Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.59AP

LO 4

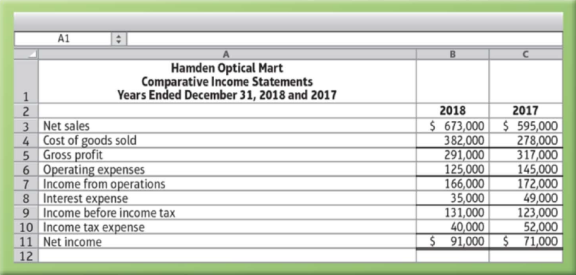

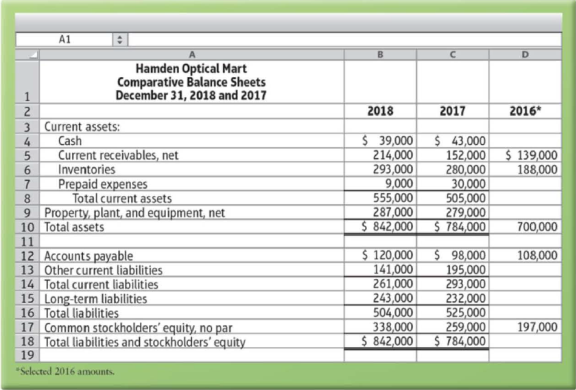

(Learning Objective 4: Use ratios to evaluate a stock investment) Comparative financial statement data of Hamden Optical Mart follow:

Other information

- 1. Market price of Hamden Optical Mart common stock: $48.15 at December 31, 2018, and $39.96 at December 31, 2017

- 2. Common shares outstanding: 17,000 during 2018 and 16,000 during 2017

- 3. All sales on credit

- 4. Cash dividends paid per share: $1. 10 in 2018 and $0.80 in 2017

Requirements

- 1. Calculate the following ratios for 2018 and 2017:

- a.

Current ratio - b. Quick (acid-test) ratio

- c. Receivables turnover and days’ sales outstanding (DSO)-round to the nearest whole day

- d. Inventory turnover and days’ inventory outstanding (DIO)-round to the nearest whole day

- e. Accounts payable turnover and days’ payable outstanding (DPO)-use cost of goods sold in the numerator of the turnover ratio and round DPO to the nearest whole day

- f. Cash conversion cycle (in days)

- g. Times-interest-earned ratio

- h. Return on assets- use DuPont Analysis

- i. Return on common stockholders’ equity- use DuPont Analysis

- j. Earnings per share of common stock

- k. Price-earnings ratio

- 2. Decide whether (a) Hamden Optical Mart’s financial position improved or deteriorated during 2018 and (b) whether the investment attractiveness of the company’s common stock appears to have increased or decreased from 2017 to 2018.

- 3. How will what you learned in this problem help you evaluate an investment?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Comparative financial statement data of Garfield, Inc. follow:

Market price of Garfield’s common stock: $69.36 at December 31, 2018, and $38.04 at December 31, 2017.

Common shares outstanding: 14,000 on December 31, 2018 and 12,000 on December 31, 2017 and 2016.

All sales are on credit.

Compute the following ratios for 2018 and 2017:

2018

2017

a. Current ratio

b. Cash ratio

c. Times-interest-earned ratio

d. Inventory turnover

e. Gross profit percentage

f. Debt to equity ratio

g. Rate of return on common stockholders’ equity

h. Earnings per share of common stock

i. Price/earnings ratio

Decide (a) whether Garfield’s ability to pay debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Using ratios to evaluate a stock investment

Comparative financial statement data of Garfield Inc. follow:

Market price of Garfield’s common stock:$69.36 at December 31 2018 and $38.04 at December 31, 2017.

Common shares outstanding 14, 000 on December 31, 2018 and 12,000 on December 31 2017 and 2016.

All sales are on credit.

Requirements

Compute the following ratios tor 2018 and 2017:

a. current ratio

b. Cash ratio

c. Times-interest-earned ratio

d. Inventory turnover

e. Gross profit percentage

f. Debt to equity ratio

g. Rate of return on common stockholder’s equity

h. Earnings per share of common stock

i. Price/earnings ratio

2. Decide (a) whether Garfield’s ability to pat debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Additional information:

1.

The market price of Pina’s common stock was $7.00, $7.50, and $8.50 for 2020, 2021, and 2022, respectively.

2.

You must compute dividends paid. All dividends were paid in cash.

Compute the following ratios for 2021 and 2022.

2022

2021

Profit margin

enter percentages

%

enter percentages

%

(Round answers to 1 decimal place, e.g. 1.5%.)

Gross profit rate

enter percentages

%

enter percentages

%

(Round answers to 1 decimal place, e.g. 1.5%.)

Asset turnover

enter asset turnover in times

times

enter asset turnover in times

times

(Round answers to 2 decimal places, e.g. 1.83.)

Earnings per share

$enter earnings per share in dollars

$enter earnings per share in dollars

(Round answers to 2 decimal places, e.g. 1.83.)

Price-earnings ratio

enter price-earnings ratio in times

times

enter price-earnings ratio in times

times

(Round answers to 1 decimal place,…

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The accounting assumption that governs given situation.

Financial Accounting (11th Edition)

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

What is an earnings management benefit from showing an increased figure for bad debt expense?

Principles of Accounting Volume 1

Trade Notes Payables. On February 1, Seville Sales, Inc. purchased Inventory costing 450,000 using a 6-month tr...

Intermediate Accounting

What is the relationship between management by exception and variance analysis?

Cost Accounting (15th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem #8. Profitability Ratios Gonzales is analyzing the earnings performance of the Bobadilla Transport Corporation. He has gathered the following data from Bobadilla's financial statements and from a report of the closing market prices of shares: Profit for 2019 Preference dividends declared during 2019 Ordinary dividends declared Dec. 31, 2019 Number of Bobadilla ordinary shares outstanding: P743,000 60,000 620,000 Jan. 1, 2019 Dec. 31, 2019 1,100,000 shs. 1,300,000 shs. Market price per ordinary share on Dec. 31, 2019 P15 Calculate the following ratios relating to the Bobadilla share: 1. Basic earnings per ordinary share 2. Price-earnings ratio 3. Dividend yield on ordinary sharearrow_forwardProfitability Ratios The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 2017, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $163,000 $147,000 $131,000 Notes payable (8% interest) 50,000 50,000 50,000 Common stock 20,000 20,000 20,000 Preferred 5% stock, $100 par 10,000 10,000 10,000 (no change during year) Retained earnings 59,090 39,790 30,000 The 2017 net income was $19,800, and the 2016 net income was $10,290. No dividends on common stock were declared between 2015 and 20Y7. Preferred dividends were declared and paid in full in 2016 and 2017. a. Determine the return on total assets, the rate earned on stockholders' equity, and the return on common stockholders' equity for the years 2016 and 2017. When required, round to one decimal place. 20Y7 20Y6 Return on total assets Return on stockholders' equity Return on common stockholders' equity % % % % % % b. The profitability ratios indicate that Vidahill Inc.'s profitability…arrow_forwardBasic earning per share ratio= (net income- prefered dividends)/weighted average common shares outstanding (21,331-0)/500= $42.66 (2020 year) (11,588-0)/494= $23.46 (2019 year) $5.19 (Walmart 2020 year) (competitor) Write financial analysis report.arrow_forward

- Profitability ratios The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 2017, 20Y6, and 20Y5: December 31 20Y7 December 31 20Y6 December 31 20Y5 Total assets $307,000 $277,000 $247,000 Notes payable (8% interest) 100,000 100,000 100,000 Common stock 40,000 40,000 40,000 Preferred 6% stock, $100 par (no change during year) Retained earnings 20,000 109,920 20,000 80,240 20,000 60,000 The 20Y7 net income was $30,880, and the 2016 net income was $21,440. No dividends on common stock were declared between 2015 and 2017. Preferred dividends were declared and paid in full in 2016 and 2017. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 2016 and 2017. When required, round your answers to one decimal place. 20Y7 20Y6 Return on total assets Return on stockholders' equity Return on common stockholders' equity % % % % % % b. The profitability ratios indicate…arrow_forwardces The financial statements of Friendly Fashions include the following selected data (in millions): ($ in millions) Sales Net income Stockholders' equity Average Shares outstanding (in millions) Dividends per share Stock price FRIENDLY FASHIONS Return on equity Numerator/Denominator Dividend yield Numerator/Denominator Required: Calculate the following ratios for Friendly Fashions in 2024. (Enter your dividend yield and price-earnings ratio values to 2 decimal places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).) Earnings per share Numerator/Denominator Price-earnings ratio Numerator/Denominator Amounts Amounts Amounts 2024 $8,943 $310 $1,680 Amounts 680 $0.40 $7.00 2023 $10,034 $708 $2,320 0 0 0arrow_forwardUse the common-size financial statements found here: ommon-Size Balance Sheet 2016Cash and marketable securities $ 480 1.5 %Accounts receivable 6,030 18.2Inventory 9,540 28.8Total current assets $ 16,050 48.5 %Net property, plant, and equipment 17,020 51.5Total assets $33,070 100.0 %Accounts payable $ 7,150 21.6 %Short-term notes 6,850 20.7Total current liabilities $ 14,000 42.3 %Long-term liabilities 7,010 21.2Total liabilities $ 21,010 63.5 %Total common shareholders’ equity 12,060 36.5Total liabilities and shareholders’ equity $33,070 100.0 %Common-Size Income Statement 2016Revenues $ 30,000 100.0 %Cost of goods sold (20,050) 66.8Gross profit $ 9,950 33.2 %Operating expenses (7,960) 26.5Net operating income $ 1,990 6.6 %Interest expense (940) 3.1Earnings before taxes $ 1,050 3.5 %Income taxes (382) 1.3Net income $668 2.2 % Specifically, write up a brief narrative that responds to the following questions: a. How much cash does Patterson have on hand relative to its total…arrow_forward

- Based on the given data, what is the returns for Company JFC? Company Dec. 30, 2020 Dec. 29, 2019 Dividends Returns (%) AC 395.00 301.00 5.00 JFC 88.90 55.00 2.50 O a. 66.18% Ob. 19.19% Oc. 32.89% d. 26.80%arrow_forwardYou are given the following information: Stockholders? equity = GHS1,250; price/earnings ratio = 5; shares outstanding = 25; and %3D market/book ratio = 1.5. %3D Calculate the market price of a share of the company?s stock. O A. GHS 33.33 B. GHS 75.00 C. GHS 10.00 D. GHS166.67 O E. GHS133.32arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forward

- The income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardThe Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License