FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

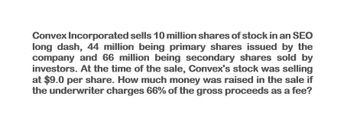

Transcribed Image Text:Convex Incorporated sells 10 million shares of stock in an SEO

long dash, 44 million being primary shares issued by the

company and 66 million being secondary shares sold by

investors. At the time of the sale, Convex's stock was selling

at $9.0 per share. How much money was raised in the sale if

the underwriter charges 66% of the gross proceeds as a fee?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need answer of this question solution general accountingarrow_forwardNeed help with this accounting questionsarrow_forwardon 1/1/20, ABC Corp bought 500 shares of XYZ Corp for $10,000. XYZ Corp has 25,000 shares outstanding. on 6/1/20, XYZ pays a $100,000 cash dividend to all shareholders. On 12/31/20, XYZ is trading at $22/share and during 2020 XYZ reported net income of $250,000. What is the total effect on net income for ABC from this investment? Assume ABC reports annually on a calendar year basis.arrow_forward

- The Apex Corporation sells one million shares of its $0.02 par value Common Stock for $15 per share. The effects of this transaction on Apex Corporation’s accounts are: Select one: a. Cash +$15 million, Common Stock +$20,000, Additional Paid-in Capital +$14,980,000. b. Cash +$20,000, Common Stock +$20,000, No Effect on Additional Paid-in-Capital. c.Cash +$15 million, Common Stock ($20,000), Additional Paid-in-Capital ($14,980,000). d. Cash +$14,980,000, Common Stock ($20,000), Additional Paid-in-Capital +$15 millionarrow_forwardwhat journal entry would be made for the following transaction? highway studios sells 10 million of its no-par common shares for $10 per share.arrow_forwardKenny Limited's issued share capital is £125,000 made up of 250,000 ordinary shares of £0.50 each. In the year to 31 October 2020, Kenny Limited makes the following profits: Profit before tax: £95,000 Profit for the year: £70,000 Kenny Limited has no preference shares in issue. What are the earnings per share of Kenny Limited for the year ended 31 October 2020?arrow_forward

- Black company owned 50,000 ordinary shares which were purchased for P120 per share. During the year, theinvestee distributed 50,000 stock rights to the investor. The investor was entitled to buy one new share for P90 cash and two of these rights. Each share had a market value of P130 and each right had a market value of P20 on the date of issue. What amount should be debited to the investment account if the rights were not accounted for separately?arrow_forwardABC purchases 118 shares of XYZ company at $38 per share in its margin account. ABC finances part of the purchase by borrowing $1967 at a rate of 9% per year. One year later the price of XYZ shares has changed by 22%. Therefore the return earned by ABC in its marging account is % (Negative amounts should be indicated by a minus sign. Round your answer to 2 decimal places, e.g. 110.10)arrow_forwardAssume the issuer incurs $1 million in otherexpenses to sell 3 million shares at $40 each to anunderwriter and the underwriter sells the shares at$43 each. By the end of the first day’s trading, theissuing company’s stock price had risen to $70.What is the total cost of underpricing?arrow_forward

- Bo's Home Manufacturing has 280,000 shares outstanding that sell for $43.87 per share. The company has announced that it will repurchase $48,000 of its stock. What will the share price be after the repurchase?arrow_forwardAyayai Corporation purchased 300 common shares of Sigma Inc. for trading purposes for $9,300 on September 8 and accounted for the investment under ASPE at FV-NI. In December, Sigma declared and paid a cash dividend of $1.65 per share. At year end, December 31, Sigma shares were selling for $35.60 per share. In late January, Ayayai sold the Sigma shares for $34.60 per share. Prepare Ayayai Corporation’s journal entry to record the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit September 8 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount Prepare Ayayai Corporation’s journal entry to record the dividends received. (Credit…arrow_forwardOn January 20, Metropolitan Inc., sold 10 million shares of stock in an SEO. The market price of Metropolitan at the time was $42.25 per share. Of the 10 million shares sold, 5 million shares were primary shares being sold by the company, and the remaining 5 million shares were being sold by the venture capital investors. Assume the underwriter charges 4.6% of the gross proceeds as an underwriting fee. a. How much money did Metropolitan raise? b. How much money did the venture capitalists receive? c. If the stock price dropped 2.5% on the announcement of the SEO and the new shares were sold at that price, how much money would Metropolitan receive? a. How much money did Metropolitan raise? After underwriting fees, Metropolitan raised $ million. (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education