FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

1200 per unit question 35

ss attached

thank for help

agpowphwtphwt

phw

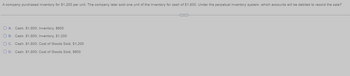

Transcribed Image Text:A company purchased inventory for $1,200 per unit. The company later sold one unit of the inventory for cash of $1,800. Under the perpetual inventory system, which accounts will be debited to record the sale?

O A. Cash, $1,800; Inventory, $600

O B. Cash, $1,800; Inventory, $1,200

O C. Cash, $1,800; Cost of Goods Sold, $1,200

O D. Cash, $1,800; Cost of Goods Sold, $600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 60 * 00 T R A myopenmath.com Wikipedia Yelp TripAdvisor Making the C...i Law Review https://www..ends_v05.pdf Stuc Apple Yahoo pno! Bing The Weather Channel Google Facebook Twitter Linkedin Activity - Montgomery County Community College C My Overview | Chegg.com Bb Announcements- 2021FA_MAT106AOSA Math Applica... myOpenMath Home | My Classes | User Settings Log Out Course Messages Forums Calendar Gradebook Home > MAT106A OSA Fall 21 > Assessment Problem Set 1: Finance Progress saved Done Score: 2/50 1/20 answered Question 6 B 0/3 pts <. Suppose you found a CD that pays 4.9% interest compounded monthly for 6 years. If you deposit $10,000 now, how much will you have in the account in 6 years? (Round to the nearest cent.) What was the interest earned? (Round to the nearest cent.) Now suppose that you would like to have $20,000 in the account in 6 years. How much would you need to deposit now? (Round to the nearest cent.) Question Help: D Video 1 D Video 2 Submit Question MacBook Air 08 F3…arrow_forwardF myCampus Portal Login - for Stu X B 09 Operational and Legal Consid x E (24,513 unread) - sharmarohit81 b My Questions | bartleby A fleming.desire2learn.com/d21/le/content/130754/viewContent/1518900/View?ou=130754 Table of Contents > Week 9: Operational and legal Considerations > Lecture Notes > 09 Operational and Legal Considerations 09 Operational and Legal Considerations - > Calculating Capacity • How many machines do you need? • You expect your sales to be 3,000,000 granola bars (20g each) • How large is your plant? per month • How many workers do you need? The machine: • How much is the investment? Capacity: 100 kgs per hour • What are the operating costs? Requires 2 people to operate it Takes 8 ft x 40 ft space • Cost per machine $15,000 Energy and maintenance: $5 per hour • Cost of material and packaging: $0.12 per bar I Group Project.xlsx Show all 12:35 AM O Type here to search A O 4) ENG 2020-12-09arrow_forwardnt Aid Home | Federal Student Aid Filling Out the FAFSA® Form F X M Question 6-CH4 Class - Connec X G [The following information appli x p.mheducation.com/ext/map/index.html?_con-con&external_browser=0&launch Url=https%253A%252F%252Fbbhosted.cuny.edu%252Fwebapps%252Fportal%252Ffra S Saved Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, Long-Term Liabilities, and Equity. For each of the following items, identify the balance sheet category where the item typically would best appear. If an item does not appear on the balance, indicate that instead. Account Title 1. Long-term investment in stock 2. Depreciation expense-Building 3. Prepaid rent (2 months of rent) 4. Interest receivable S 5. Taxes payable (due in 5 weeks) 6. Automobiles 7. Notes payable (due in 3 years) 8. Accounts payable 9. Cash 10. Patents Classification Account Title 11. Unearned services revenue 12. Accumulated…arrow_forward

- Cha Nik Cus Nik Nik Nik E Ret S pitr * Ser O Ode D No ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A pters 14 0 Saved repper Company $ 17,500 Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases selling expenses sales Company $ 14,400 18,900 7,400 30,500 21,800 21,200 24,400 6, e00 12,750 8,200 32, e00 2,450 7,460 37,e00 52, 800 229, 530 23,550 14,400 25,750 43,400 16, 200 22,000 7,400 12,750 3, 500 47, 000 8,920 3,650 54, 500 59, 200 290, e10 17, 200 124,825 19,700 Cash Factory equipment, net Accounts receivable, net 23, eee 267, 5ee 16, 200 Requlred: 1. Prepare Income…arrow_forwardRequired information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate income in each of five years as follows: $ 2,735,000 1,000,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs Depreciation Total fixed expenses 1,735,000 $ 735,000 595,000 1,330,000 Net operating income $ 405,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. 14. Assume a postaudit showed that all estimates including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual payback period? (Round your answer to 2 decimal places.) Payback period yearsarrow_forward%24 %24 %24 %24 %24 eNOWv2 | Online teachin X Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator3D&inprogress3false Blackboard Learn US: The Texas Abort... eb California governor... USN Idaho Supreme Co... Oklahom ... Calculate interest using a 360-day year. If required, round your answers to the nearest cent. Principal Interest Rate Time Interest $2,700 9.6% 30 days 45 days 3,300 6.0% 80 days 3,800 10.5% 120 days $4 5,300 150 daysarrow_forward

- M Question 6- QUIZ- CH 18-C X Project 6 x .mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%252Fw... 18 es Saved Help Save Exercises 18-41 (Algo) Allocation of Central Costs; Profit Centers [LO 18-3] Woodland Hotels Incorporated operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows: Front office personnel (desk, clerks, etc.) Administrative and executive salaries Interest on resort purchase Advertising Housekeeping Depreciation on reservations computer Room maintenance Carpet-cleaning contract Contract to repaint rooms $ 12,100 5,700 4,700 600 3,700 80 1,210 50 570 $ 28,710 Revenue (000s) Square…arrow_forwardHonorlock Launch O Question 48 - MidTerm, Chapte >x C A Aser n A s 2 252%252 H Netflix * 192,188.23.72/Ed... * https://ee.dde.pr/. y Gma YouTube Maps Traducir Se eSantaFe Iniciar .. MidTerm, Chapters 1-7 Baved. TB MC Qu. 7-111 Kansas Enterprises purchased equipment for... 48 Kansas Enterprises purchased equipment for $75,500 on January 1, 2021. The equipment $9,000 at the end of five years. Using the double-declining balance method, the book value at December 31,2022, wou 36 Multiple Cholce $31,660. $27180arrow_forwardHS15 Sydney weghaara ego nke $150 site na iji ndenye ego ejikotara na akauntų kaadi kredit ya. ulo aku ahụ na - ana ugwọ mbu uzo ego nke pasenti 3 na ego a gbaziri ma enyeghi oge amara na oganihu ego. Sydney kwurų ụ gwo n'uju mgbe ugwo̟ ahu̟ rutere. Kedu ihe bu̟ mmasi maka onwa 1 na APR nke 20%arrow_forward

- E 3 17 R H Herzing College | Canadian Care: X HAC202 Acc Il 07/23: Topic Four A: X + https://online.herzing.ca/mod/assign/view.php?id=333642 HERZING Question 7: Submission status Big Trust is a non-governmental organization that gives charity to orphans in Ontario. The members of the Trust make subscriptions to fund the organization. There are ten members who are required to make subscriptions of $140,500 each per annum. All subscriptions for the year 2020 were received. Three members contributed a total of $240,640 in excess for that year. They agreed that the excess subscriptions can be carried forward to the following year. Required: 1. What is the accounting name given to theses excess subscriptions? 2. Shall the excess subscriptions be recorded as assets or liabilities of Big Trust? Explain. 3. Provide the end of the year accounting treatment for the excess subscriptions as they would appear in: o The income statement • The statement of financial position Submission A ✩ No attempt…arrow_forwardAaBbC AaBbCcI AaBbC AaBbCcl AaBbCc AaBbCcL O Find x A A E=EE E E Replace 1 Normal Title 1 No Spac... Heading 1 Heading 2 Heading 3 Heading 4 Select ont Paragraph Styles Editing QUESTION 3 Penco Ltd. operates a defined benefit pension scheme for all of its employees. The closing balances on the scheme assets and liabilities, at 31 December 2016, were S60 million and $64 million respectively. Penco's actuary has provided the following information that has yet to be accounted for in the year-ended 31 December 2017. $m Current service cost 9. Past service cost 8. Contributions paid in Benefits paid out 6. 66 Fair value of plan asset 75 Fair value of plan liabilities 5% Yield on high quality corporate bonds Required Calculate the amounts that will appear in the financial statements of Penco for the year-ended 31 December 2017. D. Focus 28°C Sunny ^ D G EG 61 37 121arrow_forwardMay 2024 บ M Tu W Th F 8 29 30 1 2 3 5 6 7 8 9 10 12 13 15 14 16 17 19 20 21 22 23 24 26 27 28 29 30 31 Su June 2024 M Tu W Th F Seth 6-3 1-2 2.3 Brendyn 9-6 34 mod 194 v lifiv T T F 7479 139 ..... Saturday, May 11 Friday, May 24 Saturday, May 25 Sunday, May 26 Monday, May 27arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education