Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please provide this question solution general accounting

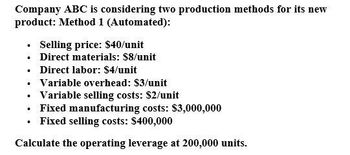

Transcribed Image Text:Company ABC is considering two production methods for its new

product: Method 1 (Automated):

⚫ Selling price: $40/unit

⚫ Direct materials: $8/unit

⚫ Direct labor: $4/unit

⚫ Variable overhead: $3/unit

⚫ Variable selling costs: $2/unit

⚫ Fixed manufacturing costs: $3,000,000

⚫ Fixed selling costs: $400,000

Calculate the operating leverage at 200,000 units.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Vaibhavarrow_forwardInteliSystems needs 79,000 optical switches next year . By outsourcing them, InteliSystems can use its idle facilities to manufacture another product that will contribute $140,000 to operating income, but none of the fixed costs will be avoidable. Should InteliSystems make or buy the switches? Show your analysis based on the information in the table below for making 70,000 switches.arrow_forwardSwifty produces 1,000 units of necessary components with the following costs: Direct material - $30,000 Direct Labor - $19,000 Variable Overhead - $3,000 Fixed Overhead - $7,000. The Fixed Overhead costs cannot be reduced, but another product could be made that would increase profit contribution to $8,000 if the components were acquired externally. If cost maximization is a major consideration and the company would prefer to buy the components, what is the maximum external price that Swifty would be willing to accept for the 1,000 units externally?arrow_forward

- What are the fixed overhead costs of making the component?arrow_forwardA manager must decide which type of machine to buy, A, B, or C. Machine costs (per individual machine) are as follows: Cost $50,000 $40,000 $70,000 Machine A BU C Product forecasts and processing times on the machines are as follows: Annual Product Demand 1 2 3 4 27,000 13,000 28,000 29,000 PROCCESSING TIME PER UNIT (minutes) AL63 m А 1 3 BL323 1 Click here for the Exool Doto Filo CH3N6 с 1 2arrow_forwardSuppose that a manufacturer can produce a part for $11.00 with a fixed cost of $7,000. Alternately, the manufacturer could contract with a supplier in Asia to purchase the part at a cost of $13.00, which includes transportation. a. If the anticipated production volume is 1,300 units, compute the total cost of manufacturing and the total cost of outsourcing. b. What is the best decision? a. The total cost of manufacturing is $.arrow_forward

- An industrial product can be manufactured by two different methods of production. Using Method X, fixed costs are RM455,000 and variable costs are RM15 per product. Using Method Y, fixed costs are RM395,000 and variable costs are RM21 per product. At what volume of output, would the two methods incur the same costs. O 23,610 units O 10,000 units O 15,000 units O 16,600 unitsarrow_forwardDay Star collected the following information: Cost to buy one unit Production costs per unit: Direct materials Direct labour Variable overhead Total fixed overhead Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative. A) buy Based on the above information only, should Day Star make or buy the product or rent its facilities out? B) make $22 $16 $2 $360,000 C) either make or buy - indifferent $48 D) rent the facilities to the subsidiary E) either make or rent - indifferentarrow_forwardA manufacturing firm is considering two locations for a plant to produce a new product. The two locations have fixed and variable costs as follows: Location A Location B Monthly Fixed Cost ( $ ) $16000 $34000 Unit variable cost ( $ /unit) (including labor, material and transportation cost) $20 $5 Which one of the the following monthly production volume is closest to the volume where the company would be indifferent between the two locations ? Select one: a. 1320 b. 1200 c. 780 d. 1440arrow_forward

- Star Company's manager, Tom, is thinking about production of a new product. Tom is considering three different products. Tom would like to select a product with highest profit. Following table contains the expected selling price and costs for each product: Selling price per unit Cost: Direct material coast per unit Direct labor cost per unit Variable overhead cost per unit Total Fixed costs A $20.90 Annual Demand in units 300,000 450,000 600,000 750,000 $5 $6 $1.4 $500,000 Tom expects the same demand for all three products. Products B $30 $8 $7 $2.5 $900,000 Probability 45% 30% 15% 10% с $28.50 Step 1: Identify a choice criterion. Step 2: Identify the set of alternative actions that can be taken. Step 3: Identify the set of events that can occur. Step 4: Assign a probability to each event that can occur. Step 5: Identify the set of possible outcomes. Calculate the expected value for each option. $4 $5.5 $9 $1,000,000 Require: Review Chapter 3 Appendix in text book, the PP slides and…arrow_forwardSolve this ASAParrow_forwardCairney, Incorporated manufactures a specialized part used in internal combustion engines. The annual demand for the part is 265,000 units. The facility has a practical capacity of 280,000 units annually. The company leased the current facility because facilities capable of manufacturing the unit require machines that can produce 70,000 units each. The annual cost of the facility is $1,120,000. The variable cost of a part is $4. Required: a. What cost per unit should the cost system report to facilitate management decision making? Note: Round your answer to 2 decimal places. b. What is the cost of excess capacity? a. Cost per unit b. Cost of excess capacityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT