Intermediate Accounting, 10 Ed

10th Edition

ISBN: 9781260310177

Author: Mark W. Nelson, Wayne B. Thomas J. David Spiceland

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.5E

Lower of cost or market

• LO9–1

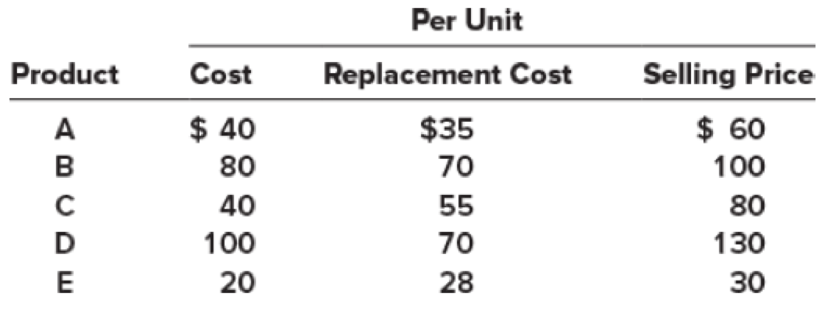

[This is a variation of E 9–2, modified to focus on the lower of cost or market.] The inventory of Royal Decking consisted of five products. Information about the December 31, 2018, inventory is as follows:

Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal gross profit percentage is 30% of selling price.

Required:

What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of ending inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

EA6. LO 10.2 Akira Company had the following transactions for the month. Number of Units cost per unit

Beginning inventory 150 $1,500

Purchased Mar. 31 160 1,920

Purchased Oct. 15 130 1,950

Total goods available for sale 440 5,370

Ending inventory 50 ?

Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $25 each. Provide your calculations. A first-in, first-out (FIFO). B. last-in, first-out (LIFO) C. weighted average (AVG)

inv 3Company A sells only one product X. At the inventory on 31/12/20X5 it was found that there were 500 pieces of X in the warehouse at a cost of EUR 30 per piece. The net realisable market value of X was estimated at EUR 28 per piece but X also has a written non-cancellable agreement to sell 300 pieces of X to company B at EUR 31 per piece. At what value will X's stock be valued?In FY20X6 all the beginning inventory was sold. In particular, the 200 pieces that were valued to KAP were sold at € 35 per piece.Carry out the journal entries resulting from the above events up to the calculation of gross profit.

0

Required information

Problem 9-6 (Algo) Retail inventory method; average cost and conventional (LO9-3, 9-4]

[The following information applies to the questions displayed below.)

Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2021

are as follows:

Beginning inventory

Purchases

Freight-in

Purchase returns

Net markups

Net markdowns

Normal spoilage

Abnormal spoilage

Sales

Sales returns

Cost

$86,000

363,000

8,600

6,600

Problem 9-6 (Algo) Part 1

4,631

Retail

$176,000

576,000

10,000

15,600

11,600

2,000

7,600

536,000

9,600

The company records sales net of employee discounts. Employee discounts for 2021 totaled $3,600

Chapter 9 Solutions

Intermediate Accounting, 10 Ed

Ch. 9 - Explain the (a) lower of cost or net realizable...Ch. 9 - What are the various levels of aggregation to...Ch. 9 - Describe the alternative approaches for recording...Ch. 9 - Explain the gross profit method of estimating...Ch. 9 - The Rider Company uses the gross profit method to...Ch. 9 - Explain the retail inventory method of estimating...Ch. 9 - Both the gross profit method and the retail...Ch. 9 - Define each of the following retail terms: initial...Ch. 9 - Explain how to estimate the average cost of...Ch. 9 - Prob. 9.10Q

Ch. 9 - Explain the LIFO retail inventory method.Ch. 9 - Discuss the treatment of freight-in, net markups,...Ch. 9 - Explain the difference between the retail...Ch. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Explain the accounting treatment of material...Ch. 9 - Identify any differences between U.S. GAAP and...Ch. 9 - (Based on Appendix 9) Define purchase commitments....Ch. 9 - (Based on Appendix 9) Explain how purchase...Ch. 9 - Lower of cost or net realizable value LO91 Ross...Ch. 9 - Lower of cost or net realizable value LO91 SLR...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.5BECh. 9 - Gross profit method; solving for unknown LO92...Ch. 9 - Retail inventory method; average cost LO93 Kiddie...Ch. 9 - Retail inventory method; LIFO LO93 Refer to the...Ch. 9 - Conventional retail method LO94 Refer to the...Ch. 9 - Conventional retail method LO94 Roberson...Ch. 9 - Lower of cost or net realizable value LO91 Herman...Ch. 9 - Lower of cost or net realizable value LO91 The...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.11ECh. 9 - Concepts; terminology LO91 through LO97 Listed...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.8PCh. 9 - Prob. 9.1DMPCh. 9 - Prob. 9.3DMPCh. 9 - Prob. 9.4DMPCh. 9 - Prob. 9.5DMPCh. 9 - Prob. 9.6DMPCh. 9 - Prob. 9.7DMPCh. 9 - Real World Case 98 Various inventory issues;...Ch. 9 - Prob. 9.9DMPCh. 9 - Judgment Case 910 Inventory errors LO97 Some...Ch. 9 - Prob. 9.12DMPCh. 9 - Prob. 2CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 1 a. Kpogo Ltd has the following products in inventory at the end of 2019: Units Cost per unit GH¢ XYZ (completed) 540 22 ABC (part complete) 280 26 Each product normally sells at GH¢34 per unit. Due to the difficult trading conditions, Kpogo Ltd intends to offer a discount of 15% per unit and expects to incur GH¢4 per unit in selling costs. GH¢10 per unit is expected to be incurred to complete each unit of ABC. Required: In accordance with IAS 2 Inventories, at what amount should inventory be stated in the financial statements of Kpogo Ltd as at 31 December 2019? b. According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, an entity must select and apply its accounting policies consistently from one period to the next and among various items in the financial statements. However, an entity may change its accounting policies under certain conditions. Required: Identify the circumstances under which it may be appropriate to change accounting policy in…arrow_forwardDecker Company has five products in its inventory. Information about ending inventory follows. Unit Product Quantity Cost $ A 1,100 30 35 4 11 34 The cost to sell for each product consists of a 10 percent sales commission. BCP с D E 900 800 400 800 1. Determine the carrying value of ending inventory, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Determine the carrying value of ending inventory, assuming the LCNRV rule is applied to the entire inventory. 3. Assuming inventory write-downs are common for Decker, record any necessary year- end adjusting entry based on the amount calculated in requirement 2. Complete this question by entering your answers in the tabs below. Product Unit Selling Price $36 38 12 10 33 Required 1 Required 2 Required 3 Determine the carrying value of ending inventory, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Note: Do not round intermediate…arrow_forwardManagement of Inventory 9.22 (1) What is the total annual cost of the existing inventory policy? (ii) How much money would be saved by employing the economic order quantity (EOQ) ? [Ans. (1) 65,063 (including cost of boxes); (ii) 62.50 or say 63] 8. Ace Ltd. Manufactures a product and the following particulars are collected for the year ended March, 2011: 1000 Units Monthly demand *100 $ Cost of placing an order 15 per unit Annual carring cost 50 units per weak Normal usage 25 units per week Minimum usage Maximum usage 75 units per week 4-6 weeks Re-order period You are required to calculate : (i) Re-order quantity ) Re-order level (iii) Minimum level (iv) Maximum level (v) Average stock level. [Ans. (i) 186 units, (ii) 450 units; (iii) 200 units; (iv) 536 units; (v) 368 units, or 293 units]arrow_forward

- 0 Required information. Problem 5-1A (Algo) Perpetual: Alternative cost flows LO P3 [The following information applies to the questions displayed below.) Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 11 March 5 March 9 March 18. March 25 March 29 Gross Margin Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals Sales Less: Cost of goods sold Gross profit FIFO Units Acquired at Cost 160 units @ $52.20 per unit 255 units @ $57.20 per unit LIFO 115 units@ $62.20 per unit 210 units @ $64.20 per unit 740 units Problem 5-1A (Algo) Part 4 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 95 units from beginning inventory, 225 units from the March 5 purchase, 75 units from the March 18 purchase, and 115 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and…arrow_forward10 Vargas Company uses the perpetual inventory method. Vargas purchased 2,200 units of inventory that cost $23.00 each. At a later date the company purchased an additional 2,600 units of inventory that cost $24.00 each. Vargas sold 2,300 units of inventory for $27.00. If Vargas uses a FIFO cost flow method, the amount of cost of goods sold appearing on the income statement will be: 1 nts 01:10:09 Multiple Choice $50,600. $53,000 $9,100 $6,900.arrow_forward21. A company has two pieces of Inventory, A and B. Inventory A cost the company P40 per unit and can now be sold for P60 per unit after incurring P15 in selling expenses per unit. It has a replacement cost of P35 per unit and a normal profit of P4 per unit. Inventory B cost the company P52 per unit and can now be sold for P63 per unit after the incurring P15 in selling expenses per unit and a normal profit of P4 per unit. If the company uses the retail method to value its inventory, how much should be reported on the balance sheet for these items? a. 90 b. 89 c. 86 d. 88 D00 000arrow_forward

- A. First In, First Out Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold .. ... B. Last In, First Out Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold ... ... C. Weighted Average Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold ... ...arrow_forward4. Given the following information for the Network Company: Market $ 800 Date December 31, 2018 December 31, 2019 December 31, 2020 Cost $ 800 1,000 940 1,100 1,060 If the allowance method of recording lower of cost or market is in use, which December 31, 2020 entry is not correct? Loss Due to Market Valuation 40 a. Allowance to Reduce Inventory to Market b. Allowance to Reduce Inventory to Market Loss Recovery Due to Market Valuation 40 20 20 c. Inventory 1,100 Income Summary d Income Summary 1,100 1,000 Inventory 1,000arrow_forwardProblem 9-2 (Algo) Lower of cost or net realizable value; by product, category, and total Inventory [LO9- 1] Almaden Hardware Store sells two product categories, tools and paint products. Information pertaining to its 2021 year-end inventory is as follows: Inventory, by Product Category Tools: Hammers Saws Screwdrivers Paint products: 1-gallon cans Paint brushes Tools: Product Hammers Saws Screwdrivers Total tools Paint products: 1-gallon cans Paint brushes Total paint Total Quantity 110 140 240 $ 440 110 Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products. (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Almaden, record any necessary year-end adjustment amount for each of the LCNRV applications in requirement 1. $ $ Complete this question by entering your answers in the tabs below. Cost Required 1 Required 2 Determine…arrow_forward

- Exercise 9-19 (Algo) Dollar-value LIFO retail [LO9-5] On January 1, 2024, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2024: Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, 12/31/2024 Required: Calculate the estimated ending inventory and cost of goods sold for 2024 using the information provided. Note: Do not round intermediate calculations. Answer is complete but not entirely correct. Ending inventory at retail Ending inventory at cost Cost of goods sold Cost $ 82,600 119,500 $ $ $ 162,000 86,386 122,113 Retail $ 140,000 247,000 4,000 12,000 217,000 1.08arrow_forwardEA9. LO 10.3 Calculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO). IT: Number of Units Unit Cost Sales 800 Beginning inventory Purchased $50 600 52 Sold 400 $80 Sold 350 90 Ending inventory 650arrow_forwardQuestion: Given the historical cost of the product, Dominoe is $65, the selling price of product Dominoe is $90, costs to sell product Dominoe are $16, the replacement cost for product Dominoe is $60, and the normal profit margin is 20% of sales price, what is the amount that should be used to value the inventory under the lower-of-cost-or-market method? a. $65. b. $56. c. $60. d. $74.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License