College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

I it IV question 14

Transcribed Image Text:%24

> > > >

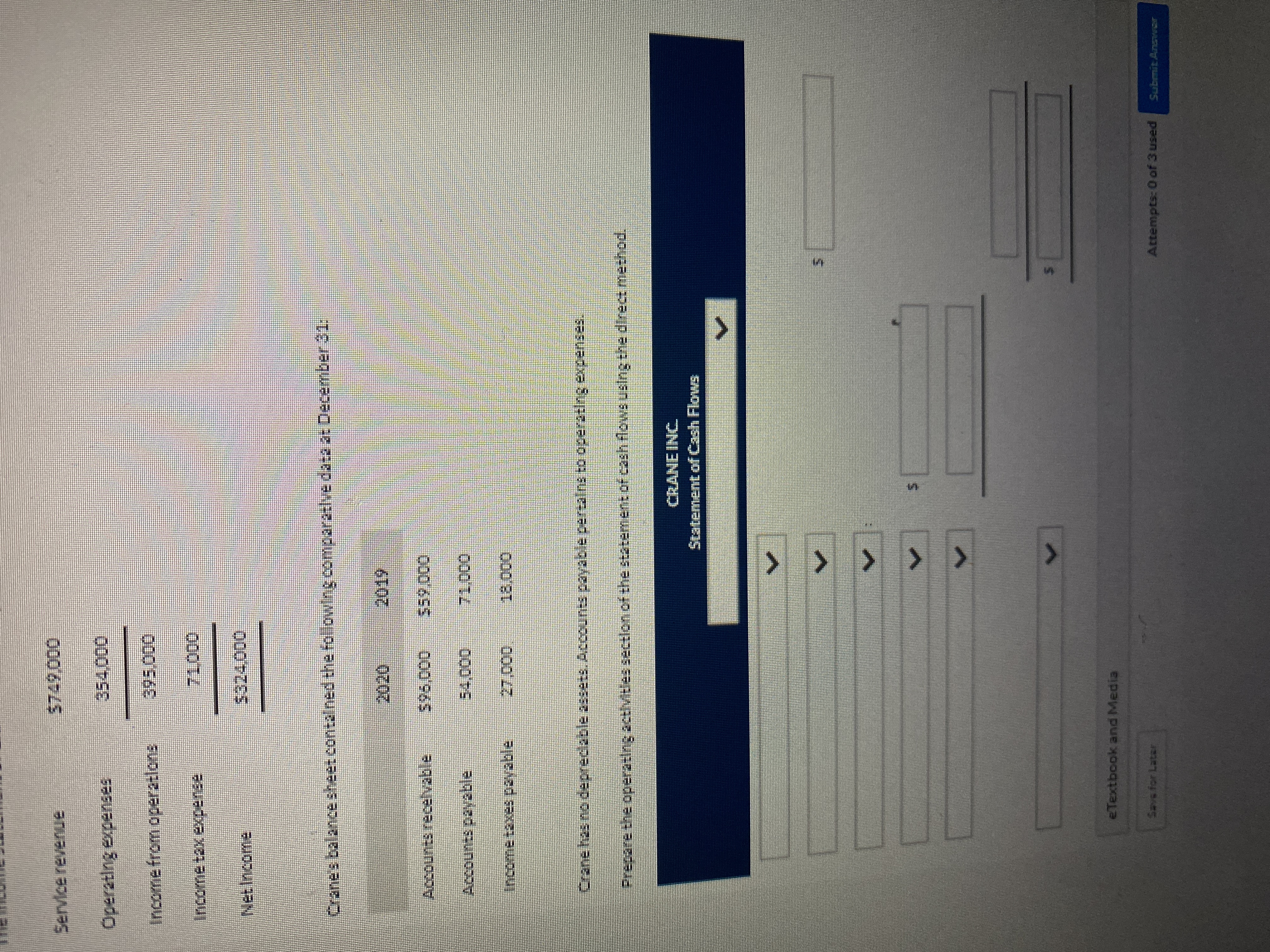

Service revenue

0000

Income from operatlons

0000.

NetIncome:

Crane's balancesheet contalned the following comparatlvedata as December 31:

Accounts recelvable

596,000

00000,

Accounts payable

00000

Incometaxes pavable

0000

Crane has no depreclable 2ssets. Accounts payable pertalns to operating expenses.

Prepare the operating actlvitles sectlon off the statement of cash flowsusing the direct method.

CRANE INC

Statement of Cash Flows

eTextbook and Media

Savs for Latar

Attempts: 0 of 3 used

Submit Anzvwor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the solution to the question I uploadedarrow_forwardPlease do not give solution in image format thankuarrow_forwardA ezto.mheducation.com Data Sales.xlsx: fa21cob204 Computer Information Systems Dashbo Saved Help Sa The fo"owing account balances come from the records of Ourso Company. Accounts receivable Allowance for doubtful accounts Beginning Balance $ 2,914 Ending Balance $ 3,805 208 104 During the accounting period, Ourso recorded $12,500 of sales revenue on account. The company also wrote off a $177 account receivable. Required a. Determine the amount of cash collected from receivables. b. Determine the amount of uncollectible accounts expense recognized during the period. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amount of cash collected from receivables. Collections of accounts receivable K Required A Required B> < Prev 1 of 1 Next MacBook Pro #3 $ & 4 6. 7 8. V くoarrow_forward

- Requlred Informatlon [The following information applies to the questions displayed below.] The Company prepared the following aging of receivables analysis at December 31. Days Past Due Total $678,00e 1 to 30 $110, eee 3% 31 to 60 61 to 90 Over 90 Accounts receivable Percent uncollectible $38, e00 9% $50, 0ee 12% $416,000 $56,000 7% 4% a. Complete the below table to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $5.600 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2.100 debit. Complete this question by entering your answers in the tabs below. Reg A Reg B and C Complete the below table to calculate the estimated balance of Allowance for…arrow_forward9. The adjusting journal entry to adjust the allowance for doubtful accounts as of December 31, 2020 will include a debit to doubtful accounts expense of:arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- a. 8,200,000 b. 6,200,000 c. 2,000,000 d. 4,200,000 Problem 4-15 (AICPA Adapted) 81 molde Steven Company provided the following information during the first year of operations: 0913410000 Total merchandise purchases for the current year Merchandise inventory on December 31 Collections from customers bgodno ode All merchandise was marked to sell at 40% above cost. All Isales are on a credit basis and all accounts are collectible, What amount should be reported as accounts receivable on December 31? od ove arlo batable pore ab a. 1,000,000 b. 3,840,000 c. 5,000,000 d. 5,800,000 7,000,000 1,400,000 4,000,000 120 000 030 000,000 at amount was received b remittance in full? a. 2,744,000 b. 2,940,000 c. 2,944,000 d. 3,140,000 Problem 4-17 (PHILCPA A Germany Company started busines year. The entity established an all- estimated at 5% of credit sales. wrote off P50,000 of uncollectible Further analysis showed th amounted to P9,000,000 and e was P1,500,000. Goods were s The total sales…arrow_forwardCurrent Attempt in Progress At December 1, 2022, Tamarisk, Inc. Accounts Receivable balance was $17470. During December, Tamarisk had credit sales of $46800 and collected accounts receivable of $37440. At December 31, 2022, the Accounts Receivable balance is O $64270 debit O $17470 debit O $26830 credit O $26830 debit Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardA edugen.wileyplus.com W WileyPLUS Bb Return to Blackboard US US Weygandt, Accounting Principles, 13th Edition, Custom WileyPLUS Course for Bronx Commun Help | System Announcements Problem 9-01A a-d (Video) At December 31, 2019, Ayayai Co. reported the following information on its balance sheet. Accounts receivable $965,100 Less: Allowance for doubtful accounts 79,700 During 2020, the company had the following transactions related to receivables. 1. Sales on account $3,692,700 2. Sales returns and allowances 49,600 3. Collections of accounts receivable 2,817,800 4. Write-offs of accounts receivable deemed uncollectible 89,600 5. Recovery of bad debts previously written off as uncollectible 27,350 Your answer is correct. Aceur me thatne neh diecouınte w ers Prepare the journal entries to record onch of tho0o fuo trnnanotionoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning