Intermediate Accounting, 10 Ed

10th Edition

ISBN: 9781260310177

Author: Mark W. Nelson, Wayne B. Thomas J. David Spiceland

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 9, Problem 9.4E

Lower of cost or market

• LO9–1

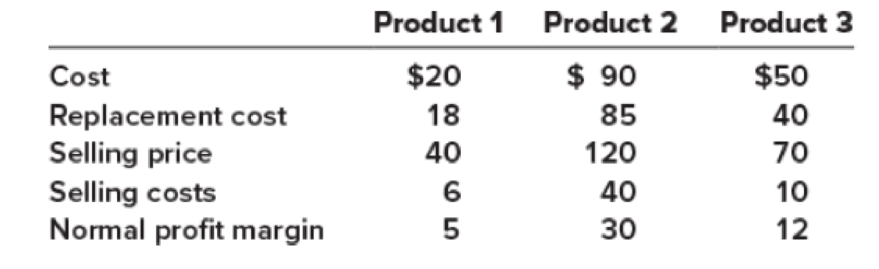

[This is a variation of E 9–1, modified to focus on the lower of cost or market.] Herman Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows:

Required:

What unit values should Herman use for each of its products when applying the lower of cost or market (LCM) rule to ending inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

toring Enabled Ex

A company has the following products in its ending inventory Compute lower of cost or market for inventory applied separately to each product and then

calculate the total lower of cost or market. What is the total lower of cost or market?

Product

Product A

Product 3

Product C

Mugle Choice

Quantity

10

$31.660

OSUN

15

20

Cost per

Unit

$708

$508

$658

Market per

Unit

$678

$548

5683

4

PA4. LO 10.3 Calculate the cost of goods sold dollar value for A74 Company for the sale on

March 11, considering the following transactions under three different cost allocation methods

and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b)

last-in, first-out (LIFO); and (c) weighted average (AVG).

Number of Units

Unit Cost

Beginning inventory Mar. 1

Purchased Mar. 8

Sold Mar. 11 for $120 per unit

110

140

$87

89

95

Solution

А.

Number of Units

Dollar per Unit

Value

Cost of goods sold

В.

Number of Units

Dollar per Unit

Value

Cost of goods sold

C.

Number of Units

Dollar

per

Unit

Value

Cost of goods sold

PA5. LO 10.3 Use the first-in, first-out (FIFO) cost allocation method, with perpetual inventory

updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75

Company, considering the following transactions.

Number

Unit

Cost

of Units

Beginning inventory

Purchased Mar. 2

Sold Mar, 31 for $75 per unit

105

150

88…

S

At the end of the year, Randy's Parts Company had the following items in inventory:

Item

P1

Quantity

60

P2

40

P3

80

P4

70

Required

Unit Cost Unit Market Value

$ 85

70

130

125

$ 90

72

a. Determine the amount of ending inventory using the lower-of-cost-or-market rule applied to each individual inventory item.

b. Provide the adjustment necessary to write down the inventory based on Requirement a. Assume that Randy's Parts Co. uses the

perpetual inventory system.

c. Determine the amount of ending inventory, assuming that the lower-of-cost-or-market rule is applied to the total inventory in

aggregate.

120

130

d. Provide the adjustment necessary to write down the inventory based on Requirement c. Assume that Randy's Parts Co. uses the

perpetual inventory system.

Required A Required B Required C

Ending inventory

Complete this question by entering your answers in the tabs below.

Required D

Determine the amount of ending inventory using the lower-of-cost-or-market rule applied to each…

Chapter 9 Solutions

Intermediate Accounting, 10 Ed

Ch. 9 - Explain the (a) lower of cost or net realizable...Ch. 9 - What are the various levels of aggregation to...Ch. 9 - Describe the alternative approaches for recording...Ch. 9 - Explain the gross profit method of estimating...Ch. 9 - The Rider Company uses the gross profit method to...Ch. 9 - Explain the retail inventory method of estimating...Ch. 9 - Both the gross profit method and the retail...Ch. 9 - Define each of the following retail terms: initial...Ch. 9 - Explain how to estimate the average cost of...Ch. 9 - Prob. 9.10Q

Ch. 9 - Explain the LIFO retail inventory method.Ch. 9 - Discuss the treatment of freight-in, net markups,...Ch. 9 - Explain the difference between the retail...Ch. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Explain the accounting treatment of material...Ch. 9 - Identify any differences between U.S. GAAP and...Ch. 9 - (Based on Appendix 9) Define purchase commitments....Ch. 9 - (Based on Appendix 9) Explain how purchase...Ch. 9 - Lower of cost or net realizable value LO91 Ross...Ch. 9 - Lower of cost or net realizable value LO91 SLR...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.5BECh. 9 - Gross profit method; solving for unknown LO92...Ch. 9 - Retail inventory method; average cost LO93 Kiddie...Ch. 9 - Retail inventory method; LIFO LO93 Refer to the...Ch. 9 - Conventional retail method LO94 Refer to the...Ch. 9 - Conventional retail method LO94 Roberson...Ch. 9 - Lower of cost or net realizable value LO91 Herman...Ch. 9 - Lower of cost or net realizable value LO91 The...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.11ECh. 9 - Concepts; terminology LO91 through LO97 Listed...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.8PCh. 9 - Prob. 9.1DMPCh. 9 - Prob. 9.3DMPCh. 9 - Prob. 9.4DMPCh. 9 - Prob. 9.5DMPCh. 9 - Prob. 9.6DMPCh. 9 - Prob. 9.7DMPCh. 9 - Real World Case 98 Various inventory issues;...Ch. 9 - Prob. 9.9DMPCh. 9 - Judgment Case 910 Inventory errors LO97 Some...Ch. 9 - Prob. 9.12DMPCh. 9 - Prob. 2CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of applying the LCNRV rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows: Inventory Write-Down Use the information in E8-1. Assume that Stiles uses the LIFO cost flow assumption and is applying the LCM rule. Required: 1. What is the correct inventory value for each product? 2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations?arrow_forwardLower of Cost or Market Garcia Company uses FIFO, and its inventory at the end of the year was recorded in the accounting records at $17,800. Due to technological changes in the market, Garcia would be able to replace its inventory for $16,500. Required: 1. Using the lower of cost or market method, what amount should Garcia report for inventory on its balance sheet at the end of the year? 2. Prepare the journal entry required to value the inventory at the lower of cost or market.arrow_forwardTB MC Qu. 05-131 (Algo) A company has the following products... A company has the following products in its ending Inventory. Compute lower of cost or market for inventory applied separately to each product Cost per Market per Unit Unit $ 726 $ 696 $ 526 $ 566 $ 676 $ 701 Product Quantity 10 15 20 Product A Product B Product Carrow_forward

- Lower-of-Cost-or-Market Method On the basis of the data shown below: Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) Raven 10 1,700 $163 $159 Dove 23 9,200 24 30 Determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9. 1:01 PM 10/23/2020arrow_forward26. The following data refer to Issue Company’s ending inventory: Item code Quantity Unit Cost Unit Market Small 100 $56 $59 Medium 420 38 44 Large 600 44 42 Extra-Large 220 64 67 How much is the inventory if the lower of cost or market rule is applied to each item of inventory?arrow_forwardA. Based on the fundamental principle of IAS2, identify two (2) circumstances where the NRV of inventory might be lower than its cost? B. Storm Inc. had 500 units of Product X at 30 June 2020 in inventory. The product had been purchased at list price of $18 per unit and normally sells for $24 per unit. Additional information relating to the units in inventory: VAT – 10%; wharehousing cost - $0.55 per unit; purchase discount - $0.40 per unit; carriage inwards - $0.60 per unit. Recently , Product X started to deteriorate but can still be sold for $24 per unit, provided that some rectification/re-packaging work is undertaken at a cost of $3 per unit. Required: At what amount would Product X be required to be stated on 30 June 2020? Provide detailed analysis to support your answerarrow_forward

- 0 Required information. Problem 5-1A (Algo) Perpetual: Alternative cost flows LO P3 [The following information applies to the questions displayed below.) Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 11 March 5 March 9 March 18. March 25 March 29 Gross Margin Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals Sales Less: Cost of goods sold Gross profit FIFO Units Acquired at Cost 160 units @ $52.20 per unit 255 units @ $57.20 per unit LIFO 115 units@ $62.20 per unit 210 units @ $64.20 per unit 740 units Problem 5-1A (Algo) Part 4 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 95 units from beginning inventory, 225 units from the March 5 purchase, 75 units from the March 18 purchase, and 115 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and…arrow_forward25 E7-12 (Algo) Reporting Inventory at Lower of Cost or Net Realizable Value LO7-4 Bwth H.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending Inventory Information about the five major Items stocked for regular sale follows: A B Item A MODE B C D C E Item Quantity Total Cost Required: Compute the valuation that should be used for the current year ending Inventory using lower of cost or net realizable value applied on an Item-by-Item basis. 62 92 22 32 302 Total Quantity on Hand 62 92 22 82 362 S ENDING INVENTORY, CURRENT YEAR 0 Unit Cost When Net Realizable Value (Market) at Year-End $ 16 31 49 26 11 Total Net Realizable Value S Acquired (FIFO) $13 53 31 6 Lower of Cost or NRV DAUGHTER 0arrow_forward32.Pomelo Company has the policy of valuing inventory at the lower of cost and net realizable value using the allowance method. Allowance to Reduce Inventory to NRV account at December 31, 2021 before adjustment is P86,000. Analysis of the net realizable value and costs of their products on December 31, 2021 revealed a valuation at the lower of cost and net realizable value of P1,200,000 applied to the individual products. The total cost of its products on that date is P1,300,000.How much is the loss from decline in NRV that Pomelo Company should report in profit or loss for the year ended December 31, 2021?arrow_forward

- 9. In the first-in, first-out (FIFO) method: a. the last units acquired are the first units to be sold b. the first units acquired are the last units to be sold c. the last units acquired are the last units to be sold d. the first units acquired are the first units to be sold 10. The inventory evaluation method which does not represent the actual ending inventory value is? a. standard cost b. first-in, first-out (FIFO) c. weighted average d. last-in, first-out (LIFO) 11. Cost of goods sold is equal to? a. Beginning inventory - Purchases + Ending Inventory b. Purchases + Beginning inventory - Ending Inventory c. Beginning inventory + Sales - Ending Inventory d. Ending Inventory + Purchases - Beginning inventory 12. The costs of ending inventory is similar under both periodic and perpetual inventory system if _________________ method is used. a. first-in, first-out (FIFO) b. standard cost c. weighted average d. last-in, first-out (LIFO) 13. If a…arrow_forward0 Required information Problem 9-6 (Algo) Retail inventory method; average cost and conventional (LO9-3, 9-4] [The following information applies to the questions displayed below.) Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2021 are as follows: Beginning inventory Purchases Freight-in Purchase returns Net markups Net markdowns Normal spoilage Abnormal spoilage Sales Sales returns Cost $86,000 363,000 8,600 6,600 Problem 9-6 (Algo) Part 1 4,631 Retail $176,000 576,000 10,000 15,600 11,600 2,000 7,600 536,000 9,600 The company records sales net of employee discounts. Employee discounts for 2021 totaled $3,600arrow_forward3 A company has four products in its inventory. Information about ending inventory is as follows: Total Net Realizable Value. Product 101 102 103 104 Total Cost $ 136,000 99,000 68,000 38,000 Required: 1. Determine the carrying value of ending inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Assuming that inventory write-downs are common for the company, record any necessary year-end adjusting entry. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Product Determine the carrying value of ending inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 101 102 103 104 $ 108,000 118,000 58,000 58,000 Cost $ 136,000 $ 99,000 68,000 38,000 341,000 $ NRV 108,000 118,000 58,000 58,000 Inventory Value $ 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License