Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.32BE

LO 4

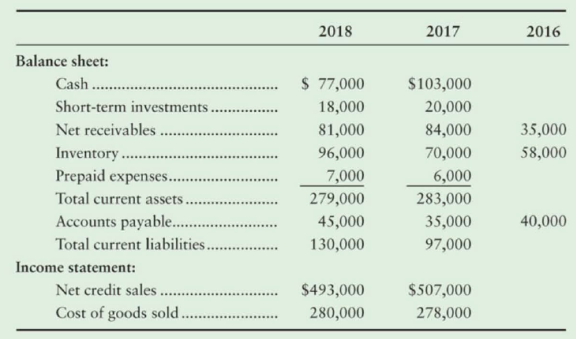

(Learning Objective 4: Calculate ratios; evaluate turnover, liquidity, and current debt-paying ability) The financial statements of Big City News, Inc., include the following items:

Requirements

1. Calculate the following ratios for 2018 and 2017. When calculating days, round your answer to the nearest whole number.

- a.

Current ratio - b. Quick (acid-test) ratio

- c. Inventory turnover and days’ inventory outstanding (DIO)

- d. Accounts receivable turnover

- e. Days' sales in average receivables or days' sales outstanding (DSO)

- f. Accounts payable turnover and days’ payable outstanding (DPO). Use cost of goods sold in the formula for accounts payable turnover.

- g. g Cash conversion cycle (in days)

2. Evaluate the company’s liquidity and current debt-paying ability for 2018. Has it improved or deteriorated from 2017?

3. As a manager of this company, what would you try to improve next year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

5. Compute the following financial ratios for 2015 and 2016 and interpreting the results in the image attached: (1 decimal place) a. current ratio b. quick ratio c. receivable turnover d. age of receivables e. inventory turnover f. age of inventory g. asset turnover h. fixed asset turnover i. times interest earned j. debt ratio k. equity ratio l. debt to equity ratio m. gross profit margin n. return on equity o. return on assets

FINANCIAL RATIO:

Requirement: Compute for the following financial ratios for the year 2021 (round-off answers to two decimal places)

a. Current ratio

b. Quick (Acid-test) ratio

c. Working capital

d. Inventory turnover

e. Days of inventory (use 365 days)

f. Accounts receivable turnover (assume all sales are on credit)

g. Days of receivable (use 365 days)

h. Debt ratio

i. Equity ratio

j. Debt-to-equity ratio

k. Gross profit ratio

1. Net profit ratio

m. Return on assets

n. Return on equity

1. Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days in its computation for some of the ratios. Show your solution.

a. Working Capital

b. Current Ratio

c. Acid Test Ratio

d. Accounts Receivable Turnover Ratio

e. Average Collection Period

f. Inventory Turnover Ratio

g. Average Days in Inventory

h. Number of days in Operating Cycle

i. Debt to Total Assets Ratio

j. Debt to Equity Ratio

k. Times Interest Earned Ratio

l. Gross Profit Ratio

m. Profit Margin Ratio

n. Return on Assets

o. Return on Equity

p. Assets Turnover Ratio

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days in its computation for some of the ratios. Show your solution. d. Accounts Receivable Turnover Ratio e. Average Collection Period f. Inventory Turnover Ratio g. Average Days in Inventory h. Number of days in Operating Cycle i. Debt to Total Assets Ratio j. Debt to Equity Ratio k. Times Interest Earned Ratio l. Gross Profit Ratio m. Profit Margin Ratio n. Return on Assets o. Return on Equity p. Assets Turnover Ratioarrow_forwardGuys could you please help me: I'm attaching AT&T's Balance Sheet and Income Statement for the analysis.I'd really appreciate help with the following: Perform a vertical financial analysis incorporatingi. Debt ratioii. Debt to equity ratioiii. Return on assetsiv. Return on equityv. Current ratiovi. Quick ratiovii. Inventory turnoverviii. Days in inventoryix. Accounts receivable turnoverx. Accounts receivable cycle in daysxi. Accounts payable turnoverxii. Accounts payable cycle in daysxiii. Earnings per share (EPS)xiv. Price to earnings ratio (P/E)xv. Cash conversion cycle (CCC), andxvi. Working capitalxvii. Explain Dupont identity, apply it to your selected company, interpret thecomponents in Dupont identity.arrow_forwardSolve and perform the different financial ratios using the financial statements of XYZ Company for the year 2021. 1. Current Ratio 2. Quick Ratio 3. Receivables Turnover 4. Inventory Turnover 5. Debt Ratio 6. Equity Ratio 7. Times Interest Earned 8. Gross Profit Margin 9. Operating Profit Margin 10. Net Profit Marginarrow_forward

- A) Calculate the following liquidity ratios for 2020. 1. Working capital- 2.Current Ratio- 3. Acid test ratio- 4. Accounts receivable turnover- B) calculate the following liquidity ratios for 2020. 1. Average collection period (in days)- 2. Inventory turnover (in times)- C) calculate the average days to sell inventory for 2020. 1. Average days to sell inventory-arrow_forwardThe following are financial ratios for the company. You are required to answer the following questions. Year 5 Year 6 Year 7 ROA 2.87% 2.60% 4.13% Profit Margin 3.2% 2.9% 3.1% Assets Turnover 0.90 0.88 0.99 Accounts receivable Turnover 6.2 11.5 118.4 Inventory Turnover 6.1 6.0 5.8 Fixed Assets Turnover 1.3 1.4 1.5 collection period 58.6 31.7 3.1 59.6 60.9 62.5 inventory period %change in sales 7.66% 9.68% Between year 5 and 6, the increase in cost of goods sold and the decrease in inventory turnover is an indication of what? Provide evidence to your answer.arrow_forwardThe following are financial ratios for the company. You are required to answer the following questions. Year 5 Year 6 Year 7 ROA 2.87% 2.60% 4.13% Profit Margin 3.2% 2.9% 3.1% Assets Turnover 0.90 0.88 0.99 Accounts receivable Turnover 6.2 11.5 118.4 Inventory Turnover 6.1 6.0 5.8 Fixed Assets Turnover 1.3 1.4 1.5 collection period 58.6 31.7 3.1 inventory period 59.6 60.9 62.5 %change in sales 7.66% 9.68% 1. Explain the decrease in ROA between year 5 and year 6? And the increase between year 5 and 6?arrow_forward

- 5. Compute the following financial ratios for 2015 and 2016 and interpreting the results in the image attached: (1 decimal place) d. age of receivables e. inventory turnover f. age of inventory g. asset turnover h. fixed asset turnover i. times interest earned j. debt ratio k. equity ratio l. debt to equity ratio m. gross profit margin n. return on equity o. return on assetsarrow_forwardFINANCIAL RATIO: Requirement: Compute for the following financial ratios for the year 2021 (round-off answers to two decimal places) f. Accounts receivable turnover (assume all sales are on credit) g. Days of receivable (use 365 days) h. Debt ratio i. Equity ratio j. Debt-to-equity ratio k. Gross profit ratio 1. Net profit ratio m. Return on assets n. Return on equityarrow_forwardRequired: Compute the following: (For Requirements 1 to 4, enter your percentage answers rounded to 2 decimal places (i.e., 0.1234 should be entered as 12.34).) 1. Gross margin percentage. 2. Net profit margin percentage. 3. Return on total assets. 4. Return on equity. 5. Was financial leverage positive or negative for the year? 1. Gross margin percentage % 2. Net profit margin percentage % 3. Return on total assets % 4. Return on equity % 5. Financial Leveragearrow_forward

- FINANCIAL RATIO: Requirement: Compute for the following financial ratios. for the year 2021 (round-off answers to two decimal places) d. Inventory turnover e. Days of inventory (use 365 days) f. Accounts receivable turnover (assume all sales are on credit) g. Days of receivable (use 365 days) h. Debt ratio i. Equity ratio j. Debt-to-equity ratioarrow_forwardQuestion 1 Mabel is a potter and sells her pottery at stalls that she rents in four tourist information centres across the south of England. Extracts from her financial statements for the years ended 31 December 2021 and 2020 are shown below. Statement of profit or loss for the year ended 31 December: 2021 28,900 |(16,500) 12,400 (3,800) 8,600 |(4,000) 4,600 2020 Revenue 27,200 (14,000) 13,200 (3,600) 9,600 Cost of sales Gross profit Operating expenses Operating profit Non-operating expenses Net profit 9,600 Statement of financial position as at 31 December: 2021 Non-current assets Current assets Total assets 22,660 4,360 27,020 2020 20,920 3,750 24,670 Equity Non-current liabilities Current liabilities Equity and liabilities 20,940 3,000 3,080 27,020 16,340 3,500 4,830 24,670 The following information is also relevant: In July 2021 the rent on one of Mabel's stalls was increased significantly for the third time in three years so she decided not to renew the annual contract. She sold…arrow_forward2. Using the following select financial statement information from Black Water Industries, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries? Year 2017 2018 2019 BLACK WATER INDUSTRIES Net Credit Sales $685,430 700,290 768,500 Ending Accounts Receivable $330,250 360,450 401,650arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License