Concept explainers

Transaction Analysis; Income Statement Preparation

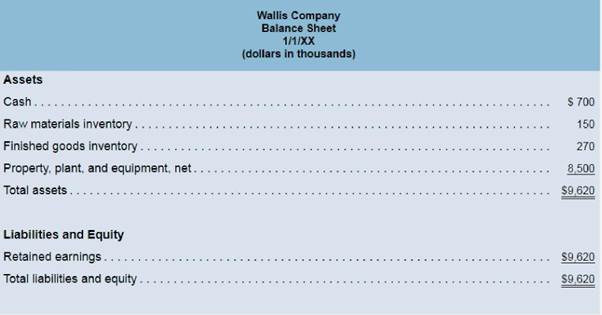

Wallis Company" manufactures only one product and uses a

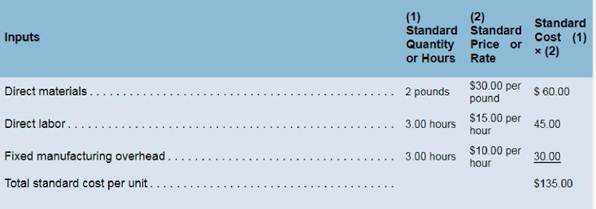

The company's standard cost card for its only product is as follows:

During the year Wallis completed the following transactions:

a. Purchased (with cash) 230.000 pounds of raw material at a price of $29.50 per pound.

b. Added 215.000 pounds of raw material to work in process to produce 95.000 units.

c. Assigned direct labor costs to work in process, The direct laborers (who were paid in cash) worked 245.000 hours at an average cost of S16.00 per hour to manufacture 95.000 units.

d. Applied fixed overhead to work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed to manufacture 95.000 units. Actual fixed overhead costs for the year were $2,740,000. Of this total, $1,340,000 related to items such as insurance, utilities, and pase 463 salaried indirect laborers that were all paid in cash and $1,400,000 related to

e. Transferred 95.000 units from work in process to finished goods.

f. Sold (for cash) 92,000 units to customers at a price of $170 per unit,

g. Transferred the standard cost associated with the 92,000 units sold from finished goods to cost of goods sold.

h. Paid $2,120,000 of selling and administrative expenses. i. Closed all standard cost variances to cost of goods sold.

Required:

1. Compute all direct materials, direct labor, and fixed overhead variances for the year.

2. Using Exhibit 9B-3 as a guide, record transactions a through i for Wallis Company.

3. Compute the ending balances for Wallis Company's balance sheet, Using Exhibit 9B−5 as a guide, prepare Wallis Company's income statement for the year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Introduction To Managerial Accounting

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forward

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardActivity-based and department rate product costing and product cost distortions Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Instructions Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is 315,000 and 540,000 for the Cutting and Finishing departments, respectively. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Determine the total and per-unit cost assigned to each product under activity-based costing. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods.arrow_forwardKoontz Company manufactures two models of Industrial components-a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Number of units produced and sold Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (loss) Basic 20,000 Advanced 10,000 Total 30,000 $ $ 3,000,000 2,000,000 5,000,000 2,300,000 1,350,000 3,650,000 700,000 650,000 1,350,000 720,000 480,000 1,200,000 (20,000) $170,000 $150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental…arrow_forward

- Subject : Accountingarrow_forwardKoontz Company manufactures two models of industrial components—a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz’s controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total Number of units produced and sold 20,000 10,000 30,000 Sales $ 3,000,000 $ 2,000,000 $ 5,000,000 Cost of goods sold 2,300,000 1,350,000 3,650,000 Gross margin 700,000 650,000 1,350,000 Selling and administrative expenses 720,000 480,000 1,200,000 Net operating income (loss) $ (20,000 ) $ 170,000 $ 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced…arrow_forwardKoontz Company manufactures two models of industrial components—a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz’s controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total Number of units produced and sold 20,000 10,000 30,000 Sales $ 3,000,000 $ 2,000,000 $ 5,000,000 Cost of goods sold 2,300,000 1,350,000 3,650,000 Gross margin 700,000 650,000 1,350,000 Selling and administrative expenses 720,000 480,000 1,200,000 Net operating income (loss) $ (20,000) $ 170,000 $ 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead…arrow_forward

- Koontz Company manufactures two models of industrial components—a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz’s controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total Number of units produced and sold 20,000 10,000 30,000 Sales $ 3,000,000 $ 2,000,000 $ 5,000,000 Cost of goods sold 2,300,000 1,350,000 3,650,000 Gross margin 700,000 650,000 1,350,000 Selling and administrative expenses 720,000 480,000 1,200,000 Net operating income (loss) $ (20,000 ) $ 170,000 $ 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardKoontz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total Number of units produced and sold 20,000 10,000 30,000 $ 5,000,000 3,650,000 1,350,000 1,200,000 $3,000,000 $2,000,000 1,350,000 650,000 480,000 Sales Cost of goods sold Gross margin Selling and administrative expenses 2,300,000 700,000 720,000 (20,000) Net operating income (loss) $4 $4 170,000 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning