Intermediate Accounting, 10 Ed

10th Edition

ISBN: 9781260310177

Author: Mark W. Nelson, Wayne B. Thomas J. David Spiceland

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.1E

Lower of cost or net realizable value

• LO9–1

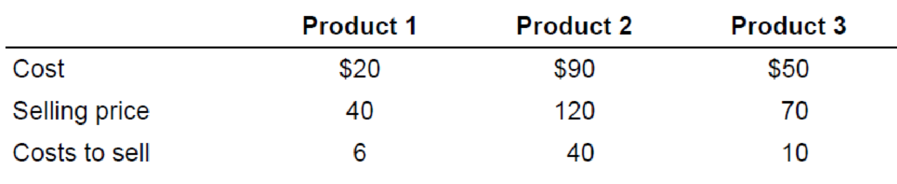

Herman Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows:

Required:

What unit values should Herman use for each of its products when applying the lower of cost or net realizable value (LCNRV) rule to ending inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

TB MC Qu. 10-72 Konan, Inc. needs to determine...

Konan, Inc. needs to determine its inventory value. The following information pertains to the individual products in ending inventory:

Replacement Selling Cost of

Cost

Price

$50

$38

40

60

24

30

Product

L-19

M-23

N-05

Multiple Choice

O

Assuming Konan uses the FIFO method for costing its inventory, the writedown of inventory value for Product N-05 is

о

O

O

$6.

$2

$8.

Cost

$40

52

20

$0.

Completion

$2

10

2

Normal

Profit

$11

8

6

Inventory Write-Down

Stiles Corporation uses the LIFO cost flow assumption and is in the process of applying the LCM rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific

data for each product are as follows:

Historical cost

Replacement cost

Estimated cost of disposal

Estimated selling price

Product A Product B

$80

$96

70

98

32

30

150

120

Required:

1. What is the correct inventory value for each product?

Product A

Product B

$

per unit

per unit

2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations?

For Product A,

For Product B,

3

A company has four products in its inventory. Information about ending inventory is as follows:

Total Net

Realizable Value.

Product

101

102

103

104

Total Cost

$ 136,000

99,000

68,000

38,000

Required:

1. Determine the carrying value of ending inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to

individual products.

2. Assuming that inventory write-downs are common for the company, record any necessary year-end adjusting entry.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Product

Determine the carrying value of ending inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to

individual products.

101

102

103

104

$ 108,000

118,000

58,000

58,000

Cost

$ 136,000 $

99,000

68,000

38,000

341,000

$

NRV

108,000

118,000

58,000

58,000

Inventory

Value

$

0

Chapter 9 Solutions

Intermediate Accounting, 10 Ed

Ch. 9 - Explain the (a) lower of cost or net realizable...Ch. 9 - What are the various levels of aggregation to...Ch. 9 - Describe the alternative approaches for recording...Ch. 9 - Explain the gross profit method of estimating...Ch. 9 - The Rider Company uses the gross profit method to...Ch. 9 - Explain the retail inventory method of estimating...Ch. 9 - Both the gross profit method and the retail...Ch. 9 - Define each of the following retail terms: initial...Ch. 9 - Explain how to estimate the average cost of...Ch. 9 - Prob. 9.10Q

Ch. 9 - Explain the LIFO retail inventory method.Ch. 9 - Discuss the treatment of freight-in, net markups,...Ch. 9 - Explain the difference between the retail...Ch. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Explain the accounting treatment of material...Ch. 9 - Identify any differences between U.S. GAAP and...Ch. 9 - (Based on Appendix 9) Define purchase commitments....Ch. 9 - (Based on Appendix 9) Explain how purchase...Ch. 9 - Lower of cost or net realizable value LO91 Ross...Ch. 9 - Lower of cost or net realizable value LO91 SLR...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.5BECh. 9 - Gross profit method; solving for unknown LO92...Ch. 9 - Retail inventory method; average cost LO93 Kiddie...Ch. 9 - Retail inventory method; LIFO LO93 Refer to the...Ch. 9 - Conventional retail method LO94 Refer to the...Ch. 9 - Conventional retail method LO94 Roberson...Ch. 9 - Lower of cost or net realizable value LO91 Herman...Ch. 9 - Lower of cost or net realizable value LO91 The...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.11ECh. 9 - Concepts; terminology LO91 through LO97 Listed...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.8PCh. 9 - Prob. 9.1DMPCh. 9 - Prob. 9.3DMPCh. 9 - Prob. 9.4DMPCh. 9 - Prob. 9.5DMPCh. 9 - Prob. 9.6DMPCh. 9 - Prob. 9.7DMPCh. 9 - Real World Case 98 Various inventory issues;...Ch. 9 - Prob. 9.9DMPCh. 9 - Judgment Case 910 Inventory errors LO97 Some...Ch. 9 - Prob. 9.12DMPCh. 9 - Prob. 2CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lower-of-Cost-or-Net Realizable Value MethodThe Claremont Company’s ending inventory is composed of 50 units that had cost $20 each and 100 units that had cost $15 each. If all 150 units have an NRV of $16 each, what value should be assigned to the company’s ending inventory assuming that it applies lower-of-cost-or-net realizable value on a group-wise basis? $Answerarrow_forwardInventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of applying the LCNRV rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows: Inventory Write-Down Use the information in E8-1. Assume that Stiles uses the LIFO cost flow assumption and is applying the LCM rule. Required: 1. What is the correct inventory value for each product? 2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations?arrow_forwardLower of Cost or Market Garcia Company uses FIFO, and its inventory at the end of the year was recorded in the accounting records at $17,800. Due to technological changes in the market, Garcia would be able to replace its inventory for $16,500. Required: 1. Using the lower of cost or market method, what amount should Garcia report for inventory on its balance sheet at the end of the year? 2. Prepare the journal entry required to value the inventory at the lower of cost or market.arrow_forward

- Black Corporation uses the LIFO cost flow assumption. Each unit of its inventory has a net realizable value of 300, a normal profit margin of 35, and a current replacement cost of 250. Determine the amount per unit that should be used as the market value to apply the lower of cost or market rule to determine Blacks ending inventory.arrow_forwardLO1 If the ending inventory is overstated by 10,000, indicate what, if anything, is incorrect about the following: Cost of goods sold___________ Gross profit___________ Net income___________ Ending owners capital___________arrow_forwardS At the end of the year, Randy's Parts Company had the following items in inventory: Item P1 Quantity 60 P2 40 P3 80 P4 70 Required Unit Cost Unit Market Value $ 85 70 130 125 $ 90 72 a. Determine the amount of ending inventory using the lower-of-cost-or-market rule applied to each individual inventory item. b. Provide the adjustment necessary to write down the inventory based on Requirement a. Assume that Randy's Parts Co. uses the perpetual inventory system. c. Determine the amount of ending inventory, assuming that the lower-of-cost-or-market rule is applied to the total inventory in aggregate. 120 130 d. Provide the adjustment necessary to write down the inventory based on Requirement c. Assume that Randy's Parts Co. uses the perpetual inventory system. Required A Required B Required C Ending inventory Complete this question by entering your answers in the tabs below. Required D Determine the amount of ending inventory using the lower-of-cost-or-market rule applied to each…arrow_forward

- PA4. LO 10.3 Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG). Number of Units Unit Cost Beginning inventory Mar. 1 Purchased Mar. 8 Sold Mar. 11 for $120 per unit 110 140 $87 89 95 Solution А. Number of Units Dollar per Unit Value Cost of goods sold В. Number of Units Dollar per Unit Value Cost of goods sold C. Number of Units Dollar per Unit Value Cost of goods sold PA5. LO 10.3 Use the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions. Number Unit Cost of Units Beginning inventory Purchased Mar. 2 Sold Mar, 31 for $75 per unit 105 150 88…arrow_forwardLower-of-Cost-or-Market Method On the basis of the data shown below: Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) Raven 10 1,700 $163 $159 Dove 23 9,200 24 30 Determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9. 1:01 PM 10/23/2020arrow_forward4 Lynn Corporation has two products in its ending inventory, each accounted for at the lower of cost or market. A profit margin of 30% on selling price is considered normal for each product. Specific data with respect to each product follows: Product Product 2 Historical cost Replacement cost Estimated cost to dispose/complete Estimated selling price $30 27 13 60 $15 35 In pricing its ending inventory using the lower of cost or market, what unit values should Lynn use for products #1 and #2, respectively? a. $15.00 and $29.00 b. $19.50 and $29.00 c. $19.50 and $30.00 d. $18.00 and $27.00arrow_forward

- 9. In the first-in, first-out (FIFO) method: a. the last units acquired are the first units to be sold b. the first units acquired are the last units to be sold c. the last units acquired are the last units to be sold d. the first units acquired are the first units to be sold 10. The inventory evaluation method which does not represent the actual ending inventory value is? a. standard cost b. first-in, first-out (FIFO) c. weighted average d. last-in, first-out (LIFO) 11. Cost of goods sold is equal to? a. Beginning inventory - Purchases + Ending Inventory b. Purchases + Beginning inventory - Ending Inventory c. Beginning inventory + Sales - Ending Inventory d. Ending Inventory + Purchases - Beginning inventory 12. The costs of ending inventory is similar under both periodic and perpetual inventory system if _________________ method is used. a. first-in, first-out (FIFO) b. standard cost c. weighted average d. last-in, first-out (LIFO) 13. If a…arrow_forwardLower-of-Cost-or-Net Realizable Value Method The following data refer to the Ian Company’s ending inventory: ItemCode Quantity UnitCost NetRealizableValue ABX 80 $50 $55 TYG 200 38 42 JIL 175 28 24 GGH 90 44 38 Calculate the value of the company’s ending inventory by using the lower-of-cost-or-net realizable value applied to each item of inventory. Ending inventory computed by applying the lower-of-cost-or-net realizable value to each item of inventory is $Answerarrow_forwardQuèstion 1 Answer the following 2 questions: Question1: Ashraf Company began operations in 2020 and determined its ending inventory at cost and at NRV on December 31 , 2020, and December 31, 2021. This information is presented below. Cost Net Realizable Value 12/31/2020 $120,000 $110,000 12/31/2021 230,000 265,000 What is the effect of applying LCNRV (lower of cost or net realizable value) on income for 20212 a- No effect b- Increases for $10,000 C- Increases for $35,000 d- Increases for $20,000 Question 2: Given the historical cost of the product, Z is $139, the selling price of product Z is $190, costs to sell product Z are $11, and the cost to complete product Z is $20, what is the amount that should be used to value the inventory under IIAS( 2)? v a. $170. b. $150. C. $159. 11:33 AM C420 37°C Haze 8/28/202 e to search DELL Delete PrtScr Insert F12 F10 F11 F9 F7 F8 F6 F5 F3 Backspace & 8 Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License