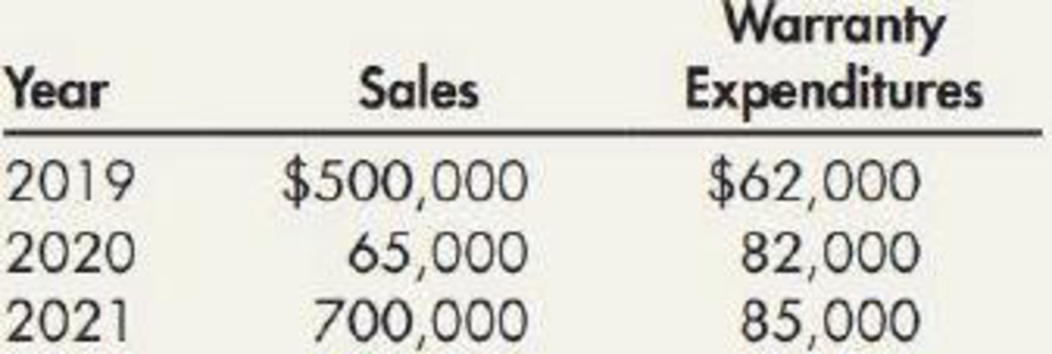

Assurance-Type Warranty Clean-All Inc. sells washing machines with a 3-year assurance-type warranty. In the past, Clean-All has found that in the year after sale, warranty costs have been 3% of sales; in the second year after sale, 5% of sales; and in the third year after sale, 7% of sales. The following data are also available:

Required:

- 1. Prepare the

journal entries for the preceding transactions for 2019–2021. Closing entries are not required. - 2. What amount would Clean-All report as a liability on its December 31, 2021, balance sheet, assuming the liability had a balance of $88,200 on December 31, 2018?

- 3. Next Level How would the failure to recognize a

contingent liability affect the financial statements?

1.

Journalize the transactions for the year 2019-2021 in the books of Incorporation CA.

Explanation of Solution

Warranty:

Warranty is a written guarantee that is given by the seller to the buyer for the product against product’s defect.

Prepare the journal entry to record the sales for the year 2019:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2019 | Cash or Accounts receivable | 500,000 | |

| Sales | 500,000 | ||

| (To record the sale revenue) |

Table (1)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $500,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $500,000.

Prepare the journal entry to record the estimated warranty liability for the year 2019:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2019 | Warranty expense (1) | 75,000 | |

| Estimated warranty liability | 75,000 | ||

| (To record the estimated warranty liability) |

Table (2)

Working note (1):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $75,000.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $75,000.

Prepare the journal entry to record the warranty cost incurred during the year 2019:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2019 | Estimated warranty liability | 62,000 | |

| Cash or other assets | 62,000 | ||

| (To record the warranty cost incurred during the year) |

Table (3)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $62,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $62,000.

Prepare the journal entry to record the sales for the year 2020:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2020 | Cash or Accounts receivable | 650,000 | |

| Sales | 650,000 | ||

| (To record the sale revenue) |

Table (4)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $650,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $650,000.

Prepare the journal entry to record the estimated warranty liability for the year 2020:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2020 | Warranty expense (2) | 97,500 | |

| Estimated warranty liability | 97,500 | ||

| (To record the estimated warranty liability) |

Table (5)

Working note (2):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $97,500.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $97,500.

Prepare the journal entry to record the warranty cost incurred during the year 2020:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2020 | Estimated warranty liability | 82,000 | |

| Cash or other assets | 82,000 | ||

| (To record the warranty cost incurred during the year) |

Table (6)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $82,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $82,000.

Prepare the journal entry to record the sales for the year 2021:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2021 | Cash or Accounts receivable | 700,000 | |

| Sales | 700,000 | ||

| (To record the sale revenue) |

Table (7)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $700,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $700,000.

Prepare the journal entry to record the estimated warranty liability for the year 2021:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2021 | Warranty expense (3) | 105,000 | |

| Estimated warranty liability | 105,000 | ||

| (To record the estimated warranty liability) |

Table (8)

Working note (3):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $105,000.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $105,000.

Prepare the journal entry to record the warranty cost incurred during the year 2021:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2021 | Estimated warranty liability | 85,000 | |

| Cash or other assets | 85,000 | ||

| (To record the warranty cost incurred during the year) |

Table (9)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $85,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $85,000.

2.

Determine the amount of liability that would be reported by Incorporation CA on its December 31, 2021 balance sheet.

Explanation of Solution

Liabilities: The claims creditors have over assets or resources of a company are referred to as liabilities. These are the debt obligations owed by company to creditors. Liabilities are classified on the balance sheet as current liabilities and long-term liabilities.

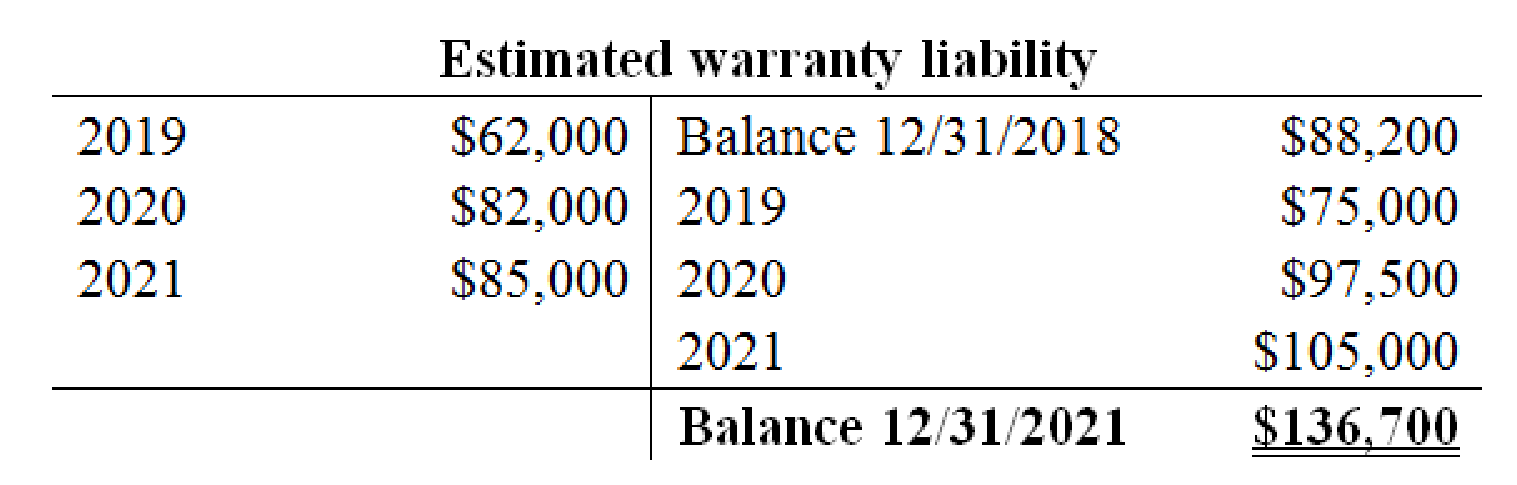

Prepare the T-account to determine the amount of estimated warranty liability:

The amount of liability that would be reported by Incorporation CA on its December 31, 2021 balance sheet is $136,700.

3.

Explain the manner in which the financial statements are affected for not recognizing the contingent liability.

Explanation of Solution

According to the recognition principle, recognition of loss contingencies is to record the loss during the current period in which it is incurred. Thus, a loss must be recognized in the same period in which it is incurred and that would result in the probable decrease in an asset or the probable increase in the value of liability. If the loss contingencies are not recognized during the particular period, then it would understate the expense, overstate the earnings, overstate the shareholders’ equity, understate the liabilities in the beginning period and understate the earning of the future period.

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Accounting: Reporting And Analysis

- Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forwardShoe Hut sells custom, handmade shoes. It offers a one-year warranty on all shoes for repair or replacement. Review each of the transactions and prepare any necessary journal entries for each situation. A. May 31: Shoe Hut sells 100 pairs of shoes during the month of May at a sales price per pair of shoes of $240 cash. Shoe Hut records warranty estimates when sales are recognized and bases warranty estimates on 4% of sales. B. June 2: A customer files a warranty claim that Shoe Hut honors in the amount of $30 for repair to laces. Laces Inventory corresponds to shoelace inventory used for repairs. C. June 4: Another customer files a warranty claim that Shoe Hut honors. Shoe Hut replaces the damaged shoes at a cost of $200, affecting their Shoe Replacement Inventory account. D. August 10: Shoe Hut explores the possibility of bankruptcy, given the current economic conditions (recession). It determines the bankruptcy is unlikely to occur (remote).arrow_forwardArvan Patel is a customer of Banks Hardware Store. For Mr. Patels latest purchase on January 1, 2018, Banks Hardware issues a note with a principal amount of $480,000, 13% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Banks Hardware Store for the following transactions. A. Note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019.arrow_forward

- Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardEmperor Pool Services provides pool cleaning and maintenance services to residential clients. It offers a one-year warranty on all services. Review each of the transactions, and prepare any necessary journal entries for each situation. A. March 31: Emperor provides cleaning services for fifteen pools during the month of March at a sales price per pool of $550 cash. Emperor records warranty estimates when sales are recognized and bases warranty estimates on 2% of sales. B. April 5: A customer files a warranty claim that Emperor honors in the amount of $100 cash. C. April 13: Another customer, J. Jones, files a warranty claim that Emperor does not honor due to customer negligence. D. June 8: J. Jones files a lawsuit requesting damages related to the dishonored warranty in the amount of $1,500. Emperor determines that the lawsuit is likely to end in the plaintiffs favor and the $1,500 is a reasonable estimate for damages.arrow_forwardJain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning