Effect of warranty obligations and payments on financial statements

The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $2,650. During the period a customer returned a product that cost $1,830 to repair.

Required

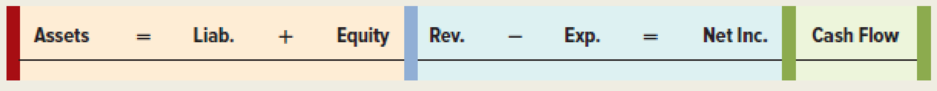

a. Show the effects of these transactions on the financial statements using a horizontal statements model like the example shown here. Use a + to indicate increase, a − for decrease, and NA for not affected. In the

b. Discuss the advantage of estimating the amount of warranty expense.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Survey Of Accounting

- Assurance-Type Warranty Clean-All Inc. sells washing machines with a 3-year assurance-type warranty. In the past, Clean-All has found that in the year after sale, warranty costs have been 3% of sales; in the second year after sale, 5% of sales; and in the third year after sale, 7% of sales. The following data are also available: Required: 1. Prepare the journal entries for the preceding transactions for 20192021. Closing entries are not required. 2. What amount would Clean-All report as a liability on its December 31, 2021, balance sheet, assuming the liability had a balance of 88,200 on December 31, 2018? 3. Next Level How would the failure to recognize a contingent liability affect the financial statements?arrow_forwardCheck my work 10 The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $1,240. During the period, a customer returned a product that cost $930 to repair. Required a. Show the effects of these transactions on the financial statements using a horizontal statements model like the example shown here. Use a + to indicate increase or a - for decrease. if the element is not affected, leave the cell blank. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). (Not all cells will require entry.) Hint Ask Print CHAIR COMPANY Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Flow Stockholder's Equity Event Assets Liabilities + Revenue - Expense = Net Income Estimates Paidarrow_forwardHANDOUT PROBLEM for CURRENT LIABILITIES I. Prepare journal entries for the following chronological transactions and a. You sold merchandise on account for $250,000 on account. The products cost $110,000. Your company uses a perpetual inventory system. Your sales included a two-year warranty on the product. You spent $1,400 to repair products in part "a." which were under warranty. On December 31, 2021, you estimated that there would be an additional $8,000 of b. с. repairs on products in part "a." You estimated that $5,000 of the repairs would оссur in 2022. In 2022, you performed $4,800 of repairs on products from part "a." and $1,920 of repairs on products sold in 2022. On December 31, 2022, you estimated that repairs on products sold in 2021 would be an additional $3,500 and for products sold in 2022 would be an additional $9,000. You believe that $5,400 of the $9,000 of repairs would occur d. е. in 2023. II. Based upon the transaction above, determine the amount of current…arrow_forward

- HANDOUT PROBLEM for CURRENT LIABILITIES I. Prepare journal entries for the following chronological transactions and a. You sold merchandise on account for $250,000 on account. The products cost $110,000. Your company uses a perpetual inventory system. Your sales included a two-year warranty on the product. spent $1,400 to repair products in part "a." which were under warranty. b. You с. On December 31, 2021, you estimated that there would be an additional $8,000 of repairs on products in part "a." You estimated that $5.000 of the repairs would occur in 2022. In 2022, you performed $4,800 of repairs on products from part "a." and $1,920 of repairs on products sold in 2022. On December 31, 2022, you estimated that repairs on products sold in 2021 d. e. would be an additional $3,500 and for products sold in 2022 would be an additional $9,000. You believe that $5,400 of the $9,000 of repairs would occur in 2023. II. Based upon the transaction above, determine the amount of current…arrow_forwardEntries for notes payable Bennett Enterprises issues a $504,000, 30-day, 8 %, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank. Question Content Area a. Journalize Bennett Enterprises' entries to record: the issuance of the note. the payment of the note at maturity. 1. 2. Question Content Area b. Journalize Spectrum Industries' entries to record: the receipt of the note. the receipt of the payment of the note at maturity. 1. 2.arrow_forward11. Record journal entries for the following transactions of Telesco Enterprises. Jan. 1, 2018 Issued a $330,700 note to customer Abe Willis as terms of a merchandise sale. The merchandise's cost to Telesco is $120,900. Note contract terms included a 36-month maturity date, and a 4% annual interest rate. Dec. 31, 2018 Telesco records interest accumulated for 2018. Dec. 31, 2019 Telesco records interest accumulated for 2019. Dec. 31, 2020 | Abe Willis honors the note and pays in full with cash.arrow_forward

- The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $1,270. During this period, a customer returned a product that cost $953 to repair. a. Show the effects of these transactions on the financial statements using a horizontal statements model. Use "+" for increase, "-" for decrease, and NA for not affected. In the Cash Flow column, indicate whether the item is an operating activity, investing activity, or financing activity. b. Prepapre the journal entries to record the warranty expense for the period and payment for the actual repair costs.arrow_forwardQuestion Content Area Note receivable Prefix Supply Company received a 120-day, 10% note for $24,000, dated April 12 from a customer on account. Assume 360-days in a year. Question Content Area a. Determine the due date of the note. b. Determine the maturity value of the note.fill in the blank 1 of 1$ Question Content Area c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blank - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardTitle Gorilla Supply Company received a 120-day, 5% note for $150,000, dated March 27 from a customer on.. Description Gorilla Supply Company received a 120-day, 5% note for $150,000, dated March 27 from a customer on account.a. Determine the due date of the note.b. Determine the maturity value of the note.c. Journalize the entry to record the receipt of the payment of the note at maturity.View Solution:Gorilla Supply Company received a 120 day 5 note for 150 000arrow_forward

- Accounting for warranty expense and warranty payable The accounting records of Sculpted Ceramics included the following at January 1,2018: In the past, Sculpted’s warranty expense has been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to satisfy warranty Claims. Requirements Journalize Sculpted’s warranty expense and warranty payments during 2018. Explanations are not required. What balance of Estimated Warranty Payable will Sculpted report on its balance sheet at December 31, 2018?arrow_forwardPrefix Supply Company received a 60-day, 4% note for $46,000 dated July 12 from a customer on account. Required: a. Determine the due date of the note. b. Determine the maturity value of the note. Assume a 360-day year. c. Journalize the entry to record the receipt of the payment of the note at maturity. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Prefix Supply Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 129 Allowance for Doubtful Accounts 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY…arrow_forwardVolvo Group reported the following information in a recent year for its product warranty costs along withprovisions and utilizations of warranty liabilities (amounts in millions). Beginning product warranty liabilities, January 1 . SEK 9,881Additional provisions to product warranty liabilities 7,836Utilizations and reductions of product warranty liabilities (7,134)Ending product warranty liabilities, December 31 . . . . . . . . . . . . . . . . . . . . . SEK 10,583 1. Prepare Volvo’s journal entry to record its estimated warranty liabilities (provisions) for the year. 2. Prepare Volvo’s journal entry to record its costs (utilizations) related to its warranty program for the year. Assume those costs involve replacements taken out of inventory, with no cash involved. 3. How much warranty expense does Volvo report for the year?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning