FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

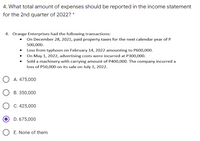

Transcribed Image Text:4. What total amount of expenses should be reported in the income statement

for the 2nd quarter of 2022? *

4. Orange Enterprises had the following transactions:

• On December 28, 2021, paid property taxes for the next calendar year of P

500,000.

• Loss from typhoon on February 14, 2022 amounting to P600,000.

• On May 1, 2022, advertising costs were incurred at P300,000.

Sold a machinery with carrying amount of P400,000. The company incurred a

loss of P50,000 on its sale on July 1, 2022.

A. 475,000

B. 350,000

C. 425,000

D. 675,000

E. None of them

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the information below to answer the questions that follow. Enter your answers using digits only - no dollar signs, commas, or decimal points. The business's year-end is December 31. Cost of equipment = 110000 Useful life in years = 4 Residual value 8000 %3D Date purchased = March 1 What is the depreciation expense per year? What is the depreciation expense per month? What is the depreciation expense in the year of purchase?arrow_forwardplease provide working i post this que 2nd timearrow_forwardUrmila benarrow_forward

- The comparative balance sheets for 2024 and 2023 and the statement of income for 2024 are given below for Dux Company. Additional information from Dux's accounting records is provided also. Assets Cash Accounts receivable Less: Allowance for uncollectible accounts Dividends receivable Inventory Long-term investment Land Buildings and equipment Less: Accumulated depreciation Liabilities Accounts payable Salaries payable Interest payable DUX COMPANY Comparative Balance Sheets December 31, 2024 and 2023 ($ in thousands) Income tax payable Notes payable Bonds payable Less: Discount on bonds Shareholders' Equity Common stock Paid-in capital-excess of par Retained earnings Less: Treasury stock 2024 $78 53 (6) 3 65 40 70 277 (45) $ 535 $34 4 9 3 20 110 (3) 210 24 132 (8) $ 535 2023 $ 33 65 (5) 2 60 36 50 280 (70) $ 451 $ 56 Ramon O 9 3 6 0 85 (4) 200 20 76 $ 451arrow_forwardThe following income statement and balance sheets for The Athletic Attic are provided. THE ATHLETIC ATTIC Income Statement For the Year Ended December 31, 2024 Net sales $8,880,000 Cost of goods sold 5,440,000 Gross profit 3,440,000 Expenses: Operating expenses $1,590,000 Depreciation expense 208,000 Interest expense 48,000 Income tax expense 358,000 Total expenses 2,204,000 Net income $1,236,000 THE ATHLETIC ATTIC Balance Sheets December 31 2024 2023 Assets Current assets: Cash $162,000 $212,000 Accounts receivable 780,000 800,000 Inventory 1,395,000 1,065,000 Supplies 108,000 83,000 Long-term assets: Equipment 1,140,000 1,140,000 Less: Accumulated depreciation (416,000) (208,000) Total assets $3,169,000 $3,092,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $113,000 $89,000 Interest payable 0 4,800 Income tax payable 39,000 30,800…arrow_forwardBLOSSOM's balance sheet at December 31, 2020, is as follows. (See Image 1) (See Image 2) Other information about BLOSSOM is as follows. Salary expense, all paid with cash during 2021 $700 Sales, all for cash 2,990 Purchases, all for cash 2,020 Inventory at 12/31/21 1,790 Property originally cost $2,100 and is depreciated on a straight-line basis over 25 years with no residual value.Interest on the note payable is 10% annually and is paid in cash on 12/31 of each year.Dividends declared and paid are $190 in 2021. Prepare an income statement for 2021. (Round answers to 1 decimal place)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education