FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

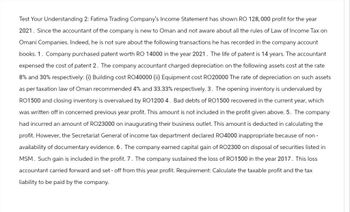

Transcribed Image Text:Test Your Understanding 2: Fatima Trading Company's Income Statement has shown RO 128,000 profit for the year

2021. Since the accountant of the company is new to Oman and not aware about all the rules of Law of Income Tax on

Omani Companies. Indeed, he is not sure about the following transactions he has recorded in the company account

books. 1. Company purchased patent worth RO 14000 in the year 2021. The life of patent is 14 years. The accountant

expensed the cost of patent 2. The company accountant charged depreciation on the following assets cost at the rate

8% and 30% respectively: (i) Building cost RO40000 (ii) Equipment cost RO20000 The rate of depreciation on such assets

as per taxation law of Oman recommended 4% and 33.33% respectively. 3. The opening inventory is undervalued by

RO1500 and closing inventory is overvalued by RO12004. Bad debts of RO1500 recovered in the current year, which

was written off in concerned previous year profit. This amount is not included in the profit given above. 5. The company

had incurred an amount of RO23000 on inaugurating their business outlet. This amount is deducted in calculating the

profit. However, the Secretariat General of income tax department declared RO4000 inappropriate because of non-

availability of documentary evidence. 6. The company earned capital gain of RO2300 on disposal of securities listed in

MSM. Such gain is included in the profit. 7. The company sustained the loss of RO1500 in the year 2017. This loss

accountant carried forward and set - off from this year profit. Requirement: Calculate the taxable profit and the tax

liability to be paid by the company.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Isaac Inc. began operations in January 2021. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. In 2021, Isaac had $676 million in sales of this type. Scheduled collections for these sales are as follows: 2021 $ 83 million 2022 137 million 2023 129 million 2024 162 million 2025 165 million $ 676 million Assume that Isaac has a 25% income tax rate and that there were no other differences in income for financial statement and tax purposes. Ignoring operating expenses, what deferred tax liability would Isaac report in its year-end 2021 balance sheet?arrow_forwardAmy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Incorporated (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company’s tax accounting balance sheet. The relevant information is summarized as follows: Note: Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign. FMV Adjusted Tax Basis Appreciation Cash $ 10,000 $ 10,000 Receivables 15,000 15,000 Building 100,000 50,000 50,000 Land 225,000 75,000 150,000 Total $ 350,000 $ 150,000 $ 200,000 Payables $ 18,000 $ 18,000 Mortgage* 112,000 112,000 Total $ 130,000 $ 130,000 * The mortgage is attached to the building and land. Ernesto was asking for $400,000 for the company. His tax basis in the BLI stock was $100,000. Included in the sales price was an unrecognized customer list valued at $100,000. The unallocated portion of the purchase price…arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education