Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 18.8EP

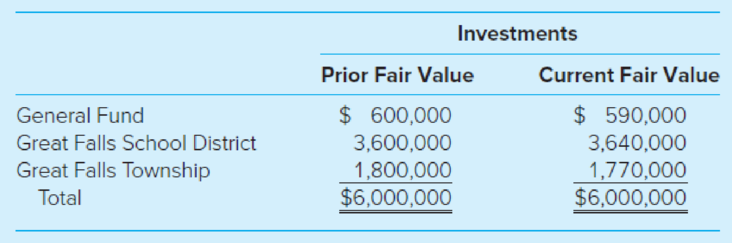

The city council of the City of Great Falls decided to pool the investments of its General Fund with those of Great Falls School District and Great Falls Township, each of which carried its investments at fair value as of the prior balance sheet date. All investments are revalued to current fair value at the date of the creation of the pool. At that date, the prior and current fair value of the investments of each of the participants were as follows:

One month after creation of the pool, earnings on pooled investments totaled $59,900. It was decided to distribute the earnings to the participants, rounding the distribution to the nearest dollar. The Great Falls School District should receive

- a. $36,000.

- b. $35,940.

- c. $36,339.

- d. $37,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources.

Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year.

Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…

The following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources.

Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year.

Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…

The following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources.

Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year.

Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…

Chapter 8 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 8 - What are the criteria for determining if a...Ch. 8 - Prob. 2QCh. 8 - Identify the different types of trust funds and...Ch. 8 - Describe the basic activities conducted by a tax...Ch. 8 - Explain how the financial reporting of fiduciary...Ch. 8 - Prob. 6QCh. 8 - How are external investment pool activities...Ch. 8 - What is a private-purpose trust fund? There are...Ch. 8 - Prob. 9QCh. 8 - Prob. 10Q

Ch. 8 - What is OPEB and how is OPEB reported by...Ch. 8 - Prob. 12CCh. 8 - Prob. 13CCh. 8 - Prob. 14CCh. 8 - Prob. 15CCh. 8 - Prob. 17.1EPCh. 8 - Which of the following is not a fiduciary fund? a....Ch. 8 - Prob. 17.3EPCh. 8 - Fiduciary fund activities are not included in the...Ch. 8 - Prob. 17.5EPCh. 8 - Prob. 17.6EPCh. 8 - The city has installed sidewalks using special...Ch. 8 - Prob. 17.8EPCh. 8 - Fiduciary funds a. Are accounted for using the...Ch. 8 - Prob. 17.10EPCh. 8 - Prob. 17.11EPCh. 8 - An investment trust fund would report in the...Ch. 8 - Prob. 17.13EPCh. 8 - Which pension fund financial statement or schedule...Ch. 8 - Prob. 17.15EPCh. 8 - Prob. 18.1EPCh. 8 - Prob. 18.2EPCh. 8 - The county collects taxes on behalf of the county,...Ch. 8 - Prob. 18.4EPCh. 8 - Prob. 18.5EPCh. 8 - At the date of the creation of the investment...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - Prob. 18.9EPCh. 8 - Prob. 18.10EPCh. 8 - Tax Custodial Fund. (LO8-2) The county collector...Ch. 8 - Special Assessment Debt. (LO8-2) Residents of...Ch. 8 - Identification of Fiduciary Funds. (LO8-2, LO8-3,...Ch. 8 - Investment Trust Fund. (LO8-3) The Albertville...Ch. 8 - Pass-through Custodial Funds. (LO8-2) Evergreen...Ch. 8 - Fiduciary Financial Statements. (LO8-4) Ray County...Ch. 8 - Fiduciary Fund Financial Statements. (LO8-4)...Ch. 8 - Prob. 26EPCh. 8 - Prob. 27EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On April 1, 2020, the City purchased a swimming pool from a private operator for $500,000 and created a Swimming Pool (Enterprise) Fund. The city has a calendar year as its fiscal year. During the year ended December 31, 2020, the following transactions occurred related to the City’s Swimming Pool Fund: On April 1, 2020, $300,000 was provided by a one-time contribution from the General Fund, and $200,000 was provided by a loan from a local bank (secured by a note), both of which were received in cash. The loan (Notes Payable) has an annual interest rate of 5%, payable semiannually on October 1 and April 1. The purchase of the pool was recorded (paid in cash). Based on an appraisal, it was decided to allocate $100,000 to the land, $300,000 to improvements other than buildings (the pool), and $100,000 to the building. Charges for services amounted to $270,000, all received in cash. Salaries paid to employees amounted to $172,500, all paid in cash, of which $100,000 was cost of services…arrow_forwardThe City of Townsend's city council authorized the establishment of an internal service fund to provide human resource services to city departments. The following transactions took place in the Inaugural month of Townsend's Human Resource internal service fund: 1. The General Fund transferred $100,000 to cover initial expenses. The transfer is not expected to be repaid. 2. The Human Resources Fund entered into a 2-year computer lease with an initial $5,000 payment. The present value of the remaining payments is $82,218. 3. Salaries and wages paid to employees totaled $15,000. . Office supplies were purchased on account for $2,500. 5. Billings totaling $3,000 were received from the enterprise fund for utility charges. 6. Billings to other departments for services provided to them were as follows: General Fund Special Revenue Fund $ 16,000 4,700 1. Closing entries were prepared. Required 1. a-1. Assume all expenses at the government-wide level are charged to the General Government…arrow_forwardThe City of Townsend's city council authorized the establishment of an internal service fund to provide human resource services to city departments. The following transactions took place in the inaugural month of Townsend's Human Resource internal service fund: 1. The General Fund transferred $100,000 to cover initial expenses. The transfer is not expected to be repaid. 2. The Human Resources Fund entered into a 2-year computer lease with an initial $5,000 payment. The present value of the remaining payments is $82.218 3. Salaries and wages paid to employees totaled $15,000. 4. Office supplies were purchased on account for $2,500. 5. Billings totaling $3,000 were received from the enterprise fund for utility charges 6. Billings to other departments for services provided to them were as follows: General Fund Special Revenue Fund 7. Closing entries were prepared Required $16,000 4,700 a-1. Assume all expenses at the government-wide level are charged to the General Government function.…arrow_forward

- The City of Algonquin maintains its books to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: Deferred inflows of resources—property taxes of $73,500 at the end of the previous fiscal year were recognized as property tax revenue in the current year's Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $13,789,400. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $309,200 is thought to be uncollectible, $365,000 would likely be collected during the 60-day period after the end of the fiscal year, and $52,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures…arrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardThe Principal City prepared the Trial Balance of the corporate-type fund as of December 31, 20X1. The enterprise fund was established this year through a transfer from the general fund. After having studied the Trial Balance of the company and the required resources of this module: 1.Prepare the fund's closing entries as of December 31, 20X1.2.Prepare the Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ending December 31.arrow_forward

- 1. Assume that the City of Juneau maintains its books and records to facilitate the preparation of its fund financial statements. The City pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30. Employees had been paid on Friday, June 25. The employees paid from the General Fund had earned $120,000 on Monday, Tuesday, and Wednesday (June 28, 29, and 30). What entry, if any, should be made in the City s General Fund? a. Debit Expenditures; Credit Wages and Salaries Payable. b. Debit Expenses; Credit Wages and Salaries Payable. c. Debit Expenditures; Credit Encumbrances. d. No entry is required.arrow_forwardThe City of Townsend’s city council authorized the establishment of an internal service fund to provide human resource services to city departments.The following transactions took place in the inaugural month of Townsend’s Human Resource internal service fund: The General Fund transferred $100,000 to cover initial expenses. The transfer is not expected to be repaid. The Human Resources Fund entered into a 2-year computer lease with an initial $5,000 payment. The present value of the remaining payments is $82,218. Salaries and wages paid to employees totaled $15,000. Office supplies were purchased on account for $2,500. Billings totaling $3,000 were received from the enterprise fund for utility charges. Billings to other departments for services provided to them were as follows: General Fund $ 16,000 Special Revenue Fund 4,700 Closing entries were prepared. Required a-1. Assume all expenses at the government-wide level are charged to the General…arrow_forwardThe City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Fund balance—unassigned goes down and fund balance—restricted goes up. Fund balance—assigned goes down and fund balance—committed goes up. Fund balance—unassigned goes down and fund balance—assigned goes up. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forward

- The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Choose the correct.a. Fund balance—unassigned goes down and fund balance—restricted goes up.b. Fund balance—assigned goes down and fund balance—committed goes up.c. Fund balance—unassigned goes down and fund balance—assigned goes up.d. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forwardOn June 1, 2020, the City of Cape May authorized the construction of a police station at an expected cost of $250,000. Financing will be provided through transfers from a Special Revenue Fund. The following transactions occurred during the fiscal year beginning June 1, 2020, relating to the Capital Project Fund. 1. The $250,000 receivable from the Special Revenue Fund was recorded. 2. The Special Revenue Fund transferred $125,000 to the Capital Project Fund to begin construction on the police station. 3. The Capital Project Fund invested the transfer of monies in a six-month certificate, at 5%. 4. A contract in the amount of $250,000 was let to the lowest bidder. 5. Architect and legal fees in the amount of $3,125 were approved for payment. There was no encumbrance for these expenditures. 6. Contract billings in the amount of $250,000 were approved for payment on the completion of the police station and the encumbrance was removed. 7. The six-month certificate was redeemed at maturity…arrow_forward- Prepare journal entries in the Capital Projects Fund to record the following transactions related to the construction of a building by the Village of Navajo Falls. (Note that only Capital Projects Fund journal entries are required.) The Village adopts a formal budget and uses encumbrance accounting. a. The Village Council adopts a capital budget at the beginning of the year. To finance construction of the building, the Village will transfer $3 million from its General Fund and apply for a state grant of $1 million. It appropriates $4 million for construction. b. The General Fund transfers $3 million to the Capital Projects Fund for the new project. c. The state approves Navajo Falls's application for a $1 million construction grant and simultaneously sends a check to the Village. The grant is expenditure driven and thus requires that Navajo Falls incur qualifying expenditures. d. Navajo Falls awards a construction contract in the amount of $3.4 million. e. The…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License