Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

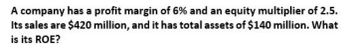

Transcribed Image Text:A company has a profit margin of 6% and an equity multiplier of 2.5.

Its sales are $420 million, and it has total assets of $140 million. What

is its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- DTO, Inc., has sales of $32 million, total assets of $25 million, and total debt of $7 million. a. If the profit margin is 6 percent, what is the net income? b. What is the ROA? c. What is the ROE?arrow_forwardA company has a profit margin of 6.5% and an equity multiplier of 2.8. Its sales are $750 million, and it has total assets of $250 million. What is its ROE?arrow_forwardWims Inc., has sales of $18.3 million total assts of $13.3 million and total debt of $4.1 million. The profit margin is 11 percent. a. What is the company's net income? b. What is the company's ROA? c. What is the company's ROE?arrow_forward

- A firm has a profit margin of 7% and an equity multiplier of 1.3. Its sales are $130 million, and it has total assets of $78 million. What is its ROE? Do not round intermediate calculations. Round your answer to twoarrow_forwardNeed answer with this accounting questionarrow_forwardWhat is the firm's ROA?arrow_forward

- What is its equity multiplier on these accounting question?arrow_forwardHenderson’s Hardware has an ROA of 11%, a 6% profit margin, andan ROE of 23%. What is its total assets turnover? What is its equity multiplier?arrow_forwardHalfway There Corp has a profit margin of 4% and an equity multiplier of 1.8. Its sales are $250 million, and it has total assets of $73 million. What is its ROE?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning