FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3

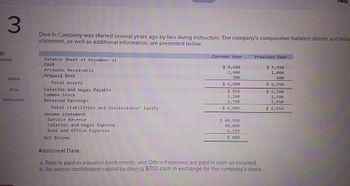

Dive In Company was started several years ago by two diving instructors. The company's comparative balance sheets and inco

statement, as well as additional information, are presented below.

50

points

Balance Sheet at December 31

Cash

eBook

Accounts Receivable

Prepaid Rent

Print

References

Total Assets

Salaries and Wages Payable

Common Stock

Retained Earnings

Total Liabilities and Stockholders' Equity

Income Statement

Service Revenue

Salaries and Wages Expense

Rent and Office Expenses

Net Income

Additional Data:

Current Year

Previous Year

$ 5,450

1,000

100

$ 4,600

2,000

200

$ 6,800

$ 850

2,200

3,750

$ 6,800

$ 44,950

40,000

4,150

$ 800

a. Rent is paid in advance each month, and Office Expenses are paid in cash as incurred.

b. An owner contributed capital by paying $700 cash in exchange for the company's stock.

$ 6,550

$2,100

1,500

2,958

$ 6,550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- X Company plans to prepare annual financial statements. After the company's first year of operation, the following financial statement information is available: Balance Sheet Total assets $15,754 Total liabilities 8,743 Total Paid-In Capital 4,771 Income Statement Total expenses $20,061 What was total revenue for the year?arrow_forwardIncome statementarrow_forwardPlease help me with show all calculation thankuarrow_forward

- PURRFECT PETS, INC. Balance Sheet at June 30, Year 1 Assets Liabilities Cash $ 732,700 Accounts Payable $ 349,100 Accounts Receivable 419,300 Notes Payable due June 30, Year 3 268,900 Supplies 58,410 Total Liabilities 618,000 Equipment 118,600 Other Assets 69,410 Stockholders' Equity Common Stock 662,000 Retained Earnings 118,420 Total Stockholders' Equity 780,420 Total Assets $ 1,398,420 Total Liabilities & Stockholders’ Equity $ 1,398,420 How much financing did the stockholders of Purrfect Pets, Inc., directly contribute to the company?arrow_forward1 Required Information [The following information applies to the questions displayed below] Simon Company's year-end balance sheets follow At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Assets Cash Req 1 For both the current year and one year ago, compute the following ratios 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Accounts receivable, net Merchandise inventory Prepaid…arrow_forwardAdams Company reports the following balance sheet accounts as of December 31. $ 7,200 Retained earnings 74,200 Notes payable (due in 9 years) 8,200 Office supplies 6 Salaries payable Buildings Prepaid rent Merchandise inventory Accounts payable Prepaid insurance Accounts receivable Common stock Required: Prepare a classified balance sheet. Current assets Total current assets Plant assets Total plant assets Total assets Current liabilities Total current liabilities Long-term liabilities Total long-term liabilities Total liabilities 16,400 Land 22,000 Accumulated depreciation-Building 5,400 Mortgages payable (due in 5 years) 16,000 Cash 14,000 ADAMS COMPANY Balance Sheet December 31 Assets Liabilities Equity P Prev 8 of 8 $ $ $ ‒‒‒ --- T 0 0 0 0 0 0 0 Next $ 70,000 54,000 4,400 46,000 7,400 36,000 40,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education