FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

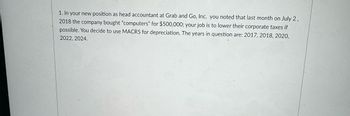

Transcribed Image Text:1. In your new position as head accountant at Grab and Go, Inc. you noted that last month on July 2,

2018 the company bought "computers" for $500,000; your job is to lower their corporate taxes if

possible. You decide to use MACRS for depreciation. The years in question are: 2017, 2018, 2020,

2022, 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Test Your Understanding 2: Fatima Trading Company's Income Statement has shown RO 128,000 profit for the year 2021. Since the accountant of the company is new to Oman and not aware about all the rules of Law of Income Tax on Omani Companies. Indeed, he is not sure about the following transactions he has recorded in the company account books. 1. Company purchased patent worth RO 14000 in the year 2021. The life of patent is 14 years. The accountant expensed the cost of patent 2. The company accountant charged depreciation on the following assets cost at the rate 8% and 30% respectively: (i) Building cost RO40000 (ii) Equipment cost RO20000 The rate of depreciation on such assets as per taxation law of Oman recommended 4% and 33.33% respectively. 3. The opening inventory is undervalued by RO1500 and closing inventory is overvalued by RO12004. Bad debts of RO1500 recovered in the current year, which was written off in concerned previous year profit. This amount is not included in the…arrow_forward4. What total amount of expenses should be reported in the income statement for the 2nd quarter of 2022? * 4. Orange Enterprises had the following transactions: • On December 28, 2021, paid property taxes for the next calendar year of P 500,000. • Loss from typhoon on February 14, 2022 amounting to P600,000. • On May 1, 2022, advertising costs were incurred at P300,000. Sold a machinery with carrying amount of P400,000. The company incurred a loss of P50,000 on its sale on July 1, 2022. A. 475,000 B. 350,000 C. 425,000 D. 675,000 E. None of themarrow_forwardGanarrow_forward

- Please explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwardCullumber Corp's controller was preparing the adjusting entries for the company's year ended December 31, 2023, when the vice- president of finance called him into her office. *Jean-Pierre," she said, "I've been considering a couple of matters that may require different treatment this year. First, the patent we acquired in early January 2021 for $591,000 will now likely be used until the end of 2025 and then be sold for $179,000. We previously thought that we'd use it for 10 years in total and then be able to sell it for $118,000. We've been using straight-line amortization on the patent." "Second, I just discovered that the property we bought on July 2, 2020, for $267,200 was charged entirely to the Land account instead of being allocated between Land ($62,200) and Building ($205,000). The building should be of use to us for a total of 20 years. At that point, it'll be sold and we should be able to realize at least $47,000 from the sale of the building." "Please let me know how these…arrow_forward3arrow_forward

- uppose a computer software developer for a certain company purchased a computer system for $75,000 on April 27, 2017. The computer system is used for business 100% of the time. The accountant for the company elected to take a $30,000 Section 179 deduction, and the asset qualified for a special depreciation allowance. (a) What was the basis for depreciation (in $) of the computer system? (See Table 17-4.) $ (b) What was the amount (in $) of the first year's depreciation using MACRS? $ (Table 17-4) Certain QualifiedAsset Placed into Service Special AllowanceSeptember 11, 2001–May 5, 2003 30%May 6, 2003–January 1, 2005 50%December 31, 2007–September 27, 2017 50%September 28, 2017–December 31, 2022 100%arrow_forwardBLOSSOM's balance sheet at December 31, 2020, is as follows. (See Image 1) (See Image 2) Other information about BLOSSOM is as follows. Salary expense, all paid with cash during 2021 $700 Sales, all for cash 2,990 Purchases, all for cash 2,020 Inventory at 12/31/21 1,790 Property originally cost $2,100 and is depreciated on a straight-line basis over 25 years with no residual value.Interest on the note payable is 10% annually and is paid in cash on 12/31 of each year.Dividends declared and paid are $190 in 2021. Prepare an income statement for 2021. (Round answers to 1 decimal place)arrow_forwardDuring June 2022, your company recorded depreciation of $8,000 on equipment in your factory. What effect did this have on your company’s accounting system? The balance in the depreciation expense account will increase, and the balance in the Accumulated Depreciation account will decrease. The balance in the factory overhead account will decrease, and the balance in the Accumulated Depreciation account will increase. The balance in the depreciation expense account will increase, and the balance in the Accumulated Depreciation account will increase. The balance in the depreciation expense account will increase, and the balance in the Factory Overhead account will decrease. The balance in the factory overhead account will increase, and the balance in the Accumulated Depreciation account will decrease. The balance in the depreciation expense account will increase, and the balance in the Factory Overhead account will increase. The balance in the factory overhead account will decrease, and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education