FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

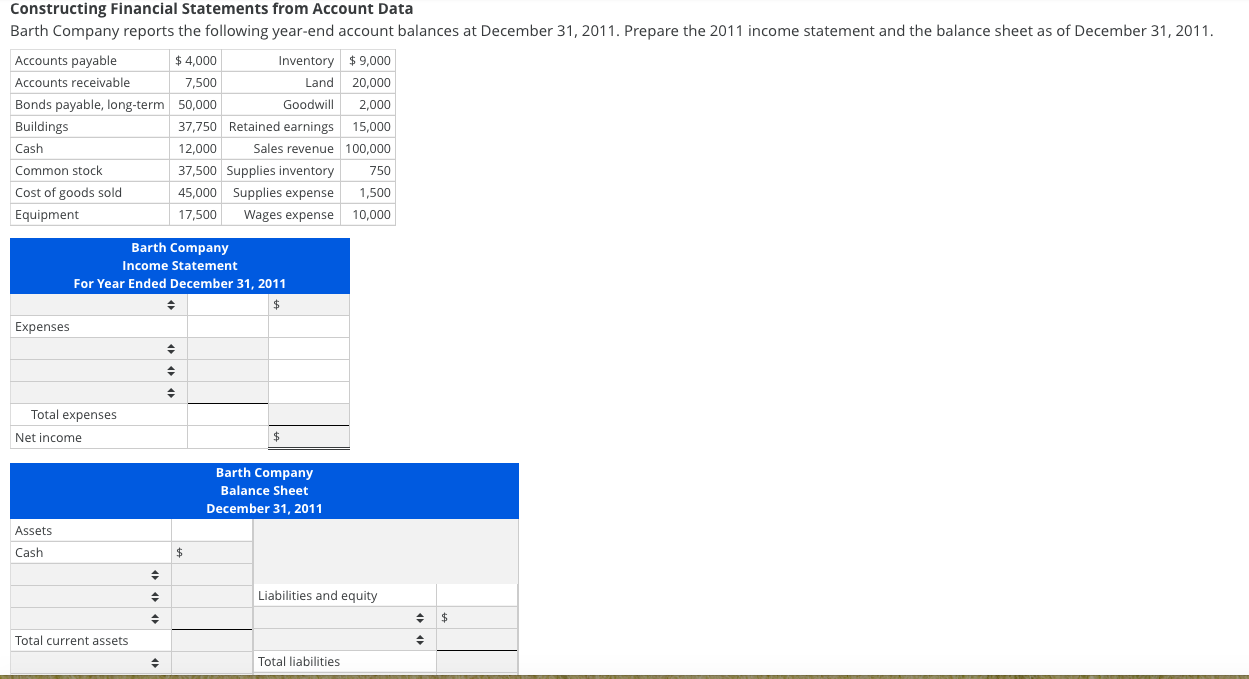

Transcribed Image Text:Constructing Financial Statements from Account Data

Barth Company reports the following year-end account balances at December 31, 2011. Prepare the 2011 income statement and the balance sheet as of December 31, 2011.

Accounts payable

$ 4,000

Inventory $ 9,000

Accounts receivable

7,500

Land 20,000

Bonds payable, long-term 50,000

Goodwill

2,000

Buildings

37,750 Retained earnings 15,000

Cash

12,000

Sales revenue 100,000

Common stock

37,500 Supplies inventory

750

Cost of goods sold

45,000 Supplies expense

1,500

Equipment

17,500

Wages expense 10,000

Barth Company

Income Statement

For Year Ended December 31, 2011

$4

Expenses

Total expenses

Net income

$.

Barth Company

Balance Sheet

December 31, 2011

Assets

Cash

2$

Liabilities and equity

$4

Total current assets

Total liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You are provided with the following information taken from Splish Brothers Inc.’s March 31, 2022, balance sheet. Cash $ 12,330 Accounts receivable 20,370 Inventory 36,900 Property, plant, and equipment, net of depreciation 120,500 Accounts payable 22,640 Common stock 153,800 Retained earnings 12,460 Additional information concerning Splish Brothers Inc. is as follows. 1. Gross profit is 26% of sales. 2. Actual and budgeted sales data: March (actual) $47,000 April (budgeted) 73,100 3. Sales are both cash and credit. Cash collections expected in April are: March $18,800 (40% of $47,000) April 43,860 (60% of $73,100) $62,660 4. Half of a month’s purchases are paid for in the month of purchase and half in the following month. Cash disbursements expected in April are: Purchases March $22,640…arrow_forwardA condensed balance sheet for Simultech Corporation and a partially completed vertical analysis are presented below. Complete the vertical analysis by computing each missing line item as a percentage of total assets. (Round your answers to the nearest whole percent.) SIMULTECH CORPORATION Balance Sheet (summarized) January 31 (in millions of U.S. dollars) Cash $433 29 % Current Liabilities $409 27 % Accounts Receivable 294 19 Long-term Liabilities 495 33 Inventory 206 14 Total Liabilities 904 Other Current Assets 109 Common Stock 118 Property and Equipment 27 2 Retained Earnings 492 32 Other Assets 445 29 Total Stockholders’ Equity 610 Total Assets $1,514 100 % Total Liabilities & Stockholders’ Equity $1,514 100 % 2A. What percentage of Simultech’s total assets relate to inventory? (Round your answer to the nearest whole percent.) 2B. What percentage of Simultech’s total assets relate to property…arrow_forwardPizza, Inc. balance sheet statement for December 31. 2015 with the following information tound to the nearest thousand i Data Table Barron Pizza, Inc. Balance Sheet as of Decemb Retained earnings: $43,512 Accounts payable: $74,547 Accounts receivable: $34,808 Common stock: $119,856 Cash: $8,258 Short-term debt $188 ($ in thousands) LIABILIT Current Inventory: $23,487 Goodwill: $48,302 Long-term debt S80,147 Other noncurrent liabilities: $42,597 Net plant, property, and equipment. $192,340 Other noncurrent assets.$16,738 Long-term investments: $22,330 Other current assets: $14,584 Total cur Total liat OWNER! Print Done a意前 %24 %24 %24 %24 %24arrow_forward

- 5arrow_forwardThe income statement for Sunland, Inc. is as follows:arrow_forwardUsing a BalanceSheetMOON CORPORATIONBALANCE SHEETJULY 31, 2011Assets Liabilities & Owners’ EquityCash . . . . . . . . . . . . . . . . $ 18,000 Liabilities:Accounts Receivable . . . 26,000 Notes PayableLand . . . . . . . . . . . . . . . . 37,200 (due in 60 days) . . . . . . . . . . . . . $ 12,400Building. . . . . . . . . . . . . . 38,000 Accounts Payable . . . . . . . . . . . . . 9,600Office Equipment . . . . . . 1,200 Total liabilities . . . . . . . . . . . . . . $ 22,000Stockholders’ equity:Capital Stock . . . . . . . . . $60,000Retained Earnings. . . . . 38,400 98,400Total . . . . . . . . . . . . . . . . $120,400 Total . . . . . . . . . . . . . . . . . . . . . . . . . $120,400STAR CORPORATIONBALANCE SHEETJULY 31, 2011Assets Liabilities & Owners’ EquityCash . . . . . . . . . . . . . . . . $ 4,800 Liabilities:Accounts Receivable . . . 9,600 Notes PayableLand . . . . . . . . . . . . . . . . 96,000 (due in 60 days) . . . . . . . . . . . . . $ 22,400Building. . . . . . . . . . . .…arrow_forward

- The comparative financial statements prepared at December 31, Year 2, for Goldfish Company showed the following summarized data: Statement of Earnings Sales revenue Cost of sales Gross profit Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) Current liabilities (no interest) Long-term debt (interest rate: 10%) Common shares (6,000 shares) Retained earningst Year 2 Year 1 $367,950 $310,000 312,178 262,000 55,780 48,000 37,410 33,400 18,370 6,310 14,600 4,800 $ 12,060 $ 9,800 $ 4,270 $ 8,400 16,830 48,350 29,810 $ 99,260 $ 11,820 40,480 24,000 22,960 20,000 42,000 25,000 $ 95,400 $14,200 39,200 24,000 18,000 Required: 1 Complete the following columns for each item in the comparative financial statements (Negative answers should be indicated by a minus sign. Round percentage answers to 2 decimal places, Le., 0.1243 should be…arrow_forwardHijab Alisha company has financial data for 2021 as follows: Calculate the firm's earnings available to common shareholders for 2021 and what is the net profit after tax for 2021arrow_forwardAsiago Company reports the following year-end balance sheet data. The company's equity ratio equals: Cash Accounts receivable Total assets Long-term liabilities Inventory 60,000 Common stock 100,000 Retained Equipment 145,000 earnings 1.70 2.07 0.63 1.22 $ Current 40,000 liabilities 1.59 55,000 Total liabilities $ 75,000 $ 300,000 and equity 36,000 89,000 $ 300,000 <arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education