Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

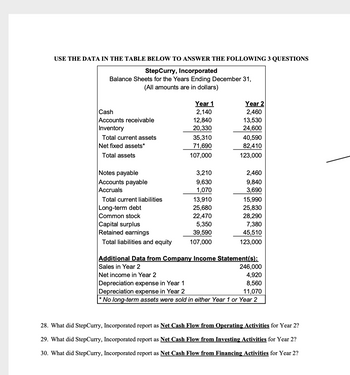

Transcribed Image Text:USE THE DATA IN THE TABLE BELOW TO ANSWER THE FOLLOWING 3 QUESTIONS

StepCurry, Incorporated

Balance Sheets for the Years Ending December 31,

(All amounts are in dollars)

Year 1

Year 2

Cash

2,140

2,460

Accounts receivable

12,840

13,530

Inventory

20,330

24,600

Total current assets

35,310

40,590

Net fixed assets*

71,690

82,410

Total assets

107,000

123,000

Notes payable

3,210

2,460

Accounts payable

9,630

9,840

Accruals

1,070

3,690

Total current liabilities

13,910

15,990

Long-term debt

25,680

25,830

Common stock

22,470

28,290

Capital surplus

5,350

7,380

Retained earnings

39,590

45,510

Total liabilities and equity

107,000

123,000

Additional Data from Company Income Statement(s):

Sales in Year 2

246,000

Net income in Year 2

4,920

Depreciation expense in Year 1

8,560

Depreciation expense in Year 2

11,070

No long-term assets were sold in either Year 1 or Year 2

28. What did StepCurry, Incorporated report as Net Cash Flow from Operating Activities for Year 2?

29. What did StepCurry, Incorporated report as Net Cash Flow from Investing Activities for Year 2?

30. What did StepCurry, Incorporated report as Net Cash Flow from Financing Activities for Year 2?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following financial data for Smith Corp.: Balance Sheet as of December 31, 2019 Cash $ 195,000 Accounts payable $ 94,000 Receivables 185,500 Short-term bank note 119,500 Inventories 214,500 Accruals 71,000 Total current assets $ 595,000 Total current liabilities $ 284,500 Long-term debt 462,500 Net plant & equip. 621,500 Common equity 469,500 Total assets $ 1,216,500 Total liab. & equity $ 1,216,500 Profit & Loss Statement for 2019 Industry Average Ratios Net sales $ 1,265,000 Current ratio 1.9× Cost of sales 986,500 Quick ratio 1.2× Gross profit $ 278,500 Days sales outstanding 64 days Operating expenses 166,500 Inventory turnover 3.3× EBIT $ 112,000 Total asset turnover 0.7× Interest expense 32,000 Net profit margin 9.1% Pre-tax income $ 80,000…arrow_forwardConsider the following financial data for Larry’s Computer Stores: Statement of Financial Position as of December 31, 2012 Cash & equivalents $ 94,500 Accounts payable $ 122,500 Receivables 202,500 Short-term bank note 162,500 Inventories 364,000 Accrued wages and taxes 110,500 Total current assets $ 661,000 Total short-term liab. $ 395,500 Long-term debt 418,000 Net fixed assets 468,500 Common equity 316,000 Total assets $ 1,129,500 Total liabilities & equity $ 1,129,500 Statement of Earnings for the Year Ended December 31, 2012 Sales revenue $ 450,000 Cost of merchandise sold 250,000 Gross profit $ 200,000 Operating expenses 97,500 Earnings before interest and taxes (EBIT) $ 102,500 Interest expense 46,500 Earnings before taxes (EBT) $ 56,000 Federal and state income taxes (45 percent) 25,200 Net earnings $ 30,800…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Balance Sheet as of December 31, 2021 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2021 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends 552 Addition to retained earnings 2$ 828arrow_forwardSubject: acountingarrow_forwardRatio Analysis Presented below are summary financial data from Pompeo's annual report: Amounts in millions Balance sheet Cash and cash equivalents $6,328 Marketable securities 63,298 Accounts receivable (net) 32,785 Total current assets 136,808 Total assets 430,773 Current liabilities 113,172 Long-term debt 21,837 Shareholders' equity 204,834 Income Statement Interest expense 1,257 Net income before taxes 42,021 Calculate the following ratios: (round to two decimal places) a. Times-interest-earned ratio b. Quick ratioarrow_forward

- Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable. Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $ 30,800 88,100 111,000 10,900 280,000 $ 520,800 $ 128,400 98,000 163,500 130,900 $ 520,800 Current Year 1 Year Ago $ 35,000 61,500 82,400 9,300 250,500 $ 438,700 $ 478,850 243,350 12,100 9,550 $73,750 101,750 163,500 99,700 $438,700 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $785,000 Interest expense Income tax expense Total costs and expenses Net income Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: 743,850 $ 41,150 $ 2.52 2…arrow_forwardItem Prior year Current year Accounts payable 8,109.00 7,758.00 Accounts receivable 6,059.00 6,782.00 Accruals 1,036.00 1,609.00 Cash ??? ??? Common Stock 11,891.00 11,189.00 COGS 12,683.00 18,018.00 Current portion long-term debt 4,980.00 4,993.00 Depreciation expense 2,500 2,813.00 Interest expense 733 417 Inventories 4,192.00 4,777.00 Long-term debt 13,329.00 13,523.00 Net fixed assets 50,636.00 54,376.00 Notes payable 4,329.00 9,999.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,278.00 29,801.00 Sales 35,119 47,221.00 Taxes 2,084 2,775 What is the firm's cash flow from investing?arrow_forwardPlease SHOw your workarrow_forward

- ! Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Current Year 1 Year Ago 2 Years Ago $ 43,247 74,941 $ 35,910 107,232 130,858 11,564 329,227 $ 614,791 $ 153,083 113,269 163,500 184,939 99,029 11,241 301,534 $ 529,992 $ 88,673 120,679 163,500 157,140 $ 529,992 $ 42,010 57,156 62,101 4,763 266,970 $ 433,000 $ 57,156 96,650 162,500 116,694 $ 433,000 Total liabilities and equity $ 614,791arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education