Concept explainers

PROBLEMS: SET A

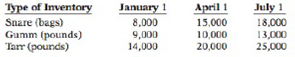

Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2017.

1. Sales: quarter 1, 40,000 bags: quarter 2, 56,000 bags. Selling price is $60 per bag.

2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr al $1,50 per pound.

3. Desired inventory levels:

4. Direct labor direct labor time is 15 minutes per bag at an hourly rate of $16 per hour.

5. Selling and administrative expenses are expected to be 15% of sales plus $175,000 per quarter.

6. Interest expense is $100,000.

7. Income taxes are expected to be 30% of income before income taxes.

Prepare

(LO 2, 3), AP

Your assistant has prepared two budgets: (1) the manufacturing

Instructions

Prepare the budgeted multiple-step income statement for the first 6 months and all required operating budgets by quarters. (Note: Use variable and fixed in the selling and administrative expense budget.) Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting: Tools for Business Decision Making

Additional Business Textbook Solutions

Managerial Accounting (4th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Construction Accounting And Financial Management (4th Edition)

Horngren's Accounting (12th Edition)

Principles of Accounting Volume 2

- Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. 1. Sales: quarter 1, 28,000 bags; quarter 2, 42,000 bags. Selling price is $61 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory January 1 April 1 July 1 Snare (bags) 8,100 12,100 18,100 Gumm (pounds) 9,100 10,100 13,100 Tarr (pounds) 14,100 20,100 25,100 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $176,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1)…arrow_forwardCook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. 1. Sales: quarter 1, 28,000 bags; quarter 2, 42,000 bags. Selling price is $61 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory January 1 April 1 July 1 Snare (bags) 8,100 12,100 18,100 Gumm (pounds) 9,100 10,100 13,100 Tarr (pounds) 14,100 20,100 25,100 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $176,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1)…arrow_forwardCook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. Sales: quarter 1, 29,800 bags; quarter 2, 42,400 bags. Selling price is $62 per bag. Direct materials: each bag of Snare requires 5 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: 1. 2. Type of Inventory Snare (bags) Gumm (pounds) Tarr (pounds) 4. 5. 6. 7. January 1 April 1 12,100 July 1 8,100 9,500 10,300 13,100 14,100 20,100 18,100 25,200 Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. Selling and administrative expenses are expected to be 15% of sales plus $179,000 per quarter. Interest expense is $100,000. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and…arrow_forward

- Use the following information for the Quick Study below. (Algo) Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,100 units (solar panels).in July and 5,100 units in August. QS 20-9 (Algo) Manufacturing: Direct materials budget LO P1 Each unit requires 3 pounds of direct materials, which cost $7 per pound. The company's policy is to maintain direct materials inventory equal to 20% of the next month's direct materials requirement. As of June 30, the company has 3,060 pounds of direct materials in inventory. Prepare the direct materials budget for July. Units to produce MIAMI SOLAR Direct Materials Budget Materials needed for production (pounds) Total materials required (pounds) Materials to purchase (pounds) Cost of direct materials purchases July 5,100arrow_forwardCook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. Sales: quarter 1, 28,600 bags; quarter 2, 42,800 bags. Selling price is $63 per bag. Direct materials: each bag of Snare requires 5 pounds of Gumm at acost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 1. 2. 3. Desired inventory levels: Type of Inventory January 1 April 1 July 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,100 12,100 18,200 9,300 10,300 13,400 14,300 20,400 25,200 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $177,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before incometaxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and…arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,600 units (solar panels) in July and 5,800 units in August. QS 20-9 (Algo) Manufacturing: Direct materials budget LO P1 Each unit requires 2 pounds of direct materials, which cost $6 per pound. The company's policy is to maintain direct materials inventory equal to 40% of the next month's direct materials requirement. As of June 30, the company has 4,480 pounds of direct materials in inventory. Prepare the direct materials budget for July. MIAMI SOLAR Direct Materials Budget Units to produce Materials required per unit (pounds) Materials needed for production (pounds) Add: Desired ending materials inventory Total materials required (pounds) Less: Beginning materials inventory (pounds) Materials to purchase (pounds); Materials cost per pound Cost of direct materials purchases $ July 5,600 2 11,200 4,640 15,840…arrow_forward

- Required Information Use the following information for the Quick Study below. Miami Solar manufactures solar panels for industrial use. The company budgets production of 4,200 units (solar panels) in July and 4,500 units in August. QS 20-13 Manufacturing: Direct materials budget LO P1 Each unit requires 4 pounds of direct materials, which cost $6 per pound. The company's policy is to maintain direct materials inventory equal to 20% of the next month's direct materials requirement. As of June 30, the company has 3,360 pounds of direct materials in inventory, which complies with the policy. Prepare a direct materials budget for July. MIAMI SOLAR Direct Materials Budget For Month Ended July 31 Budget production (units) Materials needed for production (lbs.) Total materials requirements (lbs.) Materials to be purchased (lbs.) Budgeted cost of direct materials purchases 4,200arrow_forwardScholar Suppliers manufactures backpacks for students. The backpacks come in two sizes: Small, and Large. Scholar Suppliers anticipates the following sales volumes and prices for the coming period: Size Sales Volume Selling Price Small 3,000 backpacks $25 each Large 6,000 backpacks $75 each What is the budgeted level of revenue for the coming period?arrow_forwardUse the following information for the Quick Study below. (Algo) Miami Solar manufactures solar panels for industrial use. The company budgets production of 4,500 units (solar panels) in July and 4,400 units in August. QS 20-9 (Algo) Manufacturing: Direct materials budget LO P1 Each unit requires 4 pounds of direct materials, which cost $6 per pound. The company's policy is to maintain direct materials inventory equal to 40% of the next month's direct materials requirement. As of June 30, the company has 7,200 pounds of direct materials in inventory. Prepare the direct materials budget for July. Units to produce MIAMI SOLAR Direct Materials Budget Materials needed for production (pounds) Total materials required (pounds) Materials to purchase (pounds) Cost of direct materials purchases July 4,500arrow_forward

- EcoSacks manufactures cloth shopping bags. The controller is preparing a budget for the coming year and asks for your assistance. The following costs and other data apply to bag production. Direct materials per bag 1.0 yard cotton at $4 per yard 0.2 yards canvas finish at $12 per yard Direct labor per bag 0.5 hour at $18 per hour Overhead per bag Indirect labor $ 0.60 Indirect materials 0.20 Power 0.40 Equipment costs 1.30 Building occupancy 0.90 Total overhead per unit $ 3.40 You learn that equipment costs and building occupancy are fixed and are based on a normal production of 600,000 units per year. Other overhead costs are variable. Plant capacity is sufficient to produce 750,000 units per year. Labor costs per hour are not expected to change during the year. However, the cotton supplier has informed EcoSacks that it will impose a 20 percent price increase at the start of the coming budget period. No…arrow_forwardMULTI COLORED PICTURE ATTACHED IS THE PART I NEED HELP WITH SECOND IS PART OF THE INFORMATION GIVEN WITH THE QUESTION The Grady Tire Company manufactures racing tires for bicycles. Grady sells tires for $70 each. Grady is planning for the next year by developing a master budget by quarters. Grady's balance sheet for Decembe 31,2018, follows: a. Budgeted sales are 1,800 tires for the first quarter and expected to increase by 50 tires per quarter. Cash sales are expected to be 20% of total sales, with the remaining 80% of sales on account. b. Finished Goods Inventory on December 31, 2018 consists of 100 tires at $36 each. c. Desired ending Finished Goods Inventory is 50% of the next quarter's sales; first quarter sales for 2020 are expected be 2,000 tires. FIFO inventory costing method is used. d. Raw Materials Inventory on December 31, 2018, consists of 200 pounds of rubber compound used to manufacture the tires. e. Direct materials requirements are 2 pounds of a rubber compound…arrow_forwardMohan Agribusiness Corporation is a distributor of an Agricultural product. Data concerning next month’s budget appear below: Selling price $25 per unit Variable Expenses $15 per unit Fixed Expenses $8,500 per month Unit Sales 1,000 units per month Required: 1. Compute the company’s margin of safety. Show your solution. (10 points) 2. Compute the company’s margin of safety as a percentage of its sales. Show your solution. (10 points)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College