FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:OWv2| Onlin X

om/ilrn/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLoca

Book

Show Me How

Calculator

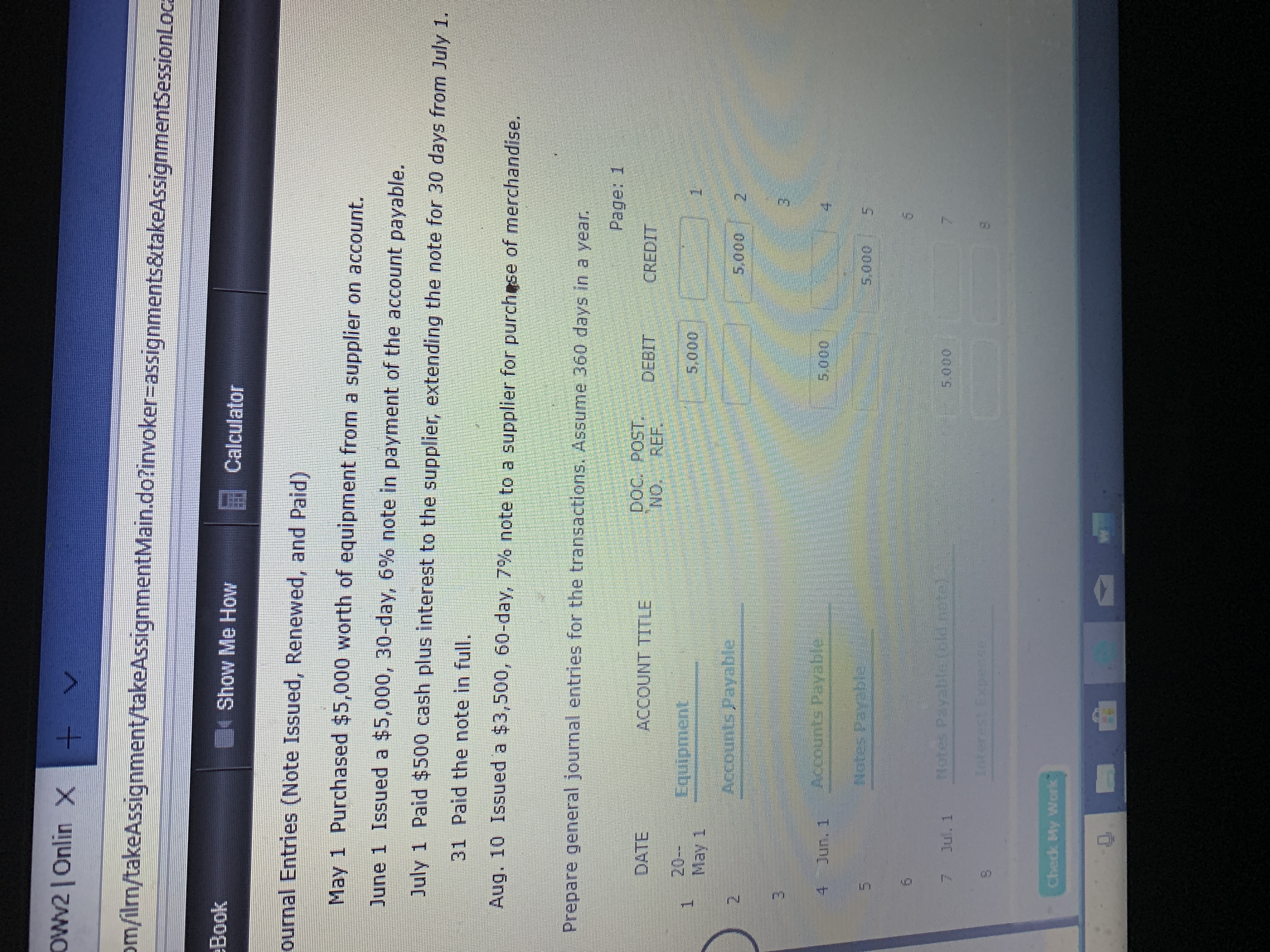

ournal Entries (Note Issued, Renewed, and Paid)

May 1 Purchased $5,000 worth of equipment from a supplier on account.

June 1 Issued a $5,000, 30-day, 6 % note in payment of the account payable.

July 1 Paid $500 cash plus interest to the supplier, extending the note for 30 days from July 1.

31 Paid the note in full.

Aug. 10 Issued a $3,500, 60-day, 7% note to a supplier for purchese of merchandise.

Prepare general journal entries for the transactions. Assume 360 days in a year

Page: 1

Doc. POST

NO REF.

DATE

ACCOUNT TITLE

DEBIT CREDIT

20-

May 1

Equipment

5,000

Accounts Payable

5,000

3

nts Payable

4 Jun. 1

5.000

Netes Pay ht

5.000

5

5

Hotes Pay lolcithots

Jul. 1

5.000

1nterest pedse

Chedk My Work

ro

n

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- Instructions to chapter 10 exercises - Word eview View Help Y Tell me what you want to do AaBbCcDc AaBbCcDc AaBbC AABBCCD AaB AaBbCcD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Paragraph Styles Exer 10-4 Entries for notes payable Obj. 1 A business issued a 120-day,5% note for $60,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Exer 10-6arrow_forwardm-Aug 28 + d.vst.idref%3DP7001016677000000000000000003B8F]!/4/2[P700101667700000000000... QAA E S4-3 Collins Woodworking accepts VISA and MasterCard at its store. Collins is charged a processing fee of 3% of the total amount of any credit card sale. Assume that Russell Knight purchases $8,000 of custom furniture and pays with a VISA card. Make the entry to record the sale to Knight. (You do not need to make the cost of goods sold entry.)arrow_forwardplease provide all journal entry without image thnxarrow_forward

- AutoSave OFF Home Insert Draw Paste Page 47 of 95 Calibri B I U 20 Design V v 16916 words 50 ab X 2 V Layout X Α Α΄ A References Aa ▾ A Αν English (United States) Mailings = Review V V W= Packet Lecture-4 View 12/31 싫 V Accessibility: Investigate Tell me 30,000 V Estimating Uncollectible Accounts An estimate of bad debts is made at the end of the accounting period to match the cost of credit sales (bad debt expense) with the revenue credit sales allowed the company to record during the period. The estimate is incorporated in the company's books through an ADJUSTING ENTRY and the entry increases the allowance for uncollectible accounts and bad debt expense. Saved to my Mac ✓ Percent of Receivables Method (an allowance method) management estimates a percent of ending accounts receivable they expect to be uncollectible the ending balance of the Allowance for Uncollectible Accounts (AUA) is determined based on the estimate (% of uncollectible accounts x ending balance of A/R, "% of A/R").…arrow_forwardg In | Federa x M UMassD Logor X EQuickLaunch -x K myCourses Da: x Univ of Mass - X * Cengage Die education.com mework i Saved View transaction list Journal entry worksheet 1 4 6 7 8 9. 10 cearch 近arrow_forwardtle=pccertified-professional-in-financial-accounting 5e33e716ef363&c=9&p=1 O New Tab 6 Currency Conversion O Silberline Intranet S.. @ https://www.comm... A SAP Health Declara. I Silberline Home ( Previous al Question 1/50 O 117 min 15 secs 2% 89% Done In October 2015 Utland sold some goods on sale or return terms for $2,500. Their cost to Utland was $1,500. The transaction has been treated as a credit sale in Utland's financial statements for the year ended 31 October 2015. In November 2015 the customer accepted half of the goods and returned the other half in good condition. What adjustments, if any, should be made to the financial statements? A. Sales and receivables should be reduced by $2,500, with no adjustment to closing inventory B. ) Sales and receivables should be reduced by $2,500, and closing inventory increased by $1,500. C. Sales and receivables should be reduced by $1,250, and closing inventory increased by $750 D. No adjustment is necessary Next O Mark For Review @…arrow_forward

- Drill Problem 7-20 (Algo) (LU 7-2 (2)] Complete the following: Note: Do not round intermediate calculations. Round your final answers to the nearest cent. Amount of invoice $ Terms 635 2/10, N/60 Invoice date 7/18 Actual partial payment made $ 435 Date of partial payment 7/27 Amount of payment to be credited Balance outstandingarrow_forwardMUMassD Logor X E Quicklaunch - x K. myCourses Da: X Se Univ of Mass - X Ceng g In | Federa x ducation.com Saved mework View transaction list Journal entry worksheet 1 3 4 8 9 10 Provided $57,971 in service to customers during the year, with $21,658 on account and the rest received in cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal 0 日 searcharrow_forwardDon't give answer in image formatarrow_forward

- Fill in the missing amounts in the accounts payable subsidiary ledgers for Al's Tractor Supply. NAME: B. Mario ACCOUNTS PAYABLE LEDGER ADDRESS: 1230 Rose Ave, Watertown, WI 53094 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- July 8 P7 1,900.00 1,900.00 July 15 J3 400.00 NAME: Denson & Soldner ACCOUNTS PAYABLE LEDGER ADDRESS: 111 Chase St, Johnson Creek, WI 53081 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- July 3 P7 3,100.00 3,100.00 July 13 CP9 3,100.00 July 29 P7 3,460.00 ACCOUNTS PAYABLE LEDGER NAME: Hutchinson Supplies ADDRESS: 1985 County Road, Lake Mills, WI 53577 DATE TTEM POST. REF. DEBIT CREDIT BALANCEarrow_forwardCurrent Attempt in Progress The Accounts Receivable account has a beginning balance of $48900 and an ending balance of $69600. If total sales on account were $39500 for the year, what were the total collections on account? $69600 O $79000 O $18800 O $60200 Save for Later Attempts: 0 of 1 used Submit Answer MacBook Air DII DD 000arrow_forwardX CengageNOWv2 | Online teachin X + .cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $32,558 Accounts receivable 60,589 Accrued liabilities 6,279 Cash 21,662 Intangible assets 44,020 Inventory 81,454 Long-term investments 97,693 79,992 Long-term liabilities Notes payable (short-term) 27,484 699,362 Property, plant, and equipment 2,375 Prepaid expenses 37,009 Temporary investments Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? Oa. 15.7 Ob. 0.9 Oc. 1.8 Od. 3.1 L $ H % 5 6 a & 7 8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education