Personal Finance

13th Edition

ISBN: 9781337669214

Author: GARMAN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Don't use ai please given answer accounting questions

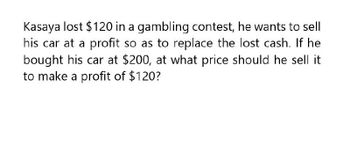

Transcribed Image Text:Kasaya lost $120 in a gambling contest, he wants to sell

his car at a profit so as to replace the lost cash. If he

bought his car at $200, at what price should he sell it

to make a profit of $120?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bill is cleaning his basement and finds an old vase. Believing the vase is worthless he sells it for $50.00. Later he discovers that the vase was really worth $25,000. Bill will be able to: A) recover $25,000. B) not recover anything because mistakes in judgement as to value do not permit you to avoid a contract. C) rescind the contract D) all of the abovearrow_forwardKim is in financial difficulty. He owes $5,000 and cannot pay it back now. Should he declare bankruptcy? Why? What do you think he should do?arrow_forwardSolve this problemarrow_forward

- Rosa Valencia has a personal automobile policy (PAP) with coverage of $25,000/$50,000 for bodily injury liability, $10,000 for property damage liability that includes coverage for her vehicle, $5,000 for medical payments, and a $500 deductible for collision insurance. How much will her insurance cover in each of the following situations? Will she have any out-of-pocket costs? Rosa loses control when she swerves to miss a dog on the street, running into a parked car and causing $5,300 damage to the unoccupied vehicle and $3,750 damage to her own car. Rosa pulls out in front of another car and causes a serious auto accident, badly injuring three people. The injured parties win lawsuits against her for $35,000 for one individual, and the other two passengers claimed $5,000 each ($10,000 total). Rosa’s 16-year-old daughter borrows her car. She runs off the road when texting while driving and causes $450 damage to the car.arrow_forwardJessica is a professional consultant. She agrees to consulting services for Joe for $2,000. After she finishes, Joe does not have cash to pay Jessica, but he has an antique, collectible baseball card with a fair market value of $2,000 that he gives her to satisfy the payment. The baseball card cost Joe $500. How much should Jessica include in her gross income?arrow_forwardMike purchased a Personal Auto Policy that included Part D (coverage for damage to your auto). He lost control of his car on an icy road, slid off the road and hit a tree. Ignoring any deductible, what will the insurer pay for the damage to Mike's car? O the lesser of actual cash value or the cost to repair or replace the vehicle O the original purchase price of the vehicle O the replacement cost of the vehicle the greater of actual cash value or the cost to repair or replace the vehicle O nothingarrow_forward

- Ricky signed a contract to sell his slightly-used Suzuki Vitara Golf for $15,000 to an old friend Boris, after the latter threatened to tell Ricky's wife that Ricky is a discharged bankrupt. The vehicle still has a market value of $24,000. Boris told Ricky that if he didn’t sell his car to him, he will could always organise some of his former associates, who are all convicted felons, to visit Ricky and force him to do so. Advise Ricky on whether he has any remedies to have the contract declared void and get his car backarrow_forwardJohn has an auto which is covered for collision losses subject to a $250 deductible. Kate's auto also has collision coverage but her deductible is $500. John got in an accident while borrowing Katie's car and incurred a $2,500 covered collision loss. John's policy will pay s of the covered loss. Katie's policy will pay $ IMPORTANT: Your answers should be rounded to the nearest integer and should NOT include symbols ('S' or ).arrow_forward2. Donald owns a car repair business. Hoodlums broke into his shop at night and stole his personal vehicle, which was there being repaired. His vehicle’s FMV before being stolen was 25,000 and FMV after was zero. The cost to replace his vehicle was 19,000, which is the amount he received in insurance proceeds. Donald’s AGI is $90,000. What deduction can Donald take on his 1040 due to the break-in? 0 6000 19000 25000arrow_forward

- Zachary Lee has a personal automobile policy (PAP) with coverage of $25,000/$50,000 for bodily injury liability, $25,000 for property damageliability, $5,000 for medical payments, and a $500 deductible for collision insurance. How much will his insurance cover in each of the following situations? Will he have any out-of-pocket costs?a. Zachary loses control and skids on ice, running into a parked car and causing $3,785 damage to the unoccupied vehicle and $2,350 damage to his own car.b. Zachary runs a stop sign and causes a serious auto accident, badly injuring two people. The injured parties win lawsuits against him for $30,000 each.c. Zachary’s 18-year-old son borrows his car. He backs into a telephone pole and causes $450 damage to the car.arrow_forwardTrent is broke and needs cash immediately to pay off a debt he incurred. He visits the local pawn shop and leaves his grandfather’s watch in exchange for $100.00 cash. This is an example of what type of loan? Multiple Choice Unsecured loan Chattle loan UCC loan Secured loan The Environmental Defense Fund, an environmental watchdog group, files a lawsuit to prevent future open-pit coal mining in West Virginia. This type of lawsuit is known as a Multiple Choice wrongful-damage suit. negligence suit. citizen suit. nuisance suit. All of the following may be used as collateral for a secured transaction except Multiple Choice Future profits of a business A promissory note A patent Seeds and cropsarrow_forward8. Which of the following best illustrates a moral hazard? . Because he has plenty of insurance, Cameron does not take steps to make his property safe when most of his neighbors have been vandalized or burglarized. . The coverage on Carl's residence has increased each year, but the value of his hom has declined due to neighborhood influences and his home's state of disrepair. . Chet purchases actual cash value, rather than replacement, coverage in order to save money on his homeowners insurance premiums. . When Clarke's empty property is vandalized, he moves furniture into the house and damages it in order to submit a larger claim.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT