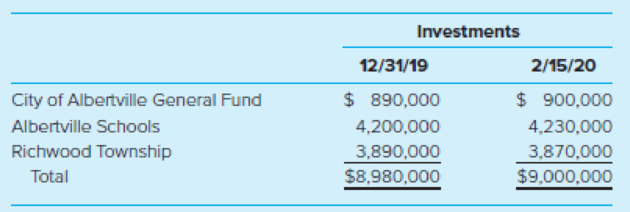

Investment Trust Fund. (LO8-3) The Albertville City Council decided to pool the investments of its General Fund with Albertville Schools and Richwood Township in an investment pool to be managed by the city. Each of the pool participants had reported its investments at fair value as of the end of 2019. At the date of the creation of the pool. February 15, 2020, the fair value of the investments of each pool participant was as follows:

Required

- a. Prepare the

journal entries that should be made by the City of Albertville, Albertville Schools, and Richwood Township on February 15 to record their participation in the investment pool. (Entries for the investment pool trust fund will be made later.) - b. Prepare the journal entries to be made in the accounts of the investment pool trust fund to record the following transactions for the first year of operations:

- (1) Record the investments transferred to the pool; assume that the investments of the city's General Fund were in U.S. Treasury notes and the investments of both the schools and the township were in certificates of deposit (CDs).

- (2) On June 15. Richwood Township decided to withdraw $3,010,000 for a capital projects payment. At the date of the withdrawal, the fair value of the Treasury notes had increased by $30,000. Assume that the trust fund was able to redeem the CDs necessary to complete the withdrawal without a penalty but did not receive interest on the funds.

- (3) On September 15, interest on Treasury notes in the amount of $50,000 was collected.

- (4) Interest on CDs accrued at year-end amounted to $28,000.

- (5) At the end of the year, undistributed earnings were allocated to the investment pool participants. Assume that there were no additional changes in the fair value of investments after the Richwood Township withdrawal. Round the amount of the distribution to each fund or participant to the nearest dollar.

- b. Record the June 15 increase in each of the participant's funds.

- c. Record the change in each participant's Equity in Pooled Investment account due to the September 15 treasury interest and December 31 CD interest accrual.

- d. Explain how the investment trust fund would report the General Fund's interest in the investment pool and the Albertville School's interest in the investment pool.

a)

Prepare the journal entries that should be made by the City A, Schools A, and Township R to record their participation in the investment pool.

Explanation of Solution

City Council A prepares the following journal entry to record the participation in the investment pool:

It is given that the fair value of investments on December 31, 2016 is $890,000. The fair value on February 15, 2020 is $900,000. City Council A decides to participate in the investment pool on February 15, 2020. Hence, the increase in fair value of investments is $10,000

The “equity in pooled investments” is the fair value of investments during the time of investment (February 15, 2020) and the “investments” is the previous value considered as fair value (December 31, 2016). The “change in fair value” refers to the increase or decrease in fair value of the investment.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| February 15 | Equity in pool investments | $900,000 | ||

| Investments | $890,000 | |||

| Revenue – change in fair value of investments | $10,000 | |||

| (To record the participation in the investment pool) |

Table (1)

To journalize the participation of City Council A in the investment pool, debit the “equity in pooled investments” (debit the increase in assets) and credit the “investments” (credit the decrease in assets) and “change in fair value” (credit the incomes and gains).

School A prepares the following journal entry to record the participation in the investment pool:

It is given that the fair value of investments on December 31, 2016 is $4,200,000. The fair value on February 15, 2020 is $4,230,000. School A decides to participate in the investment pool on February 15, 2020. Hence, the increase in fair value of investments is $30,000

The “equity in pooled investments” is the fair value of investments during the time of investment (February 15, 2020) and the “investments” is the previous value considered as fair value (December 31, 2016). The “change in fair value” refers to the increase or decrease in fair value of the investment.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

|

February 15 | Equity in pool investments | $4,230,000 | ||

| Investments | $4,200,000 | |||

| Revenue – change in fair value of investments | $30,000 | |||

| (To record the participation in the investment pool) |

Table (2)

To journalize the participation of School A in the investment pool, debit the “equity in pooled investments” (debit the increase in assets) and credit the “investments” (credit the decrease in assets) and “change in fair value” (credit the incomes and gains).

Township R prepares the following journal entry to record the participation in the investment pool:

It is given that the fair value of investments on December 31, 2016 is $3,890,000. The fair value on February 15, 2020 is $3,870,000. Township R decides to participate in the investment pool on February 15, 2020. Hence, the decrease in fair value of investments is $20,000

The “equity in pooled investments” is the fair value of investments during the time of investment (February 15, 2020) and the “investments” is the previous value considered as fair value (December 31, 2016). The “change in fair value” refers to the increase or decrease in fair value of the investment.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| February 15 | Equity in pool investments | $3,870,000 | ||

| Revenue – change in fair value of investments | $20,000 | |||

| Investments | $3,890,000 | |||

| (To record the participation in the investment pool) |

Table (3)

To journalize the participation of Township R in the investment pool, debit the “equity in pooled investments” (debit the increase in assets) and “change in fair value” (debit the expenses and losses), and credit the “investments” (credit the decrease in assets).

b)

Prepare the journal entries for the given transactions to be made in the accounts of the investment pool trust funds.

Explanation of Solution

1) Prepare journal entry to record the transfer of investments to the investment pool:

The fair value of investments of City Council A is $900,000, of School A is $4,230,000, and of Township R is $3,870,000 as on February 15, 2020. The fund invests the investment of City Council A in Country U treasury notes. It invests the total investment of School A and Township R in certificate of deposits.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| U.S. treasury notes | $900,000 | |||

| Certificates of deposit | $8,100,000 | |||

| Due to city’s general fund | $900,000 | |||

| Additions – Deposits in pooled investments-Schools A | $4,230,000 | |||

| Additions – Deposits in pooled investments-Township R | $3,870,000 | |||

| (To record the investments transferred to the investment pool) |

Table (4)

To journalize the transfer of investments to the investment pool, debit the Country U treasury notes and certificate of deposits (debit the increase in assets). Credit the “due to general fund of City Council A, “additions–deposits in pooled investments–School A”, and “additions–deposits in pooled investments–Township R” (credit the increase in liability).

2) Prepare journal entry to allocate the change in fair value of treasury notes to each participant on June 15, 2020:

It is given that the treasury notes increase by $30,000. The proportionate interest on the date of formation of the investment pool is 10% for the general fund of City Council A, 47% for School A, and 43% for Township R. Allocate the change in fair value of treasury notes to each participant based on their proportionate interest.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| U.S. treasury notes | $30,000 | |||

| Due to city’s general fund | $3,000 | |||

| Additions – Deposits in pooled investments-Schools A | $14,100 | |||

| Additions – Deposits in pooled investments-Township R | $12,900 | |||

| (To record the distribution of increase in fair value of treasury notes to the participants of the investment pool) |

Table (5)

To journalize the distribution of increase in treasury notes, debit the “Country U treasury notes” (debit the increase in asset) and credit the “due to general fund of City Council A, “additions–earnings on investment–School A”, and “additions– earnings on investment–Township R” (credit incomes and gains).

Prepare journal entry for the redemption of certificate of deposits on June 15, 2020:

Township R withdraws $3,010,000 worth of certificate of deposits. It is necessary to sell the certificate of deposits to redeem the money. The entry for the receipt of cash on the certificate of deposits by the investment trust fund is as follows:

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Cash | $3,010,000 | |||

| Certificates of deposit | $3,010,000 | |||

| (To record the receipt of cash on the redemption of certificate of deposits) |

Table (6)

To journalize the receipt of cash on the redemption of “certificate of deposits”, debit the cash account (debit what comes in) and credit the “certificate of deposits” (credit the decrease in asset).

Prepare journal entry for withdrawal of certificate of deposits on June 15, 2020 by Township R:

Township R withdraws $3,010,000 worth of certificate of deposits.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Deductions-withdrawal from pooled investments – Township R | $3,010,000 | |||

| Cash | $3,010,000 | |||

| (To record the withdrawal of certificate of deposits) |

Table (7)

To journalize the withdrawal of “certificate of deposits”, debit the “deductions–withdrawals from pooled investments–Township R” (debit the decrease in liability) and credit the “cash account” (credit what goes out).

3) Prepare journal entry to record the receipt of interest from treasury notes on September 15, 2020:

It is given that the fund receives $50,000 as interest on treasury notes. However, it does not distribute the interest to each participant immediately. Hence, consider the receipt as undistributed earnings.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Cash | $50,000 | |||

| Undistributed earnings on pooled investments | $50,000 | |||

| (To record the receipt of interest on treasury notes) |

Table (8)

To journalize the receipt of interest on treasury notes, debit the cash account (debit what comes in) and credit the “undistributed earnings on pooled investments” (credit incomes and gains).

4) Prepare journal entry to record the accrual of interest from certificate of deposits on December 31, 2020:

It is given that the fund has $28,000 as accrued interest on certificate of deposits. However, it does not distribute the interest to each participant immediately. Hence, consider the receipt as undistributed earnings.

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Interest receivable | $28,000 | |||

| Undistributed earnings on pooled investments | $28,000 | |||

| (To record the accrual interest on certificate of deposit at the end of the year) |

Table (9)

To journalize the accrual of interest on certificate of deposits, debit the interest receivable (debit the increase in asset) and credit the “undistributed earnings on pooled investments” (credit incomes and gains).

5) Prepare journal entry to record the distribution of undistributed earnings from treasury notes and certificate of deposits December 31, 2020:

It is given that the fund receives $50,000 as interest on treasury notes and has $28,000 as accrued interest on certificate of deposits. Hence, the total undistributed interest is $78,000

The proportionate interest of each participant on June 15, 2020 is 15% for the general fund of City Council A, 70.5% for School A, and 14.5% for Township R. Pass the entry for distribution of undistributed earnings as follows:

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Undistributed earnings on pooled investments | $78,000 | |||

| Due to city’s general fund | $11,700 | |||

| Additions – Deposits in pooled investments-Schools A | $54,990 | |||

| Additions – Deposits in pooled investments-Township R | $11,310 | |||

| (To record the distribution of undistributed earnings) |

Table (10)

To journalize the distribution of undistributed earnings, debit the “undistributed earnings on pooled investments” (debit the decrease in income by way of allocation). Credit the “due to general fund of City Council A, “additions–earnings on investment–School A”, and “additions– earnings on investment–Township R” (credit incomes and gains).

c)

Prepare journal entries to record the earnings in the respective financial statements each participant:

Explanation of Solution

City Council A prepares the following journal entry to record the earnings on June 15, 2020:

There is an increase in the earnings by $30,000 on June 15, 2020. City Council A records its proportionate earnings (10%) of the total earnings as follows:

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Equity in pooled investments | $3,000 | |||

| Revenue- investment earnings | $3,000 | |||

| (To record the earnings on investments) |

Table (11)

To journalize the earnings, debit the “equity in pooled investments” (debit the increase in assets) and credit the “Revenues–earnings on investment” (credit the incomes and gains).

School A prepares the following journal entry to record the earnings on June 15, 2020:

There is an increase in the earnings by $30,000 on June 15, 2020. School A records its proportionate earnings (47%) of the total earnings as follows:

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Equity in pooled investments | $14,100 | |||

| Revenue- investment earnings | $14,100 | |||

| (To record the earnings on investments) |

Table (12)

To journalize the earnings, debit the “equity in pooled investments” (debit the increase in assets) and credit the “Revenues–earnings on investment” (credit the incomes and gains).

Township R prepares the following journal entry to record the earnings on June 15, 2020:

There is an increase in the earnings by $30,000 on June 15, 2020. Township R records its proportionate earnings (43%) of the total earnings as follows:

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Equity in pooled investments | $12,900 | |||

| Revenue- investment earnings | $12,900 | |||

| (To record the earnings on investments) |

Table (13)

To journalize the earnings, debit the “equity in pooled investments” (debit the increase in assets) and credit the “Revenues–earnings on investment” (credit the incomes and gains).

Prepare journal entry for the redemption of certificate of deposits on June 15, 2020:

Township R withdraws $3,010,000 worth of certificate of deposits. It is necessary to sell the certificate of deposits to redeem the money. The entry for the receipt of cash on the certificate of deposits by the investment trust fund is as follows:

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Cash | $3,010,000 | |||

| Equity in pooled investments | $3,010,000 | |||

| (To record the receipt of cash on the redemption of certificate of deposits) |

Table (14)

d)

Prepare journal entries to record the distribution of undistributed earnings in the respective financial statements each participant

Explanation of Solution

City Council A prepares the following journal entry to record its share of undistributed earnings on December 31, 2020:

The undistributed interest is $50,000 from treasury notes and $28,000 from certificate of deposits on December 31, 2020. Hence, the total undistributed interest is $78,000

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Equity in pooled investment | $11,700 | |||

| Revenue – investment earnings | $11,700 | |||

| (To record the earnings on investment) |

Table (15)

To journalize the earnings, debit the “equity in pooled investments” (debit the increase in assets) and credit the “Revenues–investment earnings” (credit the incomes and gains).

School A prepares the following journal entry to record its share of undistributed earnings on December 31, 2020:

The undistributed interest is $50,000 from treasury notes and $28,000 from certificate of deposits on December 31, 2020. Hence, the total undistributed interest is $78,000

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Equity in pooled investment | $54,990 | |||

| Revenue – investment earnings | $54,990 | |||

| (To record the earnings on investment) |

Table (16)

To journalize the earnings, debit the “equity in pooled investments” (debit the increase in assets) and credit the “Revenues–investment earnings” (credit the incomes and gains).

Township R prepares the following journal entry to record its share of undistributed earnings on December 31, 2020:

The undistributed interest is $50,000 from treasury notes and $28,000 from certificate of deposits on December 31, 2020. Hence, the total undistributed interest is $78,000

| Date | Accounts titles and explanation | Post ref. | Debit ($) | Credit ($) |

| Equity in pooled investment | $11,310 | |||

| Revenue – investment earnings | $11,310 | |||

| (To record the earnings on investment) |

Table (17)

To journalize the earnings, debit the “equity in pooled investments” (debit the increase in assets) and credit the “Revenues– investment earnings” (credit the incomes and gains).

e)

Explain the way in which the “investment trust fund” reports investment pool and School A’s interest in the investment pool.

Explanation of Solution

Explain the way in which the “investment trust fund” reports investment pool and School A’s interest in the investment pool:

- The “investment trust fund” will not report the investment pool of the general fund of City Council A separately. It is because they general fund of City Council A is an internal participant.

- The “investment trust fund” will report the investment pool of School A separately because it is an external participant. It will report the investment of School A in the “Statement of fiduciary fund net position” and the “Statement of changes in fiduciary fund net position”.

Want to see more full solutions like this?

Chapter 8 Solutions

Accounting For Governmental & Nonprofit Entities

- The unit product cost under super-variable costing is: @ financial account.arrow_forwardWhat must the expected return on this stock be? Please answer the financial accounting questionarrow_forwardWhat is the dividend yield if your annual dividend income is 255 on these financial accounting question?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education