37,555 7,624 $ 29,931 $ 64,678 116,492 0 $ 43,289 900 106,308 $ 181,170 $ 150,497 $ 26,451 66,000 8,250 80,469 $ 22,424 66,000 8,250 53,823 $ 181,170 $ 150,497 2019 $ 57,867 4,860 61,960 $ 124,687 $ 21,820 48,000 5,333 49,534 $ 124,687arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning