FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:6.

Hal owns a small piece of land that the company acquired five years ago for $15K. Explain why

or why not the balance sheet value of the land is an appropriate gauge of the fair market value

of the land today_

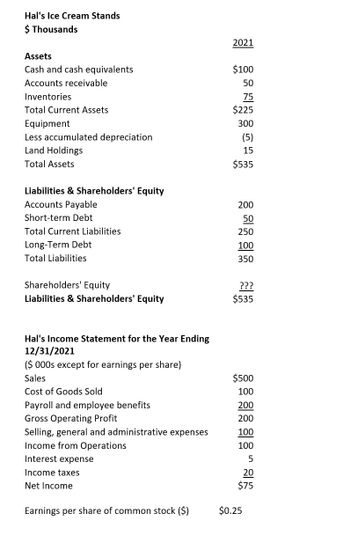

Transcribed Image Text:Hal's Ice Cream Stands

$ Thousands

Assets

Cash and cash equivalents

Accounts receivable

Inventories

Total Current Assets

Equipment

Less accumulated depreciation

Land Holdings

Total Assets

Liabilities & Shareholders' Equity

Accounts Payable

Short-term Debt

Total Current Liabilities

Long-Term Debt

Total Liabilities

Shareholders' Equity

Liabilities & Shareholders' Equity

Hal's Income Statement for the Year Ending

12/31/2021

($ 000s except for earnings per share)

Sales

Cost of Goods Sold

Payroll and employee benefits

Gross Operating Profit

Selling, general and administrative expenses

Income from Operations

Interest expense

Income taxes

Net Income

Earnings per share of common stock ($)

2021

$100

50

75

$225

300

(5)

15

$535

200

50

250

100

350

???

$535

$500

100

200

200

100

100

5

20

$75

$0.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ayayai Automotive is looking to expand its operations and has approached Dynatech Garage to acquire its business. Dynatech has agreed to sell if Ayayai assumes the mortgage on Dynatech's building as part of the sale. The fair value of Dynatech's identifiable assets and identifiable liabilities are: Inventory: 149000. Buildings: 949000. Land: 349000. Mortage payable (274000). Net identifiable assets: 1,173,000. Assuming Ayayai purchases the business for $Record the journal entry for the purchase by Ayayai Automotive. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles Debit Credit 1,324,000arrow_forwardQuestion 7 of 10. Stig purchased a house in 2020 and rented it out the entire time he owned it. His adjusted basis in the property before depreciation is $262,500 ($45,000 attributable to land). In 2022, Stig sold the property for $320,000 with $7,500 in deductible expenses. The total allowable depreciation was $19,093. What is Stig's taxable gain on the disposition of the building? $19,093 $22,345 $30,907 $60,531arrow_forwardMH Realty, LLC sells a parcel of waterfront land and a residential condo building with an adjusted tax basis of $100,000 and 250,000, respectively for $500,000. The original purchase price MH allocated to the building was $600,000. MH has deducted $350,000 in depreciation expense. MH's realized gain is $150,000. If MH takes back a note as part of the proceeds, what is MH's gross profit percentage? A. 83.33%. B. 71.43%. C. 70.00%. D. 50.00%. E. 30.00%.arrow_forward

- Alpha sold machinery, which it used in its business, to Beta, a related entity, for $40,250. Beta used the machinery in its business. Alpha bought the machinery a few years ago for $49,750 and has claimed $30,250 of depreciation expense. What is the amount and character of Alpha's gain?arrow_forward01. Martin owns land that is classified as PPE. The land has previously been valued at cost. The land will be revalued using the revaluation model to its fair value on December 31 (the company's year-end). Before revaluation, the land's carrying value was $100,000. The fair value is $125,000 as of December 31, 2021. What journal entry is required to record the revaluation? What entry would've been made if the fair value on December 31, 2022, is $90,000? 02. 1,000,000 of XYZ's no-par common shares were initially offered at a price of $13, Later, XYZ bought back 6,000 shares of these shares at $ 17 a share. XYZ is incorporated under the Canada business corporation Act and therefore retired these shares. Requirement Record the retirement of the shares. 03. ABC. declare a dividend of $100,000 and pays it all at once. Provide the journal entry needed to document the $100,000 dividend if: The dividend is paid in cash The dividend is paid in company stock (stock dividend)arrow_forwardExplanationarrow_forward

- Julia currently is considering the purchase of some land to be held as an investment. She and the seller have agreed on a contract under which Julia would pay $1,000 per month for 60 months, or $60,000 total. The seller, not in the real estate business, acquired the land several years ago by paying $10,000 in cash. Two alternative interpretations of this transaction are (1) a price of $51,726 with 6 percent interest and (2) a price of $39,380 with 18 percent interest. Which interpretation would you expect each party to prefer? Why?arrow_forwardRussell Corporation sold a parcel of land valued at $442,500. Its basis in the land was $274,350. For the land, Russell received $76,500 in cash in year 0 and a note providing that Russell will receive $265,000 in year 1 and $101,000 in year 2 from the buyer. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Russell's realized gain on the transaction? b. What is Russell's recognized gain in year 0, year 1, and year 2?arrow_forwardHart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deductions against the asset. Hart has a marginal tax rate of 32 percent. Answer the questions presented in the following alternative scenarios (assume Hart had no property transactions other than those described in the problem): Note: Loss amounts should be indicated by a minus sign. Enter NA if a situation is not applicable. Leave no answers blank. Enter zero if applicable.arrow_forward

- Chuck sold a tractor to a dealer for $16,000. He bought the tractor for $25,500 several years ago and has claimed $12,000 of depreciation deduction on the tractor. What is the amount and character of his gain or loss from the sale of the tractor?arrow_forwardTaryn sold a sculpture for $6,000 on 1 January 2020, she bought it on December 1994 for $1,500 Calculate both Indexation and Discount Capital Gain. Later on you need to advise which one will give you a better result.arrow_forwardDaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education