FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The following issue relate to clients of the firm of accountants you work for. Each

company has a year-end of 31 December 2022.

You are required to prepare detailed notes for your manager explaining the appropriate

accounting treatments in each case along with supporting calculations as necessary.

You should cite relevant accounting regulations in your answer.

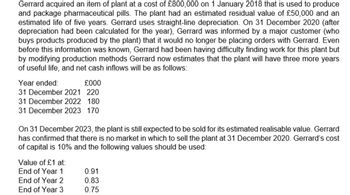

Transcribed Image Text:Gerrard acquired an item of plant at a cost of £800,000 on 1 January 2018 that is used to produce

and package pharmaceutical pills. The plant had an estimated residual value of £50,000 and an

estimated life of five years. Gerrard uses straight-line depreciation. On 31 December 2020 (after

depreciation had been calculated for the year), Gerrard was informed by a major customer (who

buys products produced by the plant) that it would no longer be placing orders with Gerrard. Even

before this information was known, Gerrard had been having difficulty finding work for this plant but

by modifying production methods Gerrard now estimates that the plant will have three more years

of useful life, and net cash inflows will be as follows:

Year ended:

£000

31 December 2021 220

31 December 2022 180

31 December 2023 170

On 31 December 2023, the plant is still expected to be sold for its estimated realisable value. Gerrard

has confirmed that there is no market in which to sell the plant at 31 December 2020. Gerrard's cost

of capital is 10% and the following values should be used:

Value of £1 at:

End of Year 1

End of Year 2

End of Year 3

0.91

0.83

0.75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Before you begin this assignment, review the Tying it All Together feature in the chapter. It will also be helpful if you review TravelCenters of America LLC’s 2075 annual report</i> (https://www.sec.gov/Archives/edgar/data/1378453/000137845316000040/a2015123110k.htm). TravelCenters of America LLC is the largest full-service travel center company in the United States, serving both professional drivers and motorists. Since 2011, the company’s growth strategy has been to acquire additional travel center and convenience center locations. In addition to agreements entered into in 2015, the company acquired 3 travel centers and 170 convenience centers for a total purchase price of $320.3 million. Requirements Using the payback method, suppose TravelCenters of America expect to receive an annual net cash inflow of $32.03 million per year. How many years would it take to pay back the initial investment? What are some disadvantages to using the payback method? Why would a company, such…arrow_forwardPlease analyze, assess, and synthesize the Annual Report or Form 10-K or Form 20 - F (whatever they call it in that jurisdiction) of the company you choose. You can usually find it on the Company's website in Investor R. Introduction 2. Industry situation and company plans A. Management Letter B. B. Review Company's Products and Services 3. Financial Statements A. Income Statement B. Cash Flow Statement C. Balance Sheet D. Accounting Policies 4. Financial Analysis & Ratio A. Financial Analysis B. Ratio C. Market Indicator Financial Ratios 5. References 6. Complete Calcuation of Part 4 in excelLimiarrow_forwardList and describe the major steps a business should follow in developing a new accounting information system (i.e., the phases of the system’s development life cycle). Be thorough in your answerarrow_forward

- your line manager wants to assess your understanding and ability to prepare and produce the appropriate final accounts such as profit and loss account, owners’ equity statement, and balance sheet as well as how these accounts are differed under different forms and types of business. Produce the final accounts for a sole trader business (Software Programming Company) from task 1 including profit and loss account, owners’ equity statement, and balance sheet for the Period ended July 31st. using the trial balance that you have produced in problem 2/ task1 2) Make the adjustments entries for the following transactions before preparing the final accounts for LLC company: On the 20th of October 2019, the business purchased supplies for 8000 cash. On 31st of December, 2019 the business found out that the supplies still on hand were 4000 only. The business has a Equipment with book value of 17000, with annual depreciation rate of 10%. On the 1st of July the business purchased a…arrow_forwardHi I need help on what is the answer for this accounting problem. I hope that you can help me and the guide for this is below https://drive.google.com/file/d/1SW5qlxo5_WjMHOnEMO7hLmdBgG8u0bi6/view?usp=sharingarrow_forwardHello! I need help with the following accounting principles question. It states that for each box, we can either select the user as being an external or internal user. Thank you in advance!arrow_forward

- What requirements are usually necessary to become licensed as a certified public accountant?a. Successful completion of the Uniform CPA Examination.b. Experience in the accounting field.c. Education.d. All of the abovearrow_forwardWhile assisting the accounting department with completing the current year's financial statements, you have been asked to review a list of contingent liabilities. How would a manager, review the list of contingent liabilities and determine their probability?arrow_forwardWhich type of accounting reports are prepared on yearly basis? Select one: a. Financial Accounting b. Cost Accounting c. Management Accounting d. None of the above.arrow_forward

- Evaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide.b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.)c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forwardWhich of the following does not accurately describe a requirement that a company must fulfill when adopting IFRS for the first time? 14 Multiple Choicearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education