FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

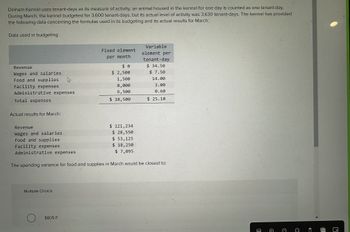

Transcribed Image Text:Dinham Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day.

During March, the kennel budgeted for 3,600 tenant-days, but its actual level of activity was 3,630 tenant-days. The kennel has provided

the following data concerning the formulas used in its budgeting and its actual results for March:

Data used in budgeting:

Revenue

Wages and salaries

Food and supplies

Facility expenses

Administrative expenses

Total expenses

Actual results for March:

Revenue

Wages and salaries

Food and supplies

Facility expenses

Administrative expenses

h

Multiple Choice

$805 F

Fixed element

per month

A

$ 0

$ 2,500

1,500

8,000

6,500

$ 18,500

The spending variance for food and supplies in March would be closest to:

$ 121,234

$ 28,550

$ 53,125

$ 18,250

$ 7,095

Variable

element per

tenant-day

$ 34.50

$ 7.50

14.00

3.00

0.60

$ 25.10

1

1

€

O

:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $6.30 per customer served. Wages and salaries should be $22,300 per month plus $0.90 per customer served. Supplies should be $0.80 per customer served. Insurance should be $5,950 per month. Miscellaneous expenses should be $4,400 per month plus $0.20 per customer served. The company reported the following actual results for October: Customers served Revenue. Wages and salaries Supplies Insurance Miscellaneous expense Required: Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U). Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Customers served Revenue Expenses: Wages and salaries Supplies Insurance 22,750 $ 177,300 $ 40,725 $…arrow_forwardDinham Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 3,400 tenant-days, but its actual level of activity was 3,460 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March: Data used in budgeting: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses Total expenses Actual results for March: Fixed Variable element per element per month tenant-day $0 $ 34.30 $ 2,300 $ 7.30 1,300 13.80 7,800 6,300 $ 17,700 2.80 0.40 $ 24.30 Revenue $ 115,625 Wages and salaries $ 28,530 Food and supplies $ 49,580 Facility expenses $ 16,500 Administrative expenses $ 7,093 The spending variance for facility expenses in March would be closest to:arrow_forwardBartosiewicz Clinic uses client-visits as its measure of activity. During January, the clinic budgeted for 3,300 client-visits, but its actual level of activity was 3,280 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for January. Data used in budgeting: Revenue Personnel expenses Medical supplies Occupancy expenses Administrative expenses. Total expenses Actual results for January: Fixed element Variable element per month. $0 $ 27,300 1,300 10,300 6,300 $ 45,200 $ 124,680 $ 72,030 $ 22,706 per client-visit $35.30 $ 11.30 5.30 1.00 0.40 $18.00 Revenue Personnel expenses Medical supplies Occupancy expenses $ 14,630 Administrative expenses $ 8,135 The activity variance for net operating income in January would be closest to:arrow_forward

- Helen is working on her department's budgeted annual income statement. In the process, she needs to determine the budgeted amount for selling, general, and administrative (SG&A) expenses in order to complete her budget. Sales Variable SG&A cost 11500 units $0.20 per unit Advertising expense $6200 per year Depreciation on office equipment $8600 per year Other fixed SG&A costs $24800 On the basis of the given data, what are total budgeted selling, general, and administrative (SG&A) expenses of the department? ○ $35700 O $33300 O $17100 O $41900arrow_forwardDinham Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 4,500 tenant-days, but its actual level of activity was 4,560 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March: Data used in budgeting: Fixed element per month Variable element per tenant-day Revenue 0 $ 35.00 Wages and salaries $ 3,400 $ 8.40 Food and supplies 2,400 14.90 Facility expenses 8,900 3.90 Administrative expenses 7,400 0.30 Total expenses $ 22,100 $ 27.50 Actual results for March: Revenue $ 142,130 Wages and salaries $ 28,640 Food and supplies $ 71,025 Facility expenses $ 26,125 Administrative expenses $ 7,104 The spending variance for food and supplies in March would be closest to:arrow_forwardGrohs Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 2,500 tenant-days, but its actual level of activity was 2,530 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting: Fixed Element per Month Variable element per tenant-day Revenue $ 0 $33.00 Wages and salaries $ 3,800 $ 7.90 Food and supplies 1,000 11.60 Facility expenses 8,600 2.20 Administrative expenses 6,200 0.20 Total expenses $19,600 $21.90 The net operating income in the planning budget for December would be closest to: Multiple Choice A. $8,150 B. $11,914 C. $8,483 D. $11,633arrow_forward

- Question 8 Paulis Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During February, the kennel budgeted for 2,500 tenant-days, but its actual level of activity was 2,480 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for February: Data used in budgeting: Fixed element per month Variable element per tenant-day $ 35,30 Revenue $0 $ 2,500 $ 5.90 Wages and salaries Food and supplies 400 13.80 Facility expenses 8,900 3.40 Administrative expenses 7,800 0.40 Total expenses $ 19,600 $ 23.50 Actual results for February: $ 85,654 $ 16,992 $ 33,084 Revenue Wages and salaries Food and supplies $ 16,682 Facility expenses Administrative expenses $ 8,732 The overall revenue and spending variance (i.e., the variance for net operating income in the revenue and spending variance column on the flexible budget performance report) for February would be…arrow_forwardThe Finch Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,312 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.40. The cost driver for meals was attendance, which was expected to be 1,460 individuals. Postage was based on $0.56 per invitation and 3,300 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,600 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,100. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FINCH MANAGEMENT ASSOCIATION…arrow_forwardOakley Wholesale Hardware and Supplies (OWHS) sells tools, lumber, and other remodeling supplies to commercial contractors. The company controller is compiling cash and other budget information for July, August, and September. On June 30, the company had inventories of $462,500. OWHS sells a wide variety of products, but for budgeting and inventory planning purposes, the company has developed a standard "unit" of inventory that reflects roughly the mix and purchase costs of the items found in inventory and expected sales volume. The inventory value of $462,500 reported above is based on these inventory units. Each inventory unit is assumed to have a purchase price from vendors (for planning purposes) of $25. This number is not expected to change in the next three months. The budget is to be based on the following assumptions: Each month’s sales are billed on the last day of the month. Customers are allowed a 3 percent discount if payment is made within 10 days after the billing date.…arrow_forward

- Subject: acountingarrow_forwardNonearrow_forwardHemphill Corporation uses customers served as its measure of activity. During June, the company budgeted for 20,000 customers, but actually served 19,000 customers. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June:Data used in budgeting: Fixed amount per month Variable amount per customer Revenue - $4.50 Wages and salaries $23,900 $1.40 Supplies $0 $0.80 Insurance $5,700 $0.00 Miscellaneous $5,000 $0.40 Actual results for June: Revenue $85,400 Wages and Salaries $52,700 Supplies $17,500 Insurance $5,500 Miscellaneous $12,200 Calculate revenue variance, spending variance for wages and salaries, and spending variance for insurance. Label them as favorable or unfavorable. Please show your workingsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education