Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

not use ai please

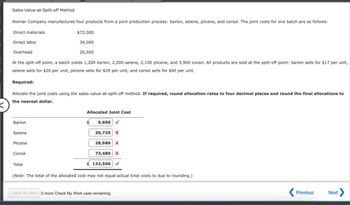

Transcribed Image Text:Sales-Value-at-Split-off Method

Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for one batch are as follows:

Direct materials

Direct labor

Overhead

$72,000

34,000

26,500

At the split-off point, a batch yields 1,200 barlon, 2,200 selene, 2,100 plicene, and 3,900 corsol. All products are sold at the split-off point: barlon sells for $17 per unit,

selene sells for $20 per unit, plicene sells for $29 per unit, and corsol sells for $40 per unit.

Required:

Allocate the joint costs using the sales-value-at-split-off method. If required, round allocation rates to four decimal places and round the final allocations to

the nearest dollar.

Barlon

Selene

Allocated Joint Cost

9,606

20,725 X

Plicene

Corsol

Total

28,686 X

73,480 X

132,500 ✔

(Note: The total of the allocated cost may not equal actual total costs to due to rounding.)

Check My Work 0 more Check My Work uses remaining.

Previous

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were 50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, 18,000; unders, 23,040. Overs sell for 2.00 per unit; unders sell for 3.14 per unit. Required: 1. Allocate the 50,000 joint costs using the estimated net realizable value method. 2. Suppose that overs could be sold at the split-off point for 1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations.arrow_forwardOakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forwardJoint cost allocation Lovely Lotion Inc. produces three different lotions: hand, body, and foot. The lotions are produced jointly in a mixing process that costs a total of 250 per batch. At the split-off point, one batchproduces 80, 40, and 25 bottles of hand, body, and foot lotion, respectively. After the split-off point,hand lotion is sold immediately for 2.50 per bottle. Body lotion is processed further at an additional cost of 0.25 per bottle and then sold for 5.75 per bottle. Foot lotion is processed further atan additional cost of 0.85 per bottle and then sold for 4.00 per bottle. Assume that body and footlotion could be sold at the split-off point for 3.00 and 3.20 per bottle, respectively. Instructions 1. Using the market value at split-off method, allocate the joint costs of production to each product. 2. Based on the information provided and your answer to part (1), should Lovely LotionInc. continue processing body and foot lotion after the split-off point? 3. Allocate the joint costs of production to each product using the net realizable value method.arrow_forward

- Joint cost allocation McKenzies Soap Sensations, Inc., produces hand soaps with three different scents: morning glory, snowflake sparkle, and sea breeze. The soap is produced through a joint production process thatcosts 30,000 per batch. Each batch produces 14,800 bottles of morning glory hand soap, 12,000bottles of snowflake sparkle hand soap, and 10,000 bottles of sea breeze hand soap at the split-offpoint. Each product is processed further after the split-off point, but the market value of a bottle ofany of the flavors at this point is estimated to be 1.25 per bottle. The additional processing costsof morning glory, snowflake sparkle, and sea breeze hand soap are 10.50, 0.55, and 0.60 perbottle, respectively. Morning glory, snowflake sparkle, and sea breeze hand soap are then sold for2.00, 2.20, and 2.40 per bottle, respectively. Instructions 1. Using the net realizable value method, allocate the joint costs of production to each product. 2. Explain why McKenzies Soap Sensations, Inc., always chooses to process each varietyof hand soap beyond the split-off point. 3. If demand for all products was the same, which product should McKenzies Soap Sensations, Inc., produce in the highest quantity?arrow_forwardTucariz Company processes Duo into two joint products, Big and Mini. Duo is purchased in 1,000-gallon drums for 2.000. Processing costs are 3,000 to process the 1,000 gallons of Duointo 800 gallons of Big and 200 gallons of Mini. The selling price is 9 per gallon for Big and4 per gallon for Mini. If the physical units method is used to allocate joint costs to the finalproducts, the total cost allocated to produce Mini is: a. 500. b. 4,000. c. 1,000. d. 4,500.arrow_forwardLeMoyne Manufacturing Inc.’s joint cost of producing 2,000 units of Product X, 1,000 units of Product Y, and 1,000 units of Product Z is $50,000. The unit sales values of the three products at the split-off point are Product X–$30, Product Y–$100, and Product Z–$90. Ending inventories include 200 units of Product X, 300 units of Product Y, and 100 units of Product Z. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales values at split-off. Assume that Product Z can be sold for $120 a unit if it is processed after split-off at a cost of $10 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forward

- Breegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of 22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit? a. B-40 only b. J-60 only c. H-102 only d. B-40 and H-102 onlyarrow_forwardLaramie Industries produces two joint products, H and C. Prior to the split-off point, the company incurred costs of $66,000. Product H weighs 44 pounds and product C weighs 66 pounds. Product H sells for $250 per pound and product C sells for $295 per pound. Based on a physical measure of output, allocate joint costs to products H and C.arrow_forwardA company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs 12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Required: 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. (Round the percentages to four significant digits. Round all cost allocations to the nearest dollar.) 2. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products?arrow_forward

- Computing joint costssales value at split-off and net realizable value methods D.L. Manufacturing Inc.s joint cost of producing 1,000 units of Product A, 500 units of Product B, and 500 units of Product C is 20,000. The unit sales values of the three products at the split-off point are Product A20, Product B200, and Product C160. Ending inventories include 100 units of Product A, 200 units of Product B, and 300 units of Product C. a. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales value at split off. b. Assume that Product C can be sold for 200 a unit if it is processed after split-off at a cost of 25 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forwardSell at Split-Off or Process Further Eunice Company produces two products from a joint process. Joint costs are 70,000 for one batch, which yields 1,000 liters of germain and 4,000 liters of hastain. Germain can be sold at the split-off point for 24 or be processed further, into geraiten, at a manufacturing cost of 4,100 (for the 1,000 liters) and sold for 33 per liter. If geraiten is sold, additional distribution costs of 0.80 per liter and sales commissions of 10% of sales will be incurred. In addition, Eunices legal department is concerned about potential liability issues with geraitenissues that do not arise with germain. Required: 1. CONCEPTUAL CONNECTION Considering only gross profit, should germain be sold at the split-off point or processed further? 2. CONCEPTUAL CONNECTION Taking a value-chain approach (by considering distribution, marketing, and after-the-sale costs), determine whether or not germain should be processed into geraiten.arrow_forwardMedical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning