Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Account

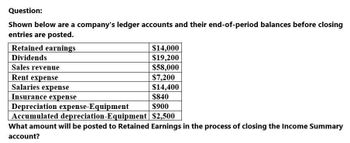

Transcribed Image Text:Question:

Shown below are a company's ledger accounts and their end-of-period balances before closing

entries are posted.

Retained earnings

Dividends

Sales revenue

Rent expense

Salaries expense

Insurance expense

Depreciation expense-Equipment

$14,000

$19,200

$58,000

$7,200

$14,400

$840

$900

Accumulated depreciation-Equipment $2,500

What amount will be posted to Retained Earnings in the process of closing the Income Summary

account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The cumulative effect of an accounting change should generally be reported as an adjustment to the beginning balance of retained earnings in tin period in which the change is made for a:arrow_forwardNet Income (or Loss) and Retained Earnings The following information is available from the records of Prestige Landscape Design Inc. at the end of the year: Required Use the previous information to answer the following questions. What is Prestiges net income for the year? What is Prestiges Retained Earnings balance at the end of the year? What is the total amount of Prestiges assets at the end of the year? What is the total amount of Prestiges liabilities at the end of the year? How much owners equity does Prestige have at the end of the year? What is Prestiges accounting equation at the end of the year?arrow_forwardQuestion: Shown below are a company's ledger accounts and their end-of-period balances before closing entries are posted. Retained earnings Dividends Sales revenue Rent expense Salaries expense Insurance expense Depreciation expense-Equipment $14,000 $19,200 $58,000 $7,200 $14,400 $840 $900 Accumulated depreciation-Equipment $2,500 What amount will be posted to Retained Earnings in the process of closing the Income Summary account?arrow_forward

- Return on Total Assets A company reports the following income statement and balance. sheet information for the current year: Net income Interest expense Average total assets $471,500 83,200 6,450,000 Determine the return on total assets. If required, round the answer to one decimal place. %arrow_forwardQuestion: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December. Nominal ledger closing balances at 31 December 2021 The following information is relevant. 1. Closing inventory at 31 December 2021 is £45,000 On further investigation of the suspense account in the trial balance above, it was discovered that: An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000. Tonson depreciates non-current assets as follows: buildings at 1 per cent on a straight-line basis plant and equipment at 10 per cent on a straight-line basis motor vehicles at 20 per cent on a reducing balance basis.…arrow_forwardplease answer do not image formatarrow_forward

- Please helparrow_forwardmework Assignment i Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity RELETEORRE Interest expense Income tax expense Total costs and expenses Net income KEREKE Earnings per share DENNE SLAP BOGATE Current Year For both the current year and one year ago, compute the following ratios: $ 32,893 100, 248 123,571 10,593 307,446 $574,751 monosokom. $ 144,544 105,892 162,500 161,815 $574, 751 $ 455,777 231, 625 12,702 9,713 The company's income statements for the current year and 1 year ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Current Year…arrow_forwardYou are provided with the following information for Wildhorse Co., effective as of its April 30, 2022, year-end. Accounts payable $ 848 Accounts receivable 880 Accumulated depreciation-equipment 670 Cash 1,320 Common stock 16,600 Cost of goods sold 1,030 Depreciation expense 350 Dividends 325 Equipment 2,510 Goodwill 1,400 Income tax expense 160 Income taxes payable 140 Insurance expense 290 Interest expense 600 Inventory 1,010 Investment in land 14,220 Land 3,500 Mortgage payable (long-term) 4,100 Notes payable (short-term) 62 Prepaid insurance Customize and control Google Chrome 1,400 Retained earnings (beginning) Salaries and wages expense 900 Salaries and wages payable 245 Sales revenue 6,300 Stock investments (short-term) 1,800 Prepare an income statement for Wildhorse Co. for the year ended April 30, 2022. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) WILDHORSE CO. Income Statement $ $arrow_forward

- Use the following information for Company COLTIB to create the BalanceSheet for 2020 and 2021arrow_forwardReturn on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $661,910Interest expense 116,810Average total assets 6,280,000Determine the return on total assets. If required, round the answer to one decimal place.fill in the blank 1 %arrow_forwardSubject :Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning