FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:S

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not in

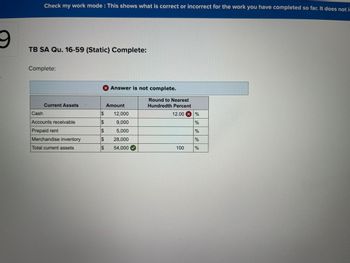

TB SA Qu. 16-59 (Static) Complete:

Complete:

Current Assets

Cash

Accounts receivable

Prepaid rent

Merchandise inventory

Total current assets

$

SA

$

SA

X Answer is not complete.

$

$

$

Amount

12,000

9,000

5,000

28,000

54,000

Round to Nearest

Hundredth Percent

12.00 x %

%

%

100

do do

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 13. Alex launched a company with $500K initial investments and 100K shares. Angel X invested $200K through convertible note in a year. Convertible note parameters were: 8.5% coupon yield and 20% discount for conversion at the next round, valuation cap $2mln. In 9 months, a new investment round closed with pre-money valuation $10mln. Angel X converted the note. How many shares did the angel get?arrow_forward2. Prepare a horizontal analysis for Year 2 using Year 1 as the base year. (Note: If the percentage increase or decrease cannot be calculated, then leave the cell blank. Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) YEAR 1 YEAR 2 AMOUNT % Cash $ 2,310,000 $ 840,000 Accounts recievable $1,305,000 $1,044,000 Inventory $4,005,000 $2,136,000 Buildings $8,580,000 $8,580,000 Less accumilated depreciation $1,200,000 $600,000 Total assests $ 15,000,000 $12,000,000 Liabilities and Stockholders Equity Accounts payable $ 1,725,000 $1,2000,000 Contingent liability $ 1,230,000 common stock $…arrow_forwardDon't give answer in image formatarrow_forward

- Complete the aging schedule. Number of Days Accounts Outstanding Receivable Estimated % Uncollectible 0-45 days $ $734,000 2% 46-90 days 265,000 5% Over 90 days 106,000 15% Total $1,105,000 +A $ Total Estimated Uncollectible Accoarrow_forward%24 %24 %24 %24 %24 %24 %24 %24 decrease answers which should be indicated by a minus sign. Round your "percent" answ LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2019 and 2020 Increase (Decrease) 2020 2019 Amount Percent Gross sales $000' 0000 0 Sales returns and allowances 000 0 00 Net sales $ 000 Cost of merchandise (goods) sold 0000 Gross profit 24 $000'S Operating expenses: $ 00% 2,200 Depreciation 009 Selling and administrative Research 550 Miscellaneous Total operating expenses 3,810 $ 3,400 Income before interest and taxes 2,190 $ 2,500 Interest expense Income before taxes 1,630 Provision for taxes 640 Net income 066 %$4 1,200 < Prev 4 of 10 here to search 直 0 EM d晶 @arrow_forward%24 %24 Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $735,000; Allowance for Doubtful Accounts has a debit balance of $6,500; and sales for the year total $3,310,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. $ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful ACcounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forward

- Please do not give solution in image format thankuarrow_forwardCamaro GTO Torino Cash $ 2,400 $ 230 $ 1,300 Short-term investments 0 0 600 Current receivables 260 510 500 Inventory 2,175 2,020 3,050 Prepaid expenses 300 600 900 Total current assets $ 5,135 $ 3,360 $ 6,350 Current liabilities $ 2,220 $ 1,320 $ 3,550 a. Compute the acid-test ratio for each of the separate cases above.b. Which company is in the best position to meet short-term obligations?arrow_forwardThe following is an example of: Cash Accounts receivable Inventory Equipment Total assets 10 Multiple Choice O O Ratio analysis. Horizontal analysis. Vertical analysis. Year NOV 17 2024 $300,000 500,000 800,000 1,200,000 $2,800,000 $2,600,000 2023 $800,000 200,000 700,000 900,000 ST 2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education