FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

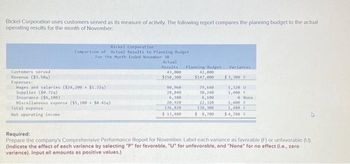

Transcribed Image Text:Bickel Corporation uses customers served as its measure of activity. The following report compares the planning budget to the actual

operating results for the month of November:

Bickel Corporation -

Comparison of Actual Results to Planning Budget

For the Month Ended November 30

Customers served

Revenue ($3.504)

Expenses:

Mages and salaries ($24,200 $1.324)

Supplies ($0.729)

Insurance ($6,100)

Miscellaneous expense (55,100 50.410)

Total expense

Net operating income

Actual

Results

43,000

$150,300

80,960

28,840

6,100

20,920

136,820

$ 11,400

Planning Budget

42,000

$147,000

79,640

30,240

6,100

22,320

138,300

$1,700

Variances

$3,300 F

1,320 U

1,400 F

0 None

1,400 F

1,480 F

$4,780 F

Required:

Prepare the company's Comprehensive Performance Report for November. Label each variance as favorable (F) or unfavorable (U).

(Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance), Input all amounts as positive values.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are required to prepare operational budget for the upcoming year including following: 1) Sales budget; 2) Production budget and Readymade production budget; 3) Direct materials budget; 4) Direct labor budget; 5) Purchase’s budget; 6) Overheads budget; 7) General production costs distribution; 8) Cost of sales budget; 9) Selling expenses budget; 10) Ending materials and ending Readymade production; 11) Profit and loss(Income statement).arrow_forwardGrohs Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 2,500 tenant-days, but its actual level of activity was 2,530 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting: Fixed Element per Month Variable element per tenant-day Revenue $ 0 $33.00 Wages and salaries $ 3,800 $ 7.90 Food and supplies 1,000 11.60 Facility expenses 8,600 2.20 Administrative expenses 6,200 0.20 Total expenses $19,600 $21.90 The net operating income in the planning budget for December would be closest to: Multiple Choice A. $8,150 B. $11,914 C. $8,483 D. $11,633arrow_forwardThe following information is from the manufacturing budget and budgeted financial statements of Altman Corporation: Direct materials inventory, 1/1 Direct materials inventory, 12/31 Direct materials budgeted for use during year Accounts payable to suppliers, 1/1 Accounts payable to suppliers, 12/31 For the year, budgeted cash payments to suppliers amounted to: $ 86,000 $ 102,000 $ 344,000 $ 54,000 $ 64,000arrow_forward

- JDC Engineering Co. provided the following information for their business year ending June 30th, 2021. Plant Manager VP of Manufacturing President Controllable Expenses Budget Actual Budget Actual Budget Actual Office expense 7,370 9,770 12,760 17,030 23,110 17,490 Printing 19,950 17,290 Paging 2,410 2,110 Binding 4,650 4,940 Purchasing 23,940 27,390 Receiving 11,380 14,130 Inspection 18,790 16,830 VP of Marketing 197,230 171,530 Controller 138,680 121,110 Treasurer 97,000 72,870 VP of Personnel 48,170 71,360 Prepare the responsibility accounting reports for the three levels of management--plant manager, vice president of manufacturing, and president.arrow_forwardNonearrow_forwardArrasmith Corporation uses customers served as its measure of activity. During February, the company budgeted for 35.100 customers. but actually served 33.400 customers. The company uses the following revenue and cost formulas in its budgeting, where is the number of customers served Revenue: $3.60g Wages and salaries: $33,300+ $113g Supplies: $0.53q Insurance: $10,500 Miscellaneous expenses: $6,500 $0.31 The company reported the following actual results for February $ 121,000 $ 60,100 $ 14,500 $ 10,500 $ 18,200 Revenue Wages and salaris Supplies Insurance Miscellaneous expense Required: Prepare the company's flexible budget performance report for February. Label each variance as favorable (F) or unfavorable (U). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (Le.. zero variance). Input all amounts as positive values.) Customer served Revenue Expenses: Wages and salaries Supplies Insurance Miscellaneous expense tal…arrow_forward

- 6) Some of the beginning and end of the period information of the production enterprise, which budgets the General Production Expenses on its products according to the Direct Labor Hours, are as follows.Budgeted General Production Expenses 20.000.-₺Actual Activity Volume 3,800 Direct labor hoursActual General Production Expenses 18.000.-₺Overload 1.000.-₺Desired: Calculate the "Budgeted Activity Volume" of the business. A. 4,500 Direct labor hoursB. 4,000 Direct labor hoursC. 2,500 direct labor hoursD. 3,000 Direct labor hoursE. 5,000 Direct labor hoursarrow_forward2 Arrangon Ltd. is a company that manufactures and sells a single product called Zoltar. For planning and control purposes they utilize a monthly master budget, which is developed in advance of the budget year. Their fiscal year end is September 30. A listing of the estimated ledger balances for the company's current year of September 30, 2024 is given below: Cash Accounts receivable Inventory-raw materials Inventory-finished goods Capital assets (net) $370,058 674,730 420,090 453,122 2,632,000 $4,550,000 The sales forecast consisted of these few lines: Accounts payable $719,488 Income tax payable 42,000 Capital stock Retained earnings 2.000.000 1,788,512 $4,550,000 • For the year ended September 30, 2024: 450,000 units at $42.00 each* For the year ended September 30, 2025: 475,000 units at $43.00 each . For the year ended September 30, 2026: 500,000 units at $44.00 each *Sales for the year ended September 30, 2024 are based on actual sales to date and budgeted sales for the duration…arrow_forwardPrestridge Corporation is a service company that measures its output by the number of customers served. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for August. Fixed Element per Variable Element per Actual Total Month Customer Served $ 4,100 $ 1,000 $ 500 for August $ 120,500 $ 71,200 $ 14,800 $ 38,400 Revenue Employee salaries and wages Travel expenses $ 41,500 Other expenses $ 38,900 When the company prepared its planning budget at the beginning of August, it assumed that 31 customers would have been served. However, 29 customers were actually served during August. The activity variance for total expenses for August would have been closest to: Multiple Choice $3,000 F $2,500 F $2,500 U $3,000 Uarrow_forward

- Valaarrow_forwardJDC Engineering Co. provided the following information for their business year ending June 30th, 2021. Plant Manager VP of Manufacturing President Controllable Expenses Budget Actual Budget Actual Budget Actual Office expense 7,370 9,770 12,760 17,030 23,110 17,490 Printing 19,950 17,290 Paging 2,410 2,110 Binding 4,650 4,940 Purchasing 23,940 27,390 Receiving 11,380 14,130 Inspection 18,790 16,830 VP of Marketing 197,230 171,530 Controller 138,680 121,110 Treasurer 97,000 72,870 VP of Personnel 48,170 71,360 Prepare the responsibility accounting reports for the three levels of management--plant manager, vice president of manufacturing, and president.Plant Manager - Responsibility Report Budget Actual Variance Office expense Printing Paging Binding Total Controllable Cost VP of Manufacturing - Responsibility…arrow_forwardGordin Kennel uses tenant-days as its measure of activity, an animal housed in the kennel for one day is counted as one tenant-day. During May, the kennel budgeted for 3,000 tenant-days, but its actual level of activity was 3,020 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for May: Data used in budgeting: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses Total expenses Actual results for May: Multiple Choice Revenue $ 86,322 Wages and salaries $ 17,984 Food and supplies $ 32,444 Facility expenses $ 19,554 Administrative expenses $ 6,162 The spending variance for food and supplies in May would be closest to: O $840 U O Fixed element per month $0 $ 2,000 $840 F 800 8,500 6,000 $ 17,300 Variable element per tenant-day $ 27.60 $ 5.20 10.20 3.70 0.10 $19.20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education