FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

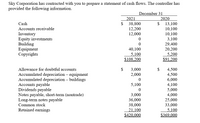

Transcribed Image Text:Sky Corporation has contracted with you to prepare a statement of cash flows. The controller has

provided the following information.

December 31

2021

$

2020

Cash

38,800

$ 13,100

Accounts receivable

12,200

12,000

10,100

Inventory

Equity investments

Building

Equipment

Copyrights

10,100

3,100

40,100

5,100

$108,200

29,400

20,200

5,200

$91,200

Allowance for doubtful accounts

$

3,000

2,000

4,500

4,500

6,000

Accumulated depreciation – equipment

Accumulated depreciation – buildings

Accounts payable

Dividends payable

Notes payable, short-term (nontrade)

Long-term notes payable

Common stock

5,100

4,100

5,000

4,000

25,000

33,000

5,100

$369,000

3,000

36,000

38,000

Retained earnings

21,100

$420,000

Transcribed Image Text:Additional information related to 2021 are as follows:

a. Equipment that had cost $11,100 and was 30% depreciated at time of disposal was sold for

$2,500.

b. $5,000 of the long-term note payable was paid by issuing common stock.

c. Distributed cash dividends of $5,000 that was declared in 2020.

d. On January 1, 2021, the building was completely destroyed by a flood. Insurance proceeds on

the building were $33,200 (net of $4,000 taxes).

e. Equity investments (ownership is less than 20% of total shares) were sold at $1,400 above their

cost. No unrealized gains or losses were recorded in 2021.

f. Cash and a long-term note for $16,000 were given for the acquisition of equipment.

g. Interest of $2,000 and income taxes of $4,900 were paid in cash.

Required:

Use the indirect method to prepare a statement of cash flows for Sky Corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- naruarrow_forwardThe following transactions occurred during 2020. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated salvage value. Depreciation is charged for a full year on all fixed assets acquired during the year, and no depreciation is charged on fixed assets disposed of during the year. Jan. 30 Mar. 10 Mar. 20 May 18 June 23 Date A building that cost $182,160 in 2003 is torn down to make room for a new building. The wrecking contractor was paid $7,038 and was permitted to keep all materials salvaged. 1/30 Machinery that was purchased in 2013 for $22,080 is sold for $4,002 cash, f.o.b. purchaser's plant. Freight of $414 is paid on the sale of this machinery. A gear breaks on a machine that cost $12,420 in 2012. The gear is replaced at a cost of $2,760. The replacement does not extend the useful life of the machine but does make the machine more efficient. Prepare general journal entries for the…arrow_forwardTamarisk Cole Inc. acquired the following assets in January of 2018. Equipment, estimated service life, 5 years; salvage value, $15,500 $546,500 Building, estimated service life, 30 years; no salvage value $639,000 The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2021, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the general journal entry to record depreciation expense for the equipment in 2021. (b) Prepare the journal entry to record depreciation expense for the building in 2021. (Round answers to 0 decimal places,…arrow_forward

- In 2021, internal auditors discovered that PKE Displays, Inc. had debited an expense account for the $356,000 cost of equipment purchased on January 1, 2018. The equipment’s life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Required:1. Determine the cumulative effect of the error on net income over the three-year period from 2018 through 2020, and on retained earnings by the end of 2020.2. Prepare the correcting entry assuming the error was discovered in 2021 before the adjusting and closing entries. (Ignore income taxes.)3. Assume instead that the equipment was disposed of in 2022 and the original error was discovered in 2023 after the 2022 financial statements were issued. Prepare the correcting entry in 2023.arrow_forwardSouth Shore Petroleum holds huge reserves of oil assets. Assume that at the end of 2018,South Shore Petroleum cost of oil reserves totaled $56,000,000, representing 7,000,000 barrels of oil. Requirement 2.Suppose South Shore PetroleumS removed and sold 600,000 barrels of oil during 2019. Journalize depletion expense for 2019.arrow_forwardOn December 31, 2021, after a slight mishap, Wreckless Transport Co. decides to evaluate its delivery truck for possible impairment. The company has the following information as of 12-31-2021: Equipment cost 65,000 Accumulated depreciation to date 20,000 Expected future net cash flows 10,000 Fair Value on 12-31-2021 8,000 Disposal costs 2,000 Fair value of equipment on 12-31-2022 15,000 Assume that the company will continue to use this asset in the future. As of December 31, 2021, the equipment has a remaining useful life of 4 years. INSTRUCTIONS: A Prepare the journal entry, if any, to record impairment at 12-31-2021 B Prepare the journal entry, if any, at December 31, 2022 to record the increase in fair value. C Prepare the journal entry on 12-31-2021 to record impairment assuming that the company intends to dispose of the truck rather than continue to use it. Show work to explain please.arrow_forward

- On December 12, 2018, an investment costing $88,000 was sold for $116,000. The total of the sale proceeds was credited to the investment account. Required:1. Prepare the journal entry to correct the error assuming it is discovered before the books are adjusted or closed in 2018. (Ignore income taxes.)2. Prepare the journal entry to correct the error assuming it is not discovered until early 2019. (Ignore income taxes.)arrow_forwardMcClain Company incurred the following expenditures during 2019: Apr. June Sept. Dec. 9 The air conditioning system in the old manufacturing facility was replaced for $80,000. The old air conditioning system had a cost of $71,750 and a book value of $1,700. The old air conditioning system had no scrap value. 29 Annual maintenance of $39,500 was performed. 12 The roof of the old manufacturing facility is replaced at a cost of $68,000. This expenditure substantially extended the life of the facility. 28 A new wing was added to the manufacturing facility at a cost of $261,000. This expenditure substantially increased the productive capacity of the plant. Required: 1. Prepare journal entries to record McClain's expenditures for 2019. 2. Next Level What is the effect on the financial statements if management had improperly accounted for the: a. addition of the new wing to the manufacturing facility b. annual maintenance expendituresarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education