Pass-through Custodial Funds. (LO8-2) Evergreen County acts as the disbursing agent for a state grant for the performing arts. The state is responsible for determining which local governments are eligible for the grant money and for following up to ensure that the recipients comply with the requirements of the grant. The county receives the grant funds and disburses them according to the schedule provided by the state. When the county was asked to participate, the county's attorney was concerned that the county might be held responsible for any disallowed costs. The state agreed to accept responsibility for any disallowed costs, so the county decided to act as the custodian for the state for this grant.

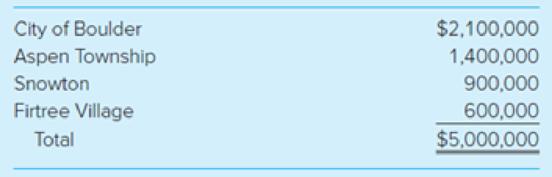

The schedule for the grant funds to be awarded in the current fiscal year is shown below:

Required

- a. Prepare the general

journal entries necessary to record Evergreen County’s receipt and disbursement of the grant money in March. - b. Prepare the general journal entries required to record Aspen Township's receipt of the funds; assume that funds arc to be used to construct a new performing arts center and all time and eligibility requirements have been met.

- c. How would the activities related to the grant be reported in the county's financial statements?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Accounting For Governmental & Nonprofit Entities

- The County of Maxnell decides to create a waste management department and offer its services to the public for a fee. As a result, county officials plan to account for this activity as an enterprise fund. Assume the information is gathered so that the county can prepare fund financial statements. Only entries for the waste management department are required here: January 1 Receive unrestricted funds of $248,000 from the general fund as permanent financing. Febrauary 1 Borrow an additional $224,000 from a local bank at a 12 percent annual interest rate. March 1 Order a truck at an expected cost of $140,000. April 1 Receive the truck and make full payment. The actual cost including transportation was $143,000. The truck has a 10-year life and no residual value. The county uses straight-line depreciation. May 1 Receive a $23,600 cash grant from the state to help supplement the pay of the department workers. According to the grant, the money must be used for that…arrow_forwardBilberry County voted to establish an internal service fund to account for printing and copying for all its departments and agencies. The county engaged in the following activities related to the new fund. REQUIRED: Prepare journal entries to record these events in the internal service fund. If no entry is required, write “No entry required.” a)The county commission voted to transfer $300,000 from the general fund to the internal service fund to establish the new fund. b)Entered into a capital lease for equipment to be used in printing activities. The total present value of the lease obligation is $600,000. c)Issued $2 million in general obligation bonds at 101. The bonds were issued to acquire additional equipment and are to be serviced from the internal service fund. d)Purchased equipment for $1,950,000. The equipment has an estimated useful life of nine years and an estimated salvage value of $150,000. e)Billed the general fund for copying and printing charges, $70,000.…arrow_forwardFulbright County constructed a library in one of the county's high-growth areas. The construction was funded by a number of sources. Below selected information related to the Library Capital Project Fund. All activity related to the library construction occurred within the current fiscal year. The county operates on a calendar-year basis. Required Prepare a journal entry for capital projects fund and governmental activities at the government-wide level. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Transaction General Journal 1. The county issued $6,000,000 of 4 percent bonds at par. Proceeds from the bonds were to be used for construction of the library. 1 Capital Projects Fund 2. A $650,000 federal grant was received to help finance construction of the library. 2 Capital Projects Fund 3. The Library Special Revenue Fund transferred $250,000 for use in construction of the library Capital Projects Fund 3 5b Fund/…arrow_forward

- Ibri city was awarded two state grants during the fiscal year 2019 RO 2 million and RO 1 million respectively. These grants used only for restricted purposes. The expenditure related to the restricted activity is RO 4 million. The excess of revenue over expenditure in special revenue fund is a. RO - 1 million b. RO 3 million c. RO 1 million d. None of the optionsarrow_forwardThe state government passes a law requiring localities to upgrade their water treatment facilities. The state then awards a grant of $500,000 to the Town of Midlothian to help pay for this cost. What type of revenue is this grant? Derived tax revenue. Imposed nonexchange revenue. Government-mandated nonexchange revenue. Voluntary nonexchange transaction.arrow_forwardPolk County's solid waste landfill operation is accounted for in a governmental fund. Polk used available cash to purchase equipment that is included in the estimated current cost of closure and post-closure care of this operation. How would this purchase affect the asset amount in Polk's governmental capital assets and the liability amount in Polk's government-wide financial statements? Asset Amount Liability Amount A.) Increase Decrease B.) Increase No effect C.) No effect Decrease D.) No effect No effectarrow_forward

- For problems 40 through 43, use the following introductory information: The City of Wolfe has issued its financial statements for Year 4 (assume that the city uses a calendar year). The city’s general fund is made up of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. It also has one discretely presented component unit. The government-wide financial statements indicated the following Year 4 totals: Education had net expenses of $710,000. Parks had net expenses of $130,000. Art museum had net revenues of $80,000. General revenues were $900,000; the overall increase in net position was $140,000. The fund financial statements issued for Year 4 indicated the following: The general fund had an increase of $30,000 in its fund balance. The capital projects fund had an increase of $40,000 in its fund balance. The enterprise fund had an increase of $60,000 in its net position.…arrow_forwardFor problems 40 through 43, use the following introductory information: The City of Wolfe has issued its financial statements for Year 4 (assume that the city uses a calendar year). The city’s general fund is made up of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. It also has one discretely presented component unit. The government-wide financial statements indicated the following Year 4 totals: Education had net expenses of $710,000. Parks had net expenses of $130,000. Art museum had net revenues of $80,000. General revenues were $900,000; the overall increase in net position was $140,000. The fund financial statements issued for Year 4 indicated the following: The general fund had an increase of $30,000 in its fund balance. The capital projects fund had an increase of $40,000 in its fund balance. The enterprise fund had an increase of $60,000 in its net position.…arrow_forwardLincoln County's General Fund had two interfund transactions: 1. The general fund paid $225,000 to the housinhg and urban development fund, a special revenue fund that is supported by grantsfrom the federal government on a cost reimbersment basis. The amount is to be reoaid to the general fund as grant proceeds are received from the federal government. 2. The general fund paid $162,000 to the tourism fund, a special revenue fund that is supported by hotel and restaurant taxes. The amount is intended to supplement the taxes raised, and there is no expectation that it will be repaid to the general fund. Required: Prepare the journal entriess in the general fund and affected special revenue funds for the interfund transactions above. Describe the effect of these transactions on the fund balance of the general fund and special revenue funds.arrow_forward

- For each of the following events or transactions, identity the fund that will be affected. JA city government pays the final contract retained percentage for JA county government establishes an investment pool to manage the A County government receives a large contribution specifying that income from the contribution be distributed each year to the county zoo. The principal is to remain intact indefinitely A county government levies real property taxes on behalf of the county and its municipalities JA central purchasing department was established to handle all the Paid the interest of general bonds Collections the pension of administrative employees of governmenal entity A Permanent Funds B. Internal Services Funds C. Debt Services Funds D Pension Trust Funds E Capital Proyect Funds F General Funds G. Trust Fundsarrow_forwardNizwa city was awarded two state grants during the fiscal year 2019 RO 4 million and RO 2 million respectively. These grants used only for restricted purposes. The expenditure related to the restricted activity is RO 2 million and bond issued and collected RO 5 million for special restricted activity. The other financing sources in the special revenue fund is a. RO 10 million b. RO 8 million c. RO 5 million d. None of the optionsarrow_forwardThe City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of the municipal building. Which of the following is true for reporting the gift within the government-wide financial statements?a. A capital asset of $240,000 must be reported.b. No capital asset will be reported.c. If conditions are met, recording the sculpture as a capital asset is optional.d. The sculpture will be recorded but only for the amount paid by the city.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education