EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question solution general accounting

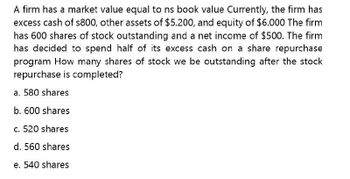

Transcribed Image Text:A firm has a market value equal to ns book value Currently, the firm has

excess cash of s800, other assets of $5.200, and equity of $6.000 The firm

has 600 shares of stock outstanding and a net income of $500. The firm

has decided to spend half of its excess cash on a share repurchase

program How many shares of stock we be outstanding after the stock

repurchase is completed?

a. 580 shares

b. 600 shares

c. 520 shares

d. 560 shares

e. 540 shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has a market value equal to its book value. Currently, the firm has excess cash of $1,100, other assets of $6,900, and equity of $8,000. The firm has 800 shares of stock outstanding and a net income of $1,000. The firm has decided to spend half of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? a. 765 shares b. 785 shares c. 725 shares d. 745 shares e. 705 sharesarrow_forwardI want to correct answer general accountingarrow_forwarded A company has the following balance sheet (market values): Liabilities + Equity Debt Equity Assets Cash Operating Assets 600 1000 400 1200 If the firm has 300, find its fair share price after it repurchases 100 worth of shares: (round your answer to the nearest 0.01)arrow_forward

- A firm has a market value equal to its book value. Currently, the firm has excess cash of $1,800 and other assets of $5,700. Equity is worth $7,500. The firm has 750 shares of stock outstanding and net income of $1,500. The firm has decided to spend all of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed?arrow_forwardA company has the following balance sheet (market values): Liabilities + Equity Debt Equity Assets Cash Operating Assets 600 1000 400 1200 If the firm has 110. find the # of outstanding shares remaining after it repurchases 120 worth of shares: (round your answer to the nearest 0.01)arrow_forwardThe stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $.50 per share, and there are 20,000 shares of stock outstanding. The market-value balance sheet for Payout is shown in the following table. Liabilities & Equity Assets $100,000 Cash Fixed $1,000,000 $1,000,000 assets 900,000 Equity Total $1,000,000 Total Required: (a.) (b.) (c.) What price is Payout stock selling for today? What price will it sell for tomorrow? Ignore taxes. Suppose that instead of paying a dividend, Payout Corp. announces that it will repurchase stock with a market value of $10,000. What happens to the stock price when the repurchase proposal is announced? Suppose that the stock is repurchased immediately after the announcement. What would be the stock price after the repurchase? (d.)arrow_forward

- You are given the following information: Book value of stockholders' equity = $5 million; price/earnings ratio = 10; shares outstanding = 100,000; and the market/book ratio = .5. Calculate the market price of %3D a share of the company's stock. O $37.50 O $25.00 O $50.00 O $75.00 O $16.67arrow_forwardA firm has a market value equal to its book value. Currently, the firm has $500,000 of excess cash, $4,500,000 in other assets, $1,000,000 in liabilities, $40,000 in common stock at $1 par, $0 in retained earnings, and $30,000 in net income. Assume that the firm uses all of its excess cash to repurchase some of its shares outstanding. How many shares will be outstanding after the repurchases are completed? (Round, if necessary, your final answer to the whole number).arrow_forwardOweninc has a current stock price of $13.70 and is expected to pay a $1.00 dividend in one year. If Oweninc's equity cost of capital is 11%, what price would Owenlnc's stock be expected to sell for immediately after it pays the dividend? OA. $11.37 OB. $15.21 OC. $9.95 OD. $14.21 wwwarrow_forward

- You have the following information about Trisha Company: total asset =P350,000; common stock equity = P175,000; Return on Equity (ROE) =12.5%. What is Trisha’s earnings available for common stockholders? A. P21,875B. P43,750C. P50,000D. P47,632arrow_forwardSuppose you have the following information about a company. Calculate the stock price per share. A company has a current value of operations of $400 million. The company has $80 million in short-term investments, $200 million in debt and 10 million shares outstanding.arrow_forwardHi, If a company has 32,000 common stock shares outstanding $10 par value, then purchases 2,300 shares of treasury stock at $25 per share. How would this be jouralized? Also, after those transaction the same company declared a $0.10 per share cash dividend on the common stock outstanding. How would this be jouralized?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT