Concept explainers

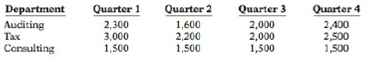

Thome and Crede, CPAs, are preparing their service revenue (sales) budget for the coming year (2017). The practice is divided into three departments: auditing, tax, and consulting. Billable hours for each department, by quarter, are provided below.

Average hourly billing rates are auditing $80, tax $90, and consulting $110.

Instructions

Prepare the service revenue (sales) budget for 2017 by listing the departments and showing for each quarter and the year in total, billable hours, billable rate, and total revenue.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting: Tools for Business Decision Making

Additional Business Textbook Solutions

Managerial Accounting (4th Edition)

Financial Accounting, Student Value Edition (4th Edition)

Financial Accounting (11th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Financial Accounting

Financial Accounting (12th Edition) (What's New in Accounting)

- Major Landscaping Company is preparing its budget for the first quarter of 2017. The next step in the budgeting process is to prepare a cash receipts schedule and a cash payments schedule. To that end the following information has been collected. Clients usually pay 60% of their fee in the month that service is provided, 30% the month after, and 10% the second month after receiving service. Actual service revenue for 2016 and expected service revenues for 2017 are: November 2016, $120,000; December 2016, $110,000; January 2017, $140,000; February 2017, $160,000; March 2017, $170,000. Purchases on landscaping supplies (direct materials) are paid 40% in the month of purchase and 60% the following month. Actual purchases for 2016 and expected purchases for 2017 are: December 2016, $21,000; January 2017, $20,000; February 2017, $22,000; March 2017, $27,000. Instructions Prepare the following schedules for each month in the first quarter of 2017 and for the quarter in total: Expected…arrow_forwardBickel Corporation uses customers served as its measure of activity. The following report compares the planning budget to the actual operating results for the month of November: Customers served Revenue ($3.60g) Expenses: Wages and salaries ($25,600+ $1.20g) Supplies ($0.50g) Insurance ($ 7,400) Miscellaneous expense ($6,200 + $0.40g) Total expense Net operating income. Customers served Revenue Expenses: Bickel Corporation Comparison of Actual Results to Planning Budget For the Month Ended November 30 Wages and salaries Supplies Insurance Miscellaneous expense Total expense Required: Prepare the company's flexible budget performance report for November. Label each variance as favorable (F) or unfavorable (U). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Bickel Corporation Flexible Budget Performance Report For the Month Ended November 30 Actual Results…arrow_forwardBickel Corporation uses customers served as its measure of activity. The following report compares the planning budget to the actual operating results for the month of November: Bickel Corporation - Comparison of Actual Results to Planning Budget For the Month Ended November 30 Customers served Revenue ($3.504) Expenses: Mages and salaries ($24,200 $1.324) Supplies ($0.729) Insurance ($6,100) Miscellaneous expense (55,100 50.410) Total expense Net operating income Actual Results 43,000 $150,300 80,960 28,840 6,100 20,920 136,820 $ 11,400 Planning Budget 42,000 $147,000 79,640 30,240 6,100 22,320 138,300 $1,700 Variances $3,300 F 1,320 U 1,400 F 0 None 1,400 F 1,480 F $4,780 F Required: Prepare the company's Comprehensive Performance Report for November. Label each variance as favorable (F) or unfavorable (U). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance), Input all amounts as positive values.)arrow_forward

- Revenue and production budgets. (CPA, adapted) The Chen Corporation manufactures and sells two products: Thingone and Thingtwo. In July 2016, Chen’s budget department gathered the following data to prepare budgets for 2017:arrow_forwardEcho Amplifiers prepared the following sales budget for the first quarter of 2018: It also has this additional information related to its expenses: Prepare a sales and administrative expense budget for each month in the quarter ending March 31, 2018.arrow_forwardRoman Inc. has the following totals from its operating budgets: Prepare a budgeted income statement for the year ended December 31, 2016, assuming that income from operations is taxed at a rate of 30%.arrow_forward

- Estimating a cost function. The controller of the Javier Company is preparing the budget for 2018 and needs to estimate a cost function for delivery costs. Information regarding delivery costs incurred in the prior two months are:arrow_forwardYou have been recently hired as general manager of Lucky’s. It is September 1, and you must prepare the operating budget of this establishment for the first quarter of the upcoming calendar year, and submit it to the corporate office. Since you have been at the operation for only a month or so, you must rely solely on historical data. You gather sales reports and records for the months of January through August of the current year. Using the data and the budget worksheet provided, prepare the operating budget for Lucky’s for the months of January through March of the upcoming year. Here is the information you determined from the most recent sales and costs records (Please note that the first month has already been completed): Sales are 10 percent higher than those of the same month during the previous year. Food cost percentage is steady at 32 percent. Fixed labor costs are steady at $9,000 per month. Variable labor costs are 15 percent of sales. Occupancy costs will remain steady…arrow_forwardConsider the following June actual ending balances and July 31, 2024 budgeted amounts for Octovios: 1(Click the icon to view the information.) Prepare a budgeted balance sheet for July 31, 2024. (Hint: It may be helpful to trace the effects of each transaction on the accounting equation to determine the ending balance of each account.) Complete the accounting equation for the July operating information. (Use a minus sign or parentheses to enter account reductions and contra asset balances and activity. If an input field is not used in the equation leave it empty; do not enter a zero. Abbreviations used: A/P = Accounts Payable, A/R = Accounts Receivable, Accum. Deprec. = Accumulated Depreciation, Merch. = Merchandise.) Stock- Merch. (Accum. Accounts holders' Cash + A/R + Inventory + Furniture + Deprec.) = Payable + equity…arrow_forward

- Consider the following June actual ending balances and July 31, 2024 budgeted amounts for Octovios: 1(Click the icon to view the information.) Prepare a budgeted balance sheet for July 31, 2024. (Hint: It may be helpful to trace the effects of each transaction on the accounting equation to determine the ending balance of each account.) Complete the accounting equation for the July operating information. (Use a minus sign or parentheses to enter account reductions and contra asset balances and activity. If an input field is not used in the equation leave it empty; do not enter a zero. Abbreviations used: A/P = Accounts Payable, A/R = Accounts Receivable, Accum. Deprec. = Accumulated Depreciation, Merch. = Merchandise.) Stock- Merch. (Accum. Accounts holders' Cash + A/R + Inventory + Furniture + Deprec.) = Payable + equity…arrow_forwardAssume Marcella and the board adopted the spreadsheet prepared to forecast operations at 890,000 units (see the spreadsheet provided with this case) as the budget for 2016. At the close of the first six months of 2016, Marcella and the board asked the accountant to prepare an income statement for the first six months of 2016 to show how well the actual data compare to the budgeted data. The board asked to see a concise presentation showing only totals for variable and fixed costs. The analysis presented in Exhibit 2 below was provided for the board. Hanson expects sales and fixed costs to occur uniformly throughout the year. Exhibit 2: Budget Analysis as of June 30, 2016 Budget Actual Variance Sales units 445,000 470,000 Sales $ 1,824,500 $ 1,880,000 $55,500 Variable costs $694,200 $ 742,600 ($48,400)…arrow_forwardDinham Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 3,600 tenant-days, but its actual level of activity was 3,630 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March: Data used in budgeting: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses Total expenses Actual results for March: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses h Multiple Choice $805 F Fixed element per month A $ 0 $ 2,500 1,500 8,000 6,500 $ 18,500 The spending variance for food and supplies in March would be closest to: $ 121,234 $ 28,550 $ 53,125 $ 18,250 $ 7,095 Variable element per tenant-day $ 34.50 $ 7.50 14.00 3.00 0.60 $ 25.10 1 1 € O :arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning