FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

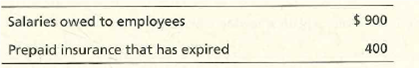

The net income of Steinbach & Sons, a landscaping company, decreased sharply during 2018. Mort Steinbach, owner and manager of the company, anticipates the need for a bank loan in 2019. Late in 2018, Steinbach instructs the company’s accountant to record $2,000 service revenue for landscape services for the Steinbach family, even though the services will not be performed until January 2019. Steinbach also tells the accountant not to make the following December 31, 2018,

Requirements

- Compute the overall effects of these transactions on the company’s reported net income for 2018.

- Why is Steinbach taking this action? Is his action ethical? Give your reason, identifying the parties helped and the parties harmed by Steinbach’s action.

- As a personal friend, what advice would you give the accountant?

Transcribed Image Text:Salaries owed to employees

Prepaid insurance that has expired

$ 900

400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2019, Rachael Parkins, president of Mathieson Company, was paid a semimonthly salary of $8,000. Compute the amount of FICA taxes that should be withheld from herarrow_forwardSuperior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2023. An analysis reveals the following: During December, Superior sold 6, 600 skateboards that carry a 60 - day warranty. The skateboard sales totalled $391,000. The company expects 7% of the skateboards will need repair under warranty and it estimates that the average repair cost per unit will be $39. A disgruntled employee is suing the company. Legal advisers believe that it is probable that Superior will have to pay damages, the amount of which cannot be reasonably estimated. Superior needs to record previously unrecorded cash sales of $2, 110,000 (cost of sales 60%) plus applicable HST. Superior recognizes that $ 96,000 of $161,000 received in advance for skateboards has now been earned. Required: Prepare any required adjusting entries at December 31, 2023, for each of the above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account…arrow_forwardABC began a gift card program in January 2023 and sold $15,350 of gift cards in January, $17,950 in February, and $20,950 in March 2023 before discontinuing further gift card sales. During 2023, gift card redemptions were $8,700 for the January gift cards sold, $4,650 for the February cards, and $6,300 for the March cards. ABC considers gift cards to be “broken” (a remote probability of redemption) 10 months after sale. What liability for deferred revenue associated with gift card sales would ABC show as of December 31, 2023? a) 6,300 b) 20,950 c) 54,250 d) 14,650arrow_forward

- Faramarzinikpey Company, a public company, is preparing its annual financial statements on December 31, 2022. The following selected information is available: The company has been sued by an employee for discrimination. The employee is seeking $5,000,000 in damages. Legal counsel believes it is unlikely that the company will have to pay any damages. The amount is material ( substantial ) to the company. Employees have accrued ( earned ) $4,200 in vacation pay benefits as of December 31,2022. The company has been sued in a $ 3,000,000 product liability lawsuit. Legal counsel believes the company will probably have to pay the full amount. On October 1, 2022, the company signed a $ 10,000, 6-month, 8% note payable. No interest has been accrued to date. Instructions: Prepare any necessary adjusting entries or disclosures on December 31, 2022.arrow_forwardPrepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forwardCharles Whyte commenced business on May 1 2019, making up his accounts to September 30 annually. The statement of the Profit or Loss Account for the first 17 months ended September 30,2020 is as follows: Gross Profit Less: Repairs and maintenance. Local transport and travelling Salaries and wages Provision for bad debts Preliminary expenses Depreciation Bank interest and charges Legal and professional charges General expenses (Allowable) Clearing expense on motor vehicle Bad debt Amounts written off Loan to absconded employee (ii) (iii) (iv) (1) You are also given the following additional information. Bad debt £ (v) £'000 30/10/2018 1/1/2019 1/5/2019 1,500 2,450 6,500 1,350 960 1,630 1,520 1,380 1,870 685 2,800 Building Motor Vehicle Furniture and fittings Legal and professional charges were: Salaries and wages: The following qualifying capital expenditures were acquired on: Fines for contravention of the law Legal expenses for tax appeal Audit and accountancy charges £'000 19,300…arrow_forward

- Do you want to make a double entry? On November 7, 2021, a fire broke out at the store, destroying merchandise worth $12,000. The insurance company has declared that it will only pay out the first $3,000 of the claim under the provisions of the contract. There haven't been any entries made yet to document this.arrow_forwardHow to calculate the following: (COVID provisions) Lamden Company paid its employee Trudy, wages of $61,500 in 2020. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudy’s spouse contracting COVID and Trudy being quarantined. Trudy spent another 10 weeks at home caring for their children that were unable to attend school. Lamden allocated $10,000 in wages to family leave. Lamden allocated $6,000 of Trudy’s wages to the employee retention credit (5 weeks). The allocation of health care costs is $200 per week. Compute Lamden’s: Credit for sick pay Credit for family leave Employee retention creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education