FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:8:46 ☑

←

Contin...ent-1

g. .i| 98%

READ ONLY - This is an older file format. To ma...

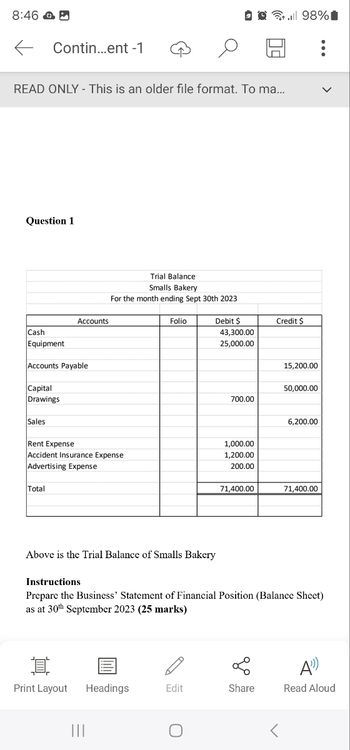

Question 1

Accounts

Trial Balance

Smalls Bakery

For the month ending Sept 30th 2023

Folio

Debit $

Credit $

Cash

43,300.00

Equipment

Accounts Payable

25,000.00

15,200.00

Capital

Drawings

50,000.00

700.00

Sales

6,200.00

Rent Expense

1,000.00

Accident Insurance Expense

1,200.00

Advertising Expense

200.00

Total

71,400.00

71,400.00

Above is the Trial Balance of Smalls Bakery

Instructions

Prepare the Business' Statement of Financial Position (Balance Sheet)

as at 30th September 2023 (25 marks)

A

Print Layout

Headings

Edit

Share

Read Aloud

|||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Vishu Subject: acountingarrow_forwardPlease do not give solution in image format thankuarrow_forwardThe company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. Its predetermined overhead rate is based on a cost formula that estimated $85,500 of manufacturing overhead for an estimated activity level of $45,000 direct labor dollars. At the beginning of the year, the inventory balances were as follows: Raw materials Work in process Finished goods During the year, the following transactions were completed: $ 10,100 $ 4,100 $ 8,700 a. Raw materials purchased on account, $169,000. b. Raw materials used in production, $142,000 (materials costing $122,000 were charged directly to jobs; the remaining materials were indirect). c. Costs for employee services were incurred as follows: Direct labor Indirect labor Sales commissions Administrative salaries $ 178,000 $ 262,200 e. Utility costs incurred in the factory, $12,000. f. Advertising costs incurred, $14,000. $ 25,000 $ 47,000 d. Rent for the year was $19,000 ($13,600 of this amount…arrow_forward

- Marked out of 20.00P Flag questionusing the income summary account for the month ofSiren MarketingAdjusted Trial BalanceMay 31, 2022Account TitleCashDebitCredit$8, 600Accounts Receivable$2, 500Prepaid Insurance$2,700 Accounts PayableUnearned RevenueKirk, Capital$1, 200$1, 800$5, 880Kirk, Withdrawals$1,600Service Revenue$8, 620Advertising Expenselnsurance ExpenseRent Expense Total$790$450$860$17,500 $17,500No comma or dollar sign should be included in the imput icklPrepare the closing entries in the proper order. For transactions that have more than 1 debit or more than 1 deditDebitAccount Title and Explanation Date May 31arrow_forwardNonearrow_forwardNew Tab wileyplus.com/edugen/student/mainfr.uni puTube * Maps E Welcome, Joseph New Tab ament CALCULATOR FULL SCREEN PRINTER VERSION NEXT Exercise 5-06 The adjusted trial balance of Cheyenne Corp. shows these data pertaining to sales at the end of its fiscal year, October 31, 2022: Sales Revenue $907,900; Freight-Out $13,900; Sales Returns and Allowances $19,800; and Sales Discounts $15,200. Prepare the sales section of the income statement. Cheyenne Corp. Income Statement (Partial) Click if you would like to Show Work for this question: Open Show Work ues pdf O Homework 4 7A G. pof Show all 12:02 AM ere to search 3/10/2021 ha prt sc 4+ delete 2$ 4. %23 2 5. 6. 7. 8. 6. backspace %3D W R Y U D F G H J. K pause M.arrow_forward

- A ezto.mheducation.com M Question 18 - Midterm 1- Connect b Accounting Question | bartleby Bb Announcements - 2021 Spring Term (1) Principles of .. Midterm 1 Saved Help Save & Exit Submit 18 Torrid Romance Publishers has total receivables of $2,800, which represents 20 days' sales. Total assets are $73,000. The firm's operating profit margin is 5.9%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.) X 01:45:00 Asset turnover ratio ROA % Mc Graw Hill Educationarrow_forward12:52 S ㅁ expert.chegg.com/qna/au Chegg Hide student question Student question LTE Skip Exit + 32 5G Classify the following balance sheet items under fixed assets, working capital, shareholders' equity, or net debt: overdraft, retained earnings, brands, taxes payable, finished goods inventories, bonds. Time Left: 01:59:57 Submit ||| 8 Trainingarrow_forwardPractice chpt 5 - Co X A ezto.mheducation.com/ext/map/index.html?_con=con&external browser=D0&launchUrl=https%253A%252F%252Fdcccd.blackboar ce chpt 5 A Saved At the end of 2021, Worthy Co's balance for Accounts Receivable is $24,000, while the company's total assets equal $1,540,000. In addition, the company expects to collect all of its receivables in 2022. In 2022, however, one customer owing $4,000 becomes a bad debt on March 14. Record the write off of this customer's account in 2022 using the direct write-off method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Rook View transaction list Journal entry worksheet Print erences Record the write off of this customer's account in 2022 using the direct write off method. Note: Enter debits before credits. Date General Journal Debit Credit March 14, 2022 Record entry Clear entry View general journal raw Type here to search Ps DII PrtScn Hom F3 F7 F8 近arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education