Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Not use

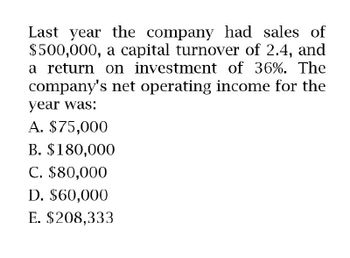

Transcribed Image Text:Last year the company had sales of

$500,000, a capital turnover of 2.4, and

a return on investment of 36%. The

company's net operating income for the

year was:

A. $75,000

B. $180,000

C. $80,000

D. $60,000

E. $208,333

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year, Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardMason Corporation had $1,162,000 in invested assets, sales of $1,265,000, operating income amounting to $208,000, and a desired minimum return on investment of 14%. The profit margin for Mason Corporation is Oa. 17.9% b. 14.0% Oc. 91.9% Od. 16.4%arrow_forwardLast year a company had sales of $410,000, a turnover of 2.1, and a return on investment of 29.4%. The company's net operating income for the year was: Multiple Cholce $63,140 $195,238 $120,540 $57.400arrow_forward

- Last year Green Co. had sales of $800,000, a turnover of 3.5, and a return on investment of 14 %. Green Co.'s net operating income for the year was?arrow_forwardMason Corporation had $1,130,000 in invested assets, sales of $1,283,000, operating income amounting to $236,000, and a desired minimum return on investment of 15%. The profit margin (rounded to one decimal place) for Mason Corporation is ○ a. 88.1% O b. 20.9% O c. 15.0% O d. 18.4%arrow_forwardBlaser Corporation had $1,092,000 in invested assets, sales of $1,214,000, income from operations amounting to $207,000, and a desired minimum return of 14%. The return on investment for Blaser Corporation is Round the percentage to one decimal place. Oa. 19.0% Оb. 22.7% Oc. 17.1% Od. 13.6% Previous Next 7:33 РM CP 12/13/2020arrow_forward

- Last year a company had sales of $400,000, a turnover of 2.4, and a return on investment of 36%. The company's net operating income for the year was: 1. $144,000 2. $120,000 3. $80,000 4. $60,000arrow_forwardMason Corporation had $1,124,000 in invested assets, sales of $1,284,000, operating income amounting to $238,000, and a desired minimum return on investment of 13%. The profit margin for Mason Corporation is a.21.2% b.18.5% c.13.0% d.87.5%arrow_forwardGrove Corp. has revenues of $1,531,000 resulting in an operating income of $183,000. Average invested assets total $801,000. If sales increase by 10% and the investment level remains constant, what is the investment turnover?A.) 2.10B.) 12.65%C.) 1.91D.) 11.95%arrow_forward

- Lewis Company has operating income of $265,000. Its return on investment (ROI) is 53%, while its target rate of return is 7%. The total assets of Lewis Company may be closest to O A. $140,450. O B. $3,785,714. O C. $18,550. O D. $500,000arrow_forwardLast year a company had sales of $400,000, a turnover of 2.4, and a return on investment of 36%. The company's net operating income for the year was: A. B. C. D. E. F. $144,000 $120,000 $80,000 $60,000 $72,000 None of the abovearrow_forwardUse this information for Mason Corporation to answer the question that follow. Mason Corporation had $1,058,000 in invested assets, sales of $1,229,000, income from operations amounting to $202,000, and a desired minimum return of 12%. Round the percentage to one decimal place. The profit margin for Mason Corporation is Oa. 19.1% Ob. 16.4% Oc. 86.1% IC. Od. 12.0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College