FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:v2.cengagenow.com

nvert PDF to Word for fr...

-Dashboard

Print Item

VPN 100%

+88

My Home

C CengageNOWv2 | Online te..

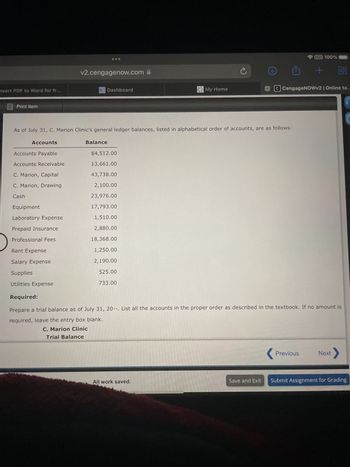

As of July 31, C. Marion Clinic's general ledger balances, listed in alphabetical order of accounts, are as follows:

Accounts

Balance

Accounts Payable

$4,512.00

Accounts Receivable

13,661.00

C. Marion, Capital

43,738.00

C. Marion, Drawing

2,100.00

Cash

23,976.00

Equipment

17,793.00

Laboratory Expense

1,510.00

Prepaid Insurance

2,880.00

Professional Fees

18,368.00

Rent Expense

1,250.00

Salary Expense

2,190.00

Supplies

525.00

Utilities Expense

733.00

Required:

Prepare a trial balance as of July 31, 20--. List all the accounts in the proper order as described in the textbook. If no amount is

required, leave the entry box blank.

C. Marion Clinic

Trial Balance

Previous

Next

All work saved.

Save and Exit Submit Assignment for Grading

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- CengageNOWv2| Assignmer * CengageNOWv2 | Online tea QAccounting Ch. 12 Flashcards New Tab com The purchases journal for J. K. Insurance for the month of October is represented below. Accounts Payable is account number 202 and Purchases is account number 501. PURCHASES JOURNAL Page 5 Purchases Debit/ Accounts Payable Date Invoice No. From Whom Purchased Post Ref. Credit Oct. 2 3118 Express Florist 3,550.00 4 3119 T. C. S. Supplies 2,790.00 8 3120 Auto Body Repair 3,850.00 3121 Signs Unlimited 4,150.00 10 3122 Dynasty Limo 2,380.00 15 3123 T. C. S. Supplies 2,150.00 18,870.00 Required: 1. Post the information from the purchases journal to the appropriate general ledger and accounts payable ledger accounts. GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 202 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT Oct. 2 P5 ACCOUNT Purchases ACCOUNT NO. 501 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT P5arrow_forwardmarks Window Help Wed Apr 28 9:37 PM edugen.wileyplus.com Return to Blackboard eygandt, Accounting Principles, 13th Edition, Custom WileyPLUS Course for Bronx Community College elp | System Announcements CALCULATOR PRINTER VERSION « BACK NEXT cise 194 a-b Water Kayak Company's bank statement for the month of September showed a balance per bank of $6,900. The company's Cash account in the general ledger had a balance 573 at September 30. Other information is as follows: Cash receipts for September 30 recorded on the company's books were $5,850 but this amount does not appear on the bank statement. The bank statement shows a debit memorandum for $25 for check printing charges. Check No. 119 payable to Blacque Company was recorded in the cash payments journal and cleared the bank for $236. A review of the accounts payable subsidiary ledger shows a $27 credit balance in the account of Blacque Company and that the payment to them should have been for $263. The total amount of checks still…arrow_forward8:33 ull LTE AA v2.cengagenow.com CengageNOWv2 | Online teaching and learning resource from Cengage Learning Close Window Print 1. EX.09-03 O eBook Show Me How Entries for Uncollectible Accounts, using Direct Write-Off Method Journalize the following transactions in the accounts of Champion Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. Sold merchandise on account to Dr. Dale Van Dyken, $30,000. The cost of the 19. merchandise sold was $20,500. July Received $12,000 from Dr. Dale Van Dyken and wrote off the remainder owed on 7. the sale of January 19 as uncollectible. Nov. Reinstated the account of Dr. Dale Van Dyken that had been written off on July 7 2. and received $18,000 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. Jan. 19-sale Jan. 19-cost July 7 Nov. 2-reinstate Nov. 2-collectionarrow_forward

- please provide all journal entry without image thnxarrow_forwardEdit View History Bookmarks Profiles Tab Window Help Question 5 - Proctoring Enable X + getproctorio.com/secured #lockdown octoring Enabled: Chapter 3 Required Homewor... D W 5 The trial balance for Canton Incorporated, listed the following account balances at December 31, 2024, the end of Canton Incorporated's fiscal year: cash, $32,000; accounts receivable, $27,000; inventory, $41,000; equipment (net), $96,000; accounts payable, $30,000; salaries payable, $13,000; interest payable, $9,000; notes payable (due in 20 months), $46,000; common stock, $82,000. Current assets Current liabilities ↑ Please calculate total current assets and total current liabilities that would appear in the year-end balance sheet of Canton Incorporated. #3 E с 54 $ R % G Search or type URL 5 T < Prev 5 of 5 Saved A 6 MacBook Pro Y & 7 Next * 00 8 + 9 O E 0 Help P | 1 50% * Save & Exit 0 + 11arrow_forwardA Ov A Aa v A A Styles s Voice Editor Reu Font rd 5 nd Print New Blank Document O Open 4 The following transactions occurred during February, affecting your A/R ledger account for Johnny Reed (Acct. No. 151, Sheet No. 2). Terms are 2/10, n/30 and credit limit is $2,500. Fill out the A/R ledger sheet for this customer. State the amount that is owed by Johnny Reedas at February 28. Feb. 1 Balance owing, $480.00 Sale on credit #13, $457.40 (SJ1) Received $150.00 on account for February 1 balance (CR2) Sale on account #18, $83.80 (SJ1) 10 Issued credit note #5, $30.00, for damaged goods returned from invoice #18 (GJ4) 13 16 Received amount owing from invoice #13 (CR3) Sale on credit #25, $133.00 (SJ1) Received amount owing from invoice #18 (CR3) Issued credit note #10, $33.00, for overcharge on invoice 18 20 #25 (GJ4) 25 Sale on account #33, $220.15 (SJ1) 26 Received amount owing from invoice #25 (CR3) 28 Received cash for rest of amount from February 1 (CR3) As of February 28, how much…arrow_forward

- it View History M faith@.. tems 37.66% ··· Bookmarks Window AOL Ma.... B E C eBook U Sales Mail - F... Cost of goods sold Help Operating income Expenses: Selling expenses Administrative expenses The following multiple-step, income statement was prepared for Carlsbad Company contains errors: CARLSBAD COMPANY Income Statement For the Year Ended February 28, 2018 Delivery expense Total expenses Other expense: Interest revenue Gross profit R V Portal h... Check My Work 10 more Check My Work uses remaining. % G Chapter... B v2.cengagenow.com Prepare a corrected income statement for Carlsbad Company for the year ended February 28, 2018. Carlsbad Company Income Statement 6 $ 1,800,000 1,350,000 112,500 H C Cengag.. 9,495,000 (5,962,500) $3,532,500 (3,262,500) 270,000 90,000 $180,000 All work saved. N MacBook Pro ** W Activity... 8 M FA 9 K Save and Exit Submit Assignment for Grading 1arrow_forwardtle=pccertified-professional-in-financial-accounting 5e33e716ef363&c=9&p=1 O New Tab 6 Currency Conversion O Silberline Intranet S.. @ https://www.comm... A SAP Health Declara. I Silberline Home ( Previous al Question 1/50 O 117 min 15 secs 2% 89% Done In October 2015 Utland sold some goods on sale or return terms for $2,500. Their cost to Utland was $1,500. The transaction has been treated as a credit sale in Utland's financial statements for the year ended 31 October 2015. In November 2015 the customer accepted half of the goods and returned the other half in good condition. What adjustments, if any, should be made to the financial statements? A. Sales and receivables should be reduced by $2,500, with no adjustment to closing inventory B. ) Sales and receivables should be reduced by $2,500, and closing inventory increased by $1,500. C. Sales and receivables should be reduced by $1,250, and closing inventory increased by $750 D. No adjustment is necessary Next O Mark For Review @…arrow_forwardPractice chpt 5 - Co X A ezto.mheducation.com/ext/map/index.html?_con=con&external browser=D0&launchUrl=https%253A%252F%252Fdcccd.blackboar ce chpt 5 A Saved At the end of 2021, Worthy Co's balance for Accounts Receivable is $24,000, while the company's total assets equal $1,540,000. In addition, the company expects to collect all of its receivables in 2022. In 2022, however, one customer owing $4,000 becomes a bad debt on March 14. Record the write off of this customer's account in 2022 using the direct write-off method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Rook View transaction list Journal entry worksheet Print erences Record the write off of this customer's account in 2022 using the direct write off method. Note: Enter debits before credits. Date General Journal Debit Credit March 14, 2022 Record entry Clear entry View general journal raw Type here to search Ps DII PrtScn Hom F3 F7 F8 近arrow_forward

- can you help me fill in the yellow boxesarrow_forwardX CengageNOWv2 | Online teachin X + .cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $32,558 Accounts receivable 60,589 Accrued liabilities 6,279 Cash 21,662 Intangible assets 44,020 Inventory 81,454 Long-term investments 97,693 79,992 Long-term liabilities Notes payable (short-term) 27,484 699,362 Property, plant, and equipment 2,375 Prepaid expenses 37,009 Temporary investments Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? Oa. 15.7 Ob. 0.9 Oc. 1.8 Od. 3.1 L $ H % 5 6 a & 7 8arrow_forwardtable » tbódy » tr » tu Question 19 Journalize this transaction: Paid Kraft Co.$4,000 on account. Edit View Insert Format Tools Table 12pt v Paragraph v |BIU Avarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education