Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Please need answer

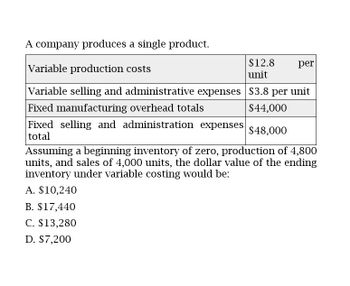

Transcribed Image Text:A company produces a single product.

Variable production costs

$12.8

unit

per

Variable selling and administrative expenses $3.8 per unit

Fixed manufacturing overhead totals

$44,000

Fixed selling and administration expenses $48,000

total

Assuming a beginning inventory of zero, production of 4,800

units, and sales of 4,000 units, the dollar value of the ending

inventory under variable costing would be:

A. $10,240

B. $17,440

C. $13,280

D. $7,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Total costs for ABC Distributing are $250,000 when the activity level is 10,000 units. If variable costs are $5 per unit, what are their fixed costs? $240,000 $200,000 $260,000 Their fixed costs cannot be determined from the information presented.arrow_forwardGrand Canyon Manufacturing Inc. produces and sells a product with a price of 100 per unit. The following cost data have been prepared for its estimated upper and lower limits of activity: Overhead: Selling and administrative expenses: Required: 1. Classify each cost element as either variable, fixed, or semi-variable. (Hint: Recall that variable expenses must go up in direct proportion to changes in the volume of activity.) 2. Calculate the break-even point in units and dollars. (Hint: First use the high-low method illustrated in Chapter 4 to separate costs into their fixed and variable components.) 3. Prepare a break-even chart. 4. Prepare a contribution income statement, similar in format to the statement appearing on page 540, assuming sales of 5,000 units. 5. Recompute the break-even point in units, assuming that variable costs increase by 20% and fixed costs are reduced by 50,000.arrow_forwardStarling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200arrow_forward

- Analyzing Income under Absorption and Variable Costing Variable manufacturing costs are $72 per unit, and fixed manufacturing costs are $137,600. Sales are estimated to be 7,600 units. If an amount is zero, enter "0". Do not round interim calculations. Round final answer to nearest whole dollar. a. How much would absorption costing income from operations differ between a plan to produce 7,600 units and a plan to produce 8,600 units?$fill in the blank 1 b. How much would variable costing income from operations differ between the two production plans?$fill in the blank 2arrow_forwardUnder absorption costing, the cost of goods sold would be: A. 39,000 B. 62,400 C. 70,200D. 71,000arrow_forwardAnalyzing Income under Absorption and Variable Costing Variable manufacturing costs are $86 per unit, and fixed manufacturing costs are $193,200. Sales are estimated to be 6,900 units. If an amount is zero, enter "0". Round intermediate calculations to the nearest cent and your final answers to the nearest dollar. a. How much would absorption costing operating income differ between a plan to produce 6,900 units and a plan to produce 9,200 units? X b. How much would variable costing operating income differ between the two production plans? ✓arrow_forward

- Provide answer the questionarrow_forwardAnalyzing Income under Absorption and Variable Costing Variable manufacturing costs are $85 per unit, and fixed manufacturing costs are $106,400. Sales are estimated to be 5,600 units. If an amount is zero, enter "0". Round intermediate calculations to the nearest cent and your final answers to the nearest dollar. a. How much would absorption costing operating income differ between a plan to produce 5,600 units and a plan to produce 7,600 units?$fill in the blank 1 b. How much would variable costing operating income differ between the two production plans?$fill in the blank 2arrow_forwardAnalyzing Income under Absorption and Variable Costing Variable manufacturing costs are $83 per unit, and fixed manufacturing costs are $126,000. Sales are estimated to be 6,000 units. If an amount is zero, enter "0". Round intermediate calculations to the nearest cent and your final answers to the nearest dollar. a. How much would absorption costing operating income differ between a plan to produce 6,000 units and a plan to produce 8,400 units?$ b. How much would variable costing operating income differ between the two production plans?$arrow_forward

- Analyzing Income under Absorption and Variable Costing Variable manufacturing costs are $99 per unit, and fixed manufacturing costs are $215,600. Sales are estimated to be 7,700 units. If an amount is zero, enter "0". Round intermediate calculations to the nearest cent and your final answers to the nearest dollar. a. How much would absorption costing operating income differ between a plan to produce 7,700 units ard a plan to produce 9,800 units? b. How much would variable costing operating income differ between the two production plans? 0 Feedback Check My Work a. Remember that under variable costing, regardless of whether 7,700 units or 9,800 units are manufactured, no fixed manufacturing costs are allocated to the units manufactured. Instead, all fixed manufacturing costs are treated as a period expense. Therefore the change in units times the per unit fixed costs for the greater production level is the difference in income between the two costing methods. b. Remember that since all…arrow_forwardLone star has computed the following unit costs solution this questionarrow_forwardA company produces a single product. Variable production costs are P12 per unit and variable selling and administrative expenses are P3 per unit. Fixed manufacturing overhead totals P36,000 and fixed selling and administration expenses total P40,000. Assuming a beginning inventory of zero, production of 4,000 units and sales of 3,600 units, the peso value of the ending inventory under variable costing would be a. P4,800 b. P8,400 c. P6,000 d. P3,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning