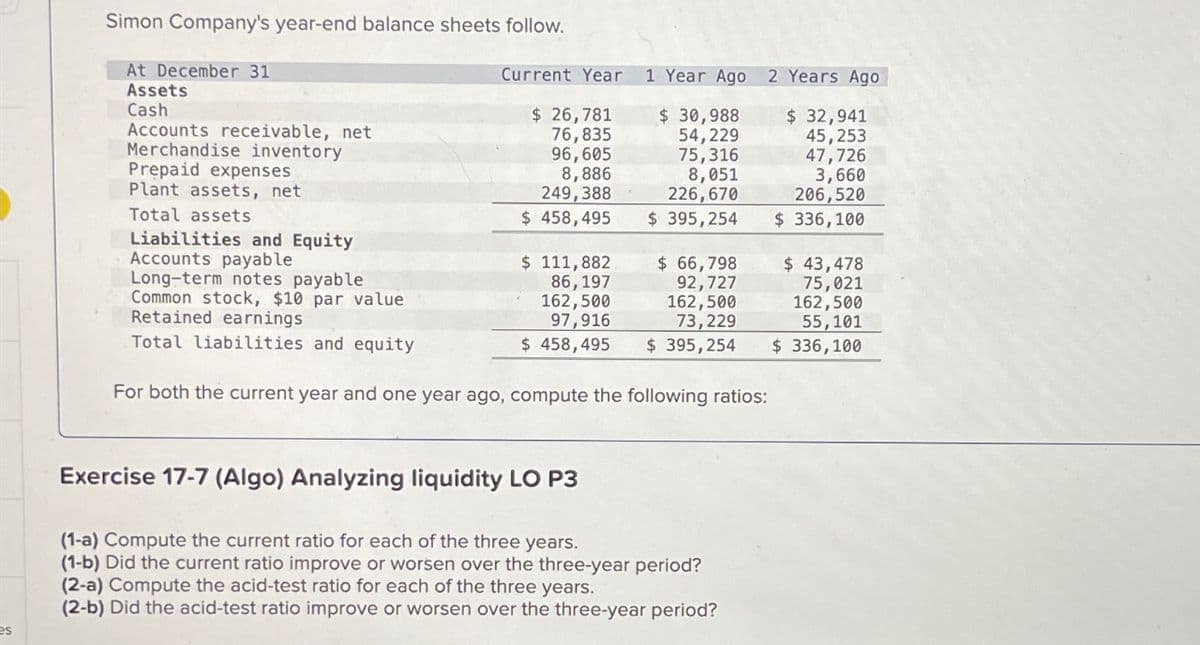

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Current Year 1 Year Ago 2 Years Ago $ 26,781 76,835 $ 30,988 54,229 96,605 8,886 249,388 $ 458,495 75,316 8,051 226,670 $ 395,254 $ 111,882 Long-term notes payable. Common stock, $10 par value 86,197 162,500 97,916 Total liabilities and equity $ 458,495 $ 395,254 Retained earnings $ 66,798 92,727 162,500 73,229 For both the current year and one year ago, compute the following ratios: $ 32,941 45,253 47,726 3,660 206,520 $ 336,100 $ 43,478 75,021 162,500 55,101 $ 336,100 es Exercise 17-7 (Algo) Analyzing liquidity LO P3 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three-year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period?

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Current Year 1 Year Ago 2 Years Ago $ 26,781 76,835 $ 30,988 54,229 96,605 8,886 249,388 $ 458,495 75,316 8,051 226,670 $ 395,254 $ 111,882 Long-term notes payable. Common stock, $10 par value 86,197 162,500 97,916 Total liabilities and equity $ 458,495 $ 395,254 Retained earnings $ 66,798 92,727 162,500 73,229 For both the current year and one year ago, compute the following ratios: $ 32,941 45,253 47,726 3,660 206,520 $ 336,100 $ 43,478 75,021 162,500 55,101 $ 336,100 es Exercise 17-7 (Algo) Analyzing liquidity LO P3 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three-year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 50E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Transcribed Image Text:Simon Company's year-end balance sheets follow.

At December 31

Assets

Current Year 1 Year Ago 2 Years Ago

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

$ 26,781

76,835

$ 30,988

54,229

$ 32,941

45,253

47,726

96,605

8,886

249,388

75,316

8,051

226,670

$ 395,254

$ 458,495

$ 111,882

Long-term notes payable

Common stock, $10 par value

Retained earnings

86,197

162,500

97,916

$ 66,798

92,727

162,500

73,229

Total liabilities and equity

$ 458,495

$ 395,254

For both the current year and one year ago, compute the following ratios:

3,660

206,520

$ 336,100

$ 43,478

75,021

162,500

55,101

$ 336,100

es

Exercise 17-7 (Algo) Analyzing liquidity LO P3

(1-a) Compute the current ratio for each of the three years.

(1-b) Did the current ratio improve or worsen over the three-year period?

(2-a) Compute the acid-test ratio for each of the three years.

(2-b) Did the acid-test ratio improve or worsen over the three-year period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning