Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.70CEP

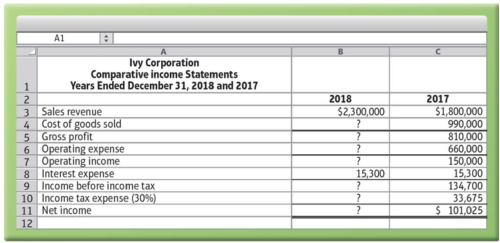

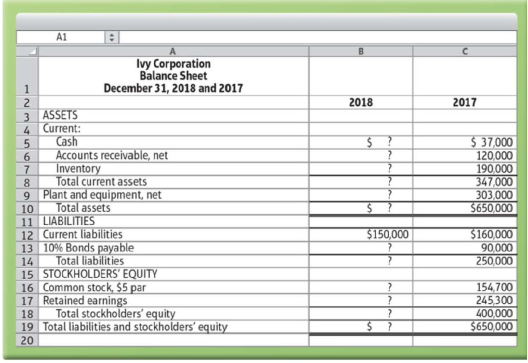

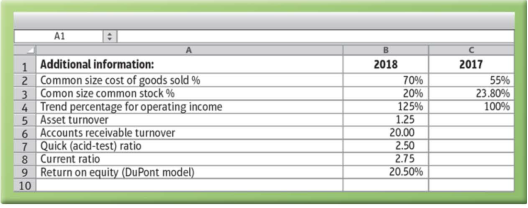

(Learning Objectives 2, 3.4: Use trend percentages. Common-size percentages, and ratios to reconstruct financial statements) An incomplete comparative income statement and

Requirement

1. Using the ratios, common-size percentages, and trend percentages given, complete the income statement and balance sheet for Ivy for 2018. Additional information:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question 1

Mabel is a potter and sells her pottery at stalls that she rents in four tourist information centres

across the south of England.

Extracts from her financial statements for the years ended 31 December 2021 and 2020 are

shown below.

Statement of profit or loss for the year ended 31 December:

2021

28,900

|(16,500)

12,400

(3,800)

8,600

|(4,000)

4,600

2020

Revenue

27,200

(14,000)

13,200

(3,600)

9,600

Cost of sales

Gross profit

Operating expenses

Operating profit

Non-operating expenses

Net profit

9,600

Statement of financial position as at 31 December:

2021

Non-current assets

Current assets

Total assets

22,660

4,360

27,020

2020

20,920

3,750

24,670

Equity

Non-current liabilities

Current liabilities

Equity and liabilities

20,940

3,000

3,080

27,020

16,340

3,500

4,830

24,670

The following information is also relevant:

In July 2021 the rent on one of Mabel's stalls was increased significantly for the third time in

three years so she decided not to renew the annual contract. She sold…

(Learning Objective 7: Calculate return on assets) Handley Grocery Corporationreported the following information in its comparative financial statements for the fiscal yearended January 31, 2018:January 31,2018January 31,2017Net sales....................................Net earnings..............................Average total assets...................$50,000$ 2,200$40,000$48,350$ 2,100$39,300Requirements1. Compute the net profit margin ratio for the years ended January 31, 2018, and 2017. Did itimprove or worsen in 2018?2. Compute asset turnover for the years ended January 31, 2018, and 2017. Did it improve orworsen in 2018?3. Compute return on assets for the years ended January 31, 2018, and 2017. Did it improveor worsen in 2018? Which component—net profit margin ratio or asset turnover—wasmostly responsible for the change in the company’s return on assets?

(Learning Objective 7: Evaluate liquidity using the quick [acid-test] ratio and days’sales in receivables) Northern Products reported the following amounts in its 2019 financialstatements. The 2018 amounts are given for comparison.2019 2018Current assets:Cash............................................ $ 9,500Short-term investments................ 7,000Accounts receivable..................... $70,100Less: Allowance foruncollectibles.......................$86,500(7,500) (5,500) 64,600Inventory..................................... 190,000Prepaid insurance ........................ 2,200Total current assets..................... 273,300Total current liabilities.................... 106,000Net sales (all on account) ................$ 9,50010,50079,000189,0002,200290,20099,0001,077,000 734,000Requirements1. Compute Northern’s quick (acid-test) ratio at the end of 2019. Round to two decimalplaces. How does the quick ratio compare with the industry average of 0.92?2. Compare days’ sales…

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Learning Objective 7: Calculate return on assets) Hometown Supply Companyreported the following information in its comparative financial statements for the fiscal yearended January 31, 2018:January 31,2018January 31,2017Net sales....................................Net earnings..............................Average total assets...................$84,000$ 4,200$70,000$82,600$ 4,050$69,450Requirements1. Compute the net profit margin ratio for the years ended January 31, 2018, and 2017. Did itimprove or worsen in 2018?2. Compute asset turnover for the years ended January 31, 2018, and 2017. Did it improve orworsen in 2018?3. Compute return on assets for the years ended January 31, 2018, and 2017. Did it improveor worsen in 2018? Which component—net profit margin ratio or asset turnover—wasmostly responsible for the change in the company’s return on assets?arrow_forwardE1-23A. (Learning Objective 4: Identify financial statement by type of information) ButlerTech, Inc., is expanding into India. The company must decide where to locate and how tofinance the expansion. Identify the financial statement where these decision makers can findthe following information about Butler Tech, Inc. In some cases, more than one statement willreport the needed data.a. Revenueb. Common stockc. Current liabilitiesd. Long-term debte. Dividendsf. Ending cash balanceg. Adjustments to reconcile net income tonet cash provided by operationsh. Cash spent to acquire the buildingi. Income tax expensej. Ending balance of retained earningsk. Selling, general, and administrativeexpensel. Total assetsm. Net incomen. Income tax payablearrow_forwardUsing the fiscal year end 2020 annual report for General Mills, Inc. and the figures from the 2020 annual report as noted below, calculate the financial ratios for 2020 and 2019 indicated using the EXCEL template provided:1. Gross profit percentage2. Return on sales3. Asset turnover 4. Return on assets5. Return on common stockholders’ equity6. Current ratio7. Quick ratio8. Operating-cash-flow-to-current-liabilities ratio9. Accounts receivable turnoverTotal assets 2020 = $30,806.7Total stockholders’ equity 2020 = $8,349.5Total current liabilities 2020 = $7,491.5Accounts receivable 2020 = $1,615.1Inventory 2020 = $1,426.3Year-end closing stock price May 2020 = $58.80Year-end closing stock price May 2019 = $53.56 To calculate averages use (current year balance + poor year balance) / 2) Round percentages to 1 decimal place; round other answers to 2 decimal places.arrow_forward

- 1. Compute for the financial health ratios of the company for 2019 C.Financial Health/ (Solvency and Liquidity) Solvency ratio: a. Debt to equity ratio b. Debt Ratio c. Equity Ratio d. Interest Coverage Ratio Liquidity ratio: a. Current Ratio b. Quick Ratioarrow_forwardComplete the common-size and common-base year financial statements [Income Statement (IS) and Balance Sheet (BS)] or Brady Corp. Include spark lines to easily show the trends. Write a brief analysis in the Excel worksheet of the main trends that you notice. Perform the 3 step DuPont Return on Equity (ROE) analysis for Brady Corp. using cell references. Write a brief analysis from the DuPont analysis on Excel worksheet.arrow_forwardAs part of your analysis, you are required to investigate DEVCON Industries' cash flows and selected ratios. Required: Using the financial statement provided on page 1: (a) Compute the following ratios for DEVCON Industries for 2018 and 2019: i. Return on Equity using Du Pont Identity ii. Earnings Per Share (EPS iii. Price/Earning (P/E) Ratioarrow_forward

- Not Graded Using the fiscal year end 2020 annual report for General Mills, Inc. and the figures from the 2020 annual report as noted below, calculate the financial ratios for 2020 and 2019 indicated using the EXCEL template provided:1. Gross profit percentage2. Return on sales3. Asset turnover 4. Return on assets5. Return on common stockholders’ equity6. Current ratio7. Quick ratio8. Operating-cash-flow-to-current-liabilities ratio9. Accounts receivable turnoverTotal assets 2020 = $30,806.7Total stockholders’ equity 2020 = $8,349.5Total current liabilities 2020 = $7,491.5Accounts receivable 2020 = $1,615.1Inventory 2020 = $1,426.3Year-end closing stock price May 2020 = $58.80Year-end closing stock price May 2019 = $53.56arrow_forwardThe image uploaded is the calculation of Cal Bank's Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardIncome statement and balance sheet data for The Athletic Attic are provided below.Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. c. Current ratio. b. Inventory turnover ratio. d. Debt to equity ratio. 2. Calculate the following profitability ratios for 2021 and 2022: a. Gross profit ratio. c. Profit margin. b. Return on assets. d. Asset turnover. 3. Based on the ratios calculated, determine whether overall risk and profitability improved from 2021 to 2022.arrow_forward

- Use information from the balance sheet and income statement to calculate the following financial ratios and the market value added (MVA). Whenever balance sheet numbers are used to calculate financial ratios, please ensure that you use the average of the 2019 and 2020 numbers in your calculation. To calculate MVA, you can assume that the average book value number for common stock and paid-in-surplus is the amount that the shareholders initially invested in the company.arrow_forwardPlease refer to the financial data for Link, Incorporation above. What is Link’s profit margin for 2021? That. Rightarrow_forwardUsing the financiaql statements of Top Glove Corporation Berhad for the year 2020, provide and comment on the following: Calculate the profitability, liquidity and effiency ratios of the Top Glove Corporation Berhad company (use the following ratios: gross profit margin, net profit margin, return on capital employed, quick ratio, current ratio, accounts receivable turnover, accounts payables turnover, inventory turnover) for the year 2019 and 2020.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License