FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:4

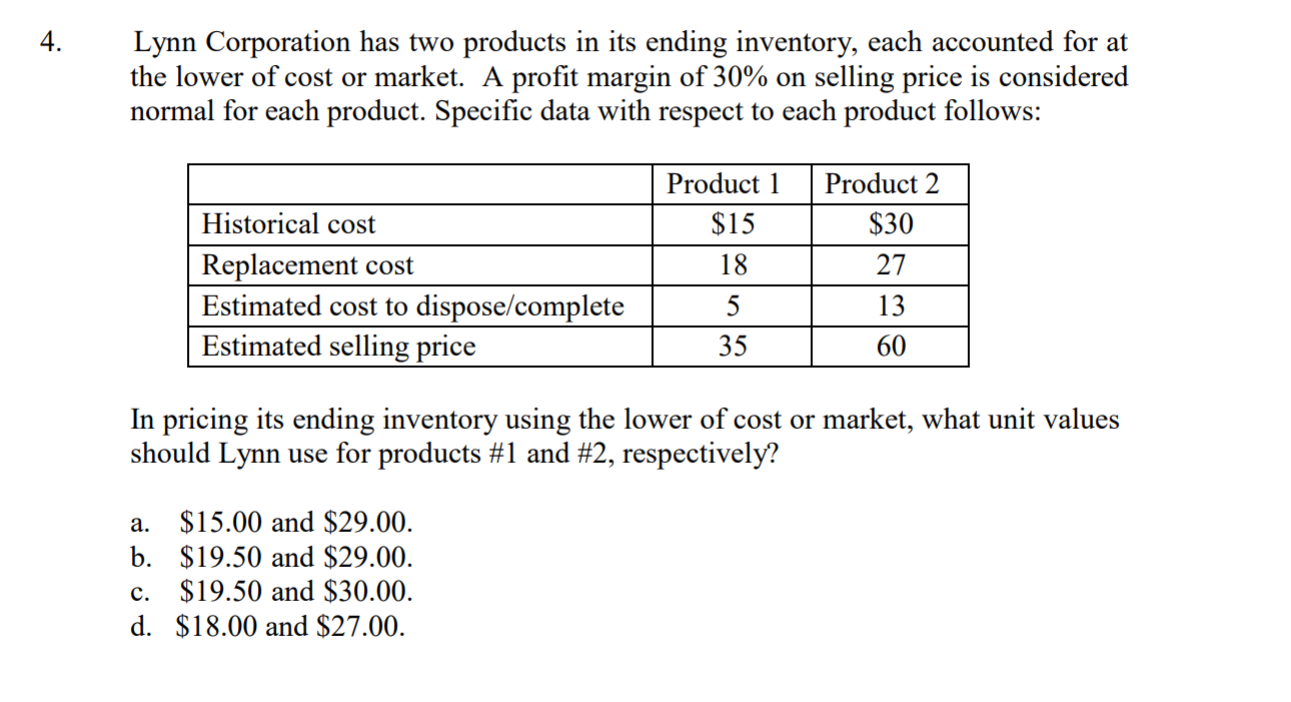

Lynn Corporation has two products in its ending inventory, each accounted for at

the lower of cost or market. A profit margin of 30% on selling price is considered

normal for each product. Specific data with respect to each product follows:

Product Product 2

Historical cost

Replacement cost

Estimated cost to dispose/complete

Estimated selling price

$30

27

13

60

$15

35

In pricing its ending inventory using the lower of cost or market, what unit values

should Lynn use for products #1 and #2, respectively?

a. $15.00 and $29.00

b. $19.50 and $29.00

c. $19.50 and $30.00

d. $18.00 and $27.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please help with question is correct solutionarrow_forwardThe VARCOST2 worksheet is capable of calculating variable and absorption income when unit sales are equal to or less than production. An equally common situation (that this worksheet cannot handle) is when beginning inventory is present and sales volume exceeds production volume. Revise the worksheet Data Section to include: Beginning inventory in units 15,000 Beginning inventory cost (absorption) $266,875 Beginning inventory cost (variable) $210,000, Also, change actual production to 70,000. Revise the Answer Section to accommodate this new data. Assume that Anderjak uses the weighted-average costing method for inventory. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Check figure: Absorption income, $670,000.arrow_forwardInformation pertaining to the inventory of Palette Company follows. LIFO Selling Replacement Cost Price Cost Category: Supreme Item A $5,600 $6,400 $4,800 Item B 7,200 7,200 7,680 Item C 17,600 17,600 16,800 Category: Classic Item X 28,800 28,800 30,400 Item Y 35,200 42,400 41,600 Item Z 56,000 48,000 52,800 The company has a normal profit margin of 20% of selling price and has no additional costs to complete or sell the items. What is the lower-of-cost-or-market value of the company's inventory applying the rule to (a) each individual item and (b) to each inventory category? Select one: a. Inventory item: $147,200; Inventory Category: $147,200 b. Inventory item: $150,400; Inventory Category: $150,400 c. Inventory item: $143,520; Inventory Category: $150,400 d. Inventory item: $141,120; Inventory Category: $147,520arrow_forward

- Jenks Company developed the following information about its inventories in applying the lower-of-cost-or-net-realizabl e-value(LCNRV) basis in valuing inventories: Product Cost NRV A $114,000 $120,000 B 80,000 76,000 C 160,000 162,000 After Jenks applies the LCNRV rule, the value of the inventory reported on the balance sheet would bearrow_forwardNonearrow_forwardNonearrow_forward

- Question - Company sells three different categories of tools (small, medium, and large). The cost and market value of its inventory of tools is as follows. Cost Market Value Small $ 63,200 $ 72,000 Medium 2,89,400 2,60,800 Large 1,52,100 1,72,800 Determine the value of the company's inventory under the lower-of- cost-or-market value approach.arrow_forward5arrow_forwardCost Selling price Costs to sell Product 1 2 3 $ Required: What unit values should Han use for each of its products when applying the lower of cost or net realizable value (LCNRV) rule to ending inventory? Cost Product 1 $ 20 40 20✔ $ 90 ✓ 50 ✓ 6 NRV Product 2 $ 90 120 40 34✔✔ $ X 60✔ Product 3 $ 50 70 10 Per Unit Inventory Value 20✔ X 50 ✓arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education