FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

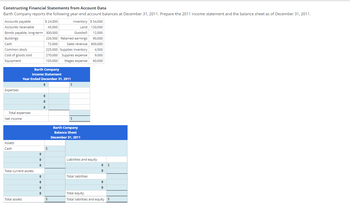

Transcribed Image Text:Constructing Financial Statements from Account Data

Barth Company reports the following year-end account balances at December 31, 2011. Prepare the 2011 income statement and the balance sheet as of December 31, 2011.

Accounts payable

Accounts receivable

Bonds payable, long-term

Buildings

Cash

Common stock

Cost of goods sold

Equipment

Expenses

Total expenses

Net income

Assets

Cash

Total current assets

Total assets

Barth Company

Income Statement

Year Ended December 31, 2011

♦

$

♦

◆

◆

$24.000

Inventory $ 54,000

45,000

Land

120,000

12,000

300,000

Goodwill

226,500 Retained earnings

90,000

72,000

Sales revenue

600,000

♦

+

♦

♦

225,000 Supplies inventory

4,500

270,000 Supplies expense 9,000

105,000

Wages expense 60,000

◆

◆

◆

$

$

$

Barth Company

Balance Sheet

December 31, 2011

Liabilities and equity

Total liabilities

♦

◆

+

Total equity

Total liabilities and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Current Year 1 Year Ago 2 Years Ago $ 35,625 62,500 $ 37,800 50,200 $ 31,800 89,500 112,500 10,700 278,500 98,500 $ 523,000 $ 129,900 Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity 82,500 9,375 255,000 $ 445,000 $ 75,250 101,500 163,500 104,750 163,500 131,100 $ 523,000 $ 445,000 For both the current year and one year ago, compute the following ratios: 54,000 5,000 230,500 $ 377,500 $ 51,250 83,500 163,500 79,250 $ 377,500 1-a) Compute the current ratio for each of the three years. 1-b) Did the current ratio improve or worsen over the three-year period? 2-a) Compute the acid-test ratio for each of the three years. 2-b) Did the acid-test…arrow_forwardSimon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $31,800 89,500 112,500 10,700 278,500 $523,000 $129,900 98,500 163,500 131,100 $523,000 1 Year Ago $35,625 62,500 82,500 9,375 255,000 $445,000 $75,250 101,500 2 Years Ago $37,800 50,200 54,000 5,000 230,500 $377,500 $51,250 83,500 163,500 163,500 104,750 79,250 $445,000 $377,500 Required: 1. Express the balance sheets in common-size percents. (Use cells A4 to D17 from the given information to complete this question.)arrow_forwardEMM, Inc. has the following balance sheet: EMM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 1,200 Accounts payable $ 4,900 Accounts receivable 8,900 Bank note payable 7,700 Inventory 6,100 Long-term assets 4,400 Equity 8,000 $ 20,600 $ 20,600 It has estimated the following relationships between sales and the various assets and liabilities that vary with the level of sales: Accounts receivable = $3,560 + 0.35 Sales, Inventory = $2,356 + 0.28 Sales, Accounts payable = $1,449 + 0.20 Sales. If the firm expects sales of $27,000, what are the forecasted levels of the balance sheet items above? Round your answers to the nearest dollar. Accounts receivable: $ Inventory: $ Accounts payable: $ Will the expansion in accounts payable cover the expansion in inventory and accounts receivable? Round your answers to the nearest dollar. The expansion in accounts payable of $ the total…arrow_forward

- Here are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales $ 887.00 Cost of goods sold 747.00 Depreciation 37.00 Earnings before interest and taxes (EBIT) $ 103.00 Interest expense 18.00 Income before tax $ 85.00 Taxes 17.85 Net income $ 67.15 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Current assets $ 375 $ 324 Long-term assets 270 228 Total assets $ 645 $ 552 Liabilities and shareholders’ equity Current liabilities $ 200 $ 163 Long-term debt 114 127 Shareholders’ equity 331 262 Total liabilities and shareholders’ equity $ 645 $ 552 The company’s cost of capital is 8.5%. Required: What is the company’s return on capital? (Use start-of-year rather than average capital.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. P.S- Answer is not 26.48%arrow_forwardCondensed financial data are presented below for the Tulsa Corporation: Accounts receivable Inventory C. d. Total current assets Total assets Current liabilities Long-term liabilities Sales Cost of goods sold Interest expense Net income Tax rate 2021 $277,500 310,000 675,000 800,000 700,000 250,000 200,000 77,500 75,000 1,640,000 985,000 10,000 130,000 25% 2020 $230,000 250,000 565,000 The profit margin used to calculate return on assets for 2021 is (rounded): a. b. 8.9% 16.3% 17.2% 18.3%arrow_forwardSimon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Current Year $ 31,800 89,500 112,500. 10,700 278,500 $ 523,000 Interest expense Income tax expense Total costs and expenses Net income. Earnings per share $ 129,900 98,500 163,500 131,100 $ 523,000 Current Year $ 411,225 209,550 1 Year Ago $ 35,625 62,500 82,500 9,375 255,000 $ 445,000 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: 4 12,100 9,525 $ 75,250 101,500 163,500 104,750 $ 445,000 $ 673,500 2 Years Ago 642,400 $ 31,100 $ 1.90 $ 37,800 50,200 54,000 5,000 230,500 $ 377,500 $51,250 83,500 163,500 79,250 $ 377,500 1 Year Ago $ 345,500…arrow_forward

- Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Current Year 1 Year Ago $ 31,099 $ 26,605 89, 200 114,500 62,900 85,000 8,568 221, 258 8,163 209,503 $ 460, 131 $ 396,665 Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 112,281 84,775 162,500 100,575 $ 460,131 $ 396,665 $ 65,696 89,408 162,500 79, 061 Current Year The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: $364,884 185,433 10, 169 7,776 $598,170 2 Years Ago 568, 262 $ 29,908 $ 1.84 $ 32,725 50,800…arrow_forwardIKIBAN INCORPORATED Comparative Balance Sheets 2021 At June 30 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation Equipment Total assets Notes payable (long term) Total liabilities. Equity Common stock, $5 par value Retained earnings. Total liabilities and. equity Liabilities and Equity) Accounts payable Wages payable Income taxes payable. Total current liabilities 39,200 Sales Cost of goods sold. Gross profit $ 105,100 71,000 67,800 4,800 248,700 128,000 (29,000) $ 347,700 Cash flows from operating activities $ 29,000 6,400 3,800 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Operating expenses (excluding depreciation) Depreciation expense: Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income Cash flows from investing activities 228,000 46,500 $ 347,700 Cash flows from financing activities Net increase (decrease) in cash Cash balance at prior year-end…arrow_forwardRequired Information [The following Information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Current Year 1 Year Ago 2 Years Ago Cash $ 34,475 Accounts receivable, net 101,959 $ 42,354 70,522 Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable 130,758 11,329 317,729 $ 596,250 110,974 162,500 171,340 96,043 11,118 293,972 $ 514,009 $ 86,868 118,222 162,500 146,419 $ 596,250 $ 514,009 $ 41,986 56,541 60,824 4,758 259,991 $ 424,100 $ 54,862 91,852 162,500 114,886 $ 424,100 $ 151,436 Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For both the current year and one year ago, compute the following ratios: The company's Income statements for the current year and 1 year ago, follow. For Year Ended December 31 Sales Cost of goods sold Interest expense Income tax expense Other operating expenses Total costs and expenses…arrow_forward

- Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year: 1 Year Ago: Current Year Net sales $ 30,400 87,600 113,000 10,500 281,000 $ 522,500 Numerator: $ 128,400 97,500 160,000 136,600 $ 522,500 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Current Year $ 441,000 227,850 12, 200 9,350 1 1 1 Year Ago $ 35,750 62,000 82,000 9,350 249,000 $ 438,100 Income tax expense Total costs and expenses Net income Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: (2) Compute total asset turnover for the current year and one year ago. Total Asset Turnover I $ 75,250 99,500…arrow_forwardHow to calculate Net Operating Asset from this balance sheet for fiscal year-end 2015 .arrow_forwardThe following financial statements apply to Adams Company: ADAMS COMPANY Income Statements for the Years Ending December 31 Year 1 $180,400 Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities $ 220,800 Stockholders equity Common stock (49,000 shares) 124, 600 20,200 10,000 2.100 20,400 177,300 $ 43,500 ADAMS COMPANY Balance Sheets As of December 31 F Retained earnings Total stockholders equity Total liabilities and stockholders' equity 102, 100 18.200 9,000 2,100 17,600 149,000 $ 31,400 $ 5,100 1,800 36,000 101, 200 4,800 148,900 107,000 20,600 $ 276,500 $38,200 16,500…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education